The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

How to Improve Credit Score for a Personal Loan

Understanding your credit score is crucial when you want to improve your chances of getting a personal loan. Lenders look at your credit score to decide if you’re a responsible borrower. A higher score can lead to better loan terms, which means lower interest rates and monthly payments. So, how can you improve your credit score for a personal loan? Let’s dive in!

What is a Credit Score?

A credit score is a number that shows how well you manage your money. It usually ranges from 300 to 850. The higher your score, the more trustworthy you appear to lenders. Here are some key factors that affect your score:

- Payment History: Paying bills on time boosts your score.

- Credit Utilization: Using less than 30% of your available credit is ideal.

- Length of Credit History: A longer history can improve your score.

- Types of Credit: Having different types of credit, like credit cards and loans, can help.

- New Credit Inquiries: Too many inquiries can lower your score.

Steps to Improve Your Credit Score

To improve your credit score for a personal loan, follow these simple steps:

- Check Your Credit Report: Look for errors and dispute them.

- Pay Bills on Time: Set reminders or automate payments.

- Reduce Debt: Focus on paying down high-interest debts first.

- Limit New Credit Applications: Only apply for credit when necessary.

- Keep Old Accounts Open: This helps maintain a longer credit history.

By following these steps, you can boost your credit score and increase your chances of getting that personal loan!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Why a Higher Credit Score Matters for Personal Loans

Your credit score is vital when it comes to personal loans. A higher score can lead to better loan options, lower interest rates, and larger loan amounts. Knowing how to improve your credit score for a personal loan is key to reaching your financial goals.

Better Interest Rates

A higher credit score typically results in lower interest rates, which can save you a lot of money over time. Even a small difference in rates can lead to significant savings!

Increased Loan Amounts

Lenders are more inclined to approve larger loans for those with higher credit scores. This means you can borrow more when you need it, whether for home renovations or unexpected expenses.

Easier Approval Process

With a good credit score, you face fewer hurdles during the loan approval process. Lenders view you as a lower risk, making it easier to secure the funds you need quickly.

More Loan Options

A higher credit score opens up a wider variety of loan products. This allows you to choose a loan that best fits your needs instead of settling for what’s available.

Confidence from Lenders

Improving your credit score boosts lenders’ confidence in your repayment ability. This trust can lead to better terms and conditions, enhancing your loan experience.

Building Financial Health

Improving your credit score is about more than just loans; it’s about creating a healthier financial future, helping you in areas like renting and insurance.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

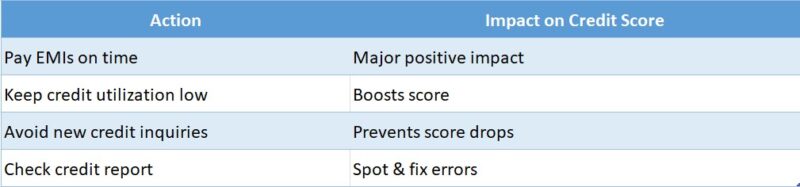

Top Strategies to Improve Your Credit Score for a Personal Loan

When it comes to securing a personal loan, your credit score plays a crucial role. A higher credit score not only increases your chances of approval but can also lead to lower interest rates. So, understanding how to improve your credit score for a personal loan is essential for financial success.

Check Your Credit Report

First things first, get a copy of your credit report. This document shows your credit history and any outstanding debts. Look for errors or inaccuracies that could be dragging your score down. Disputing these mistakes can give your score a quick boost!

Pay Your Bills on Time

One of the simplest ways to improve your credit score for a personal loan is to pay your bills on time. Late payments can significantly hurt your score. Set reminders or automate payments to ensure you never miss a due date. This habit builds trust with lenders!

Reduce Your Credit Utilization

Another effective strategy is to lower your credit utilization ratio. This means using less of your available credit. Aim to keep it below 30%. You can do this by paying down existing debt or asking for a credit limit increase. Both actions can positively impact your score!

Avoid New Hard Inquiries

Finally, be cautious about applying for new credit. Each time you apply, lenders perform a hard inquiry, which can temporarily lower your score. Instead, focus on improving your existing credit before seeking new loans. This approach helps you maintain a healthy credit profile.

How Long Does It Take to Improve Your Credit Score?

Improving your credit score is crucial when you’re looking to secure a personal loan. A higher score can lead to better interest rates and loan terms, making it easier to manage your finances. But how long does it actually take to improve your credit score? Let’s dive into that!

Understanding the Timeline

Generally, it can take anywhere from a few weeks to several months to see a noticeable change in your credit score. Here are some factors that influence this timeline:

- Current Credit Score: If you’re starting from a low score, it may take longer to see improvements.

- Payment History: Consistently paying bills on time can boost your score faster.

- Credit Utilization: Reducing your credit card balances can show quick results.

Steps to Speed Up Improvement

To improve your credit score for a personal loan, consider these steps:

- Check Your Credit Report: Look for errors that could be dragging your score down.

- Pay Down Debt: Focus on paying off high-interest debts first.

- Limit New Credit Applications: Too many inquiries can hurt your score.

By following these steps, you can potentially see improvements in as little as 30 days, making it easier to qualify for that personal loan you need!

Common Mistakes That Hurt Your Credit Score and How to Avoid Them

When it comes to securing a personal loan, your credit score plays a crucial role. A higher score can lead to better interest rates and terms. However, many people unknowingly make mistakes that hurt their credit score. Understanding these common pitfalls is the first step to improve credit score for a personal loan.

Common Mistakes That Hurt Your Credit Score

1. Missing Payments

One of the biggest mistakes is missing payment deadlines. Late payments can significantly lower your score. To avoid this, set reminders or automate payments to ensure you never miss a due date.

2. High Credit Utilization

Using too much of your available credit can also harm your score. Aim to keep your credit utilization below 30%. This means if you have a $1,000 limit, try not to use more than $300. You can achieve this by paying off balances regularly.

3. Ignoring Your Credit Report

Many people forget to check their credit reports. Errors can occur, and they can negatively impact your score. Make it a habit to review your report at least once a year. If you find mistakes, dispute them immediately to improve your score. By avoiding these common mistakes, you can take significant steps to improve credit score for a personal loan. Remember, a little awareness goes a long way in managing your credit health.

How ExpressCash Can Help You Achieve a Better Credit Score

Improving your credit score is crucial when applying for a personal loan. A higher score can lead to better interest rates and loan terms, making it easier to manage your finances. At ExpressCash, we understand the importance of a good credit score and are here to help you navigate this journey.

We offer a variety of resources and tools designed to help you improve your credit score for a personal loan. Here are some ways we can assist you:

- Personalized Credit Reports: Get insights into your credit history and understand what factors are affecting your score.

- Credit Score Monitoring: Stay updated with real-time alerts about changes to your credit score, helping you take action when necessary.

- Educational Resources: Access articles and guides that explain how credit scores work and tips to improve them.

By utilizing our services, you can take proactive steps to enhance your credit score. Remember, a better score not only increases your chances of loan approval but also saves you money in the long run. Let ExpressCash be your partner in achieving financial success!

Tracking Your Progress: Tools and Tips for Monitoring Your Credit Score

Improving your credit score is essential when applying for a personal loan. A higher score can lead to better interest rates and loan terms. But how do you keep track of your progress? Let’s explore some effective tools and tips to help you monitor your credit score as you