The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Interest-Free Personal Loans Explained: How Do They Work?

Interest-Free Personal Loans Explained

Interest-free personal loans are a great way to borrow money without the burden of extra costs. These loans, often offered by banks or online lenders as promotional deals, allow you to use a set amount of money without paying interest if you repay it within a specified period. It’s like borrowing from a friend who doesn’t charge you extra!

Understanding these loans can help you make smart financial choices and save money.

Bank Loan Rates vs. Online Loan Rates

- Bank Loan Rates: Traditional banks typically have higher interest rates due to their overhead costs.

- Online Loan Rates: Online lenders can offer lower rates and sometimes interest-free options because they operate with fewer expenses.

Choosing an interest-free loan is wise if you need quick cash without extra costs. However, it’s crucial to repay on time to avoid hidden fees, much like returning a library book on time to avoid fines.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Interest-free personal loans are a great option when you need money for urgent expenses, like fixing a car or buying a laptop, without the burden of extra fees. These loans allow you to borrow money without paying interest, making them ideal for short-term needs. Typically offered by online lenders or through special bank promotions, these loans require you to repay only the amount borrowed, saving you money compared to traditional bank loans.

When comparing bank loan rates vs. online loan rates, interest-free options are often available online. Banks usually charge interest, increasing your repayment amount over time. However, online lenders might offer interest-free loans as part of a promotional deal, allowing you to borrow without extra costs. Always read the fine print to understand the terms.

Key Points to Remember:

- Short-Term Solution: Ideal for a few months.

- Promotional Offers: Check terms carefully.

- Credit Score Impact: Your credit score might still be checked.

Understanding these loans helps you make smarter financial decisions, avoiding unnecessary costs.

Who Can Benefit from Interest-Free Personal Loans?

Interest-Free Personal Loans Explained: How Do They Work? is a common query for those seeking extra cash without high interest. These loans are particularly beneficial when traditional bank loan rates are too high.

Young adults starting their careers can use these loans to manage finances amid student loans and other expenses, bridging the gap between paychecks without worrying about bank loan rates vs. online loan rates.

Families facing unexpected expenses like medical bills or home repairs can also benefit, as these loans help manage costs without accumulating interest, aiding in budget management.

Small business owners needing quick funds for inventory or equipment can access capital without high interest, focusing on growth rather than debt.

Finally, anyone facing unexpected expenses like car repairs or sudden travel needs can find these loans a practical solution, handling costs without the worry of interest piling up.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

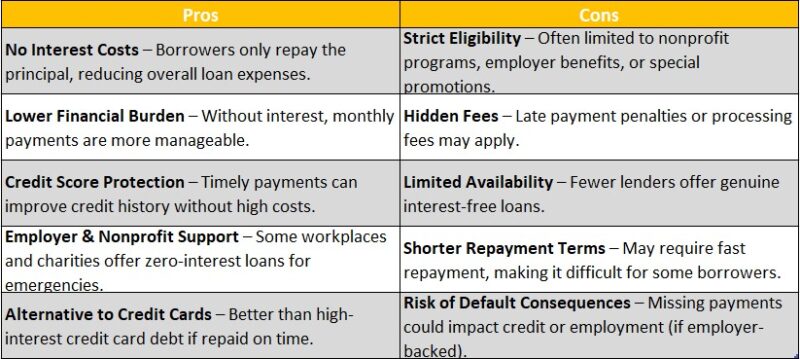

The Pros and Cons of Interest-Free Personal Loans

Understanding how interest-free personal loans work is crucial for making informed financial choices. These loans allow you to borrow money without paying interest, which sounds appealing. However, they come with both advantages and disadvantages.

Pros include no interest costs, making them budget-friendly since you repay only what you borrowed. They also offer quick approval, especially with online lenders.

Cons involve short repayment periods, meaning you have less time to pay back the loan. Eligibility can be strict, often requiring a good credit score, and there might be hidden fees, so it’s essential to read the fine print.

When comparing Bank Loan Rates vs. Online Loan Rates, interest-free loans might seem attractive, but it’s important to consider the pros and cons. Bank loans may have higher rates but offer more flexibility and longer repayment terms. Online loans are faster but come with their own challenges. Understanding these differences helps you choose the best option for your financial needs.

Read Also: Bank Loan Rates vs. Online Loan Rates: Which Is Cheaper?

How to Qualify for an Interest-Free Personal Loan

Interest-free personal loans can be a fantastic way to borrow money without paying extra costs. These loans don’t charge interest, making them appealing for those aiming to save. To qualify, start by checking your credit score, as a good score is crucial. Lenders prefer borrowers with a history of timely payments, so if your score is low, work on improving it before applying.

Next, compare Bank Loan Rates vs. Online Loan Rates. Traditional banks may have stricter requirements, while online lenders often offer more flexible terms, making qualification easier. Always compare rates and terms to secure the best deal.

Finally, gather necessary documents like proof of income and identification to streamline the application process. Being prepared can significantly speed up your loan approval. By following these steps, you enhance your chances of qualifying for an interest-free personal loan. Preparation and understanding lender expectations are key to success.

Pros and Cons of Interest-Free Personal Loans

Comparing Interest-Free Personal Loans to Traditional Loans

Interest-free personal loans can be a financial lifesaver, especially when stacked against traditional loans. Imagine borrowing money without the burden of interest! This is why understanding “Interest-Free Personal Loans Explained” is vital. These loans allow you to repay only what you borrowed, unlike traditional loans that require paying back more due to interest.

When considering “Bank Loan Rates vs. Online Loan Rates,” traditional bank loans often come with higher interest rates compared to online lenders. However, interest-free loans eliminate interest entirely, making them a cost-effective choice.

Key Differences include:

- Interest Costs: Traditional loans increase repayment amounts with interest.

- Repayment Terms: Interest-free loans usually have shorter repayment periods.

- Accessibility: Online platforms may offer easier access to interest-free options.

In summary, understanding these differences helps you make smarter financial decisions. Comparing interest-free loans to traditional ones reveals how they might better suit your needs, especially when considering the competitive nature of online loan rates.

Common Misconceptions About Interest-Free Personal Loans

Understanding Interest-Free Personal Loans Explained can be tricky, as they often seem too good to be true. However, they can offer genuine benefits if you know the facts. Let’s debunk some myths to help you make informed choices.

“Interest-Free Means No Costs”

While interest-free loans don’t charge interest, they may include other fees like application or processing charges. It’s crucial to read the fine print to grasp the total cost.

“Bank Loan Rates vs. Online Loan Rates”

A common belief is that bank loan rates are always higher than online rates. This isn’t always true, as banks can offer competitive rates, especially if you have a good relationship with them. Comparing both options is essential to find the best deal.

“Interest-Free Loans Are Hard to Qualify For”

Many think these loans are only for those with perfect credit. In reality, many lenders provide interest-free options to a broad range of credit scores. Finding the right lender for your financial situation is key.

Steps to Apply for an Interest-Free Personal Loan

Interest-Free Personal Loans offer a unique opportunity to borrow money without the burden of interest, making them an attractive option for many. Understanding how these loans work is essential for making informed financial decisions. Unlike traditional loans, where interest can accumulate quickly, these loans allow you to borrow without additional costs. Here’s how to apply:

1. Research Your Options

Begin by comparing different lenders. Look at bank loan rates vs. online loan rates to find the best deal. Online lenders often have more competitive rates, but always check for hidden fees.

2. Check Eligibility Requirements

Lenders have specific criteria, usually requiring a good credit score, stable income, and proof of identity. Meeting these requirements is crucial for approval.

3. Gather Necessary Documents

Prepare your ID, proof of income, and bank statements. Having these ready will expedite the application process.

4. Submit Your Application

Choose a lender, complete the application form, and ensure all information is accurate. After submission, expect a response within a few days.

Following these steps ensures a smooth application process, helping you secure the best deal possible.

How ExpressCash Can Help You Find the Best Interest-Free Personal Loan

Interest-Free Personal Loans Explained: How Do They Work? is a common question for those seeking to borrow money without extra fees. These loans offer a way to manage finances without high interest rates. But finding the best option can be tricky. That’s where ExpressCash.com steps in, making it simple to compare loan options and choose the best fit.

Understanding the Basics

- Interest-Free Personal Loans: These loans allow borrowing without interest but come with specific terms.

- Bank Loan Rates vs. Online Loan Rates: Online lenders often offer more attractive rates than traditional banks.

Why Choose ExpressCash.com?

ExpressCash.com streamlines the search for the best interest-free personal loan. Our platform lets you compare lenders to secure the best deal, providing detailed loan information to ensure transparency. This helps you make informed decisions and avoid hidden fees, ensuring a smooth borrowing experience.

Frequently Asked Questions About Interest-Free Personal Loans

-

What are interest-free personal loans?

Interest-free personal loans are loans where the borrower does not have to pay any interest on the borrowed amount, usually offered by non-profits, religious organizations, or special government programs. -

Where can I get an interest-free personal loan?

Interest-free loans are sometimes available from charitable organizations, credit unions, employer-sponsored programs, and certain government initiatives. -

Are there any hidden fees in interest-free loans?

While no interest is charged, some lenders may have processing fees, late payment penalties, or administrative charges, so it’s essential to read the terms carefully. -

Who qualifies for an interest-free personal loan?

Eligibility depends on the lender, but typically, applicants with financial hardship, students, or those meeting specific income criteria may qualify. -

What are the repayment terms for an interest-free loan?

Repayment terms vary, but most interest-free loans require timely payments within a set period to maintain the no-interest benefit.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.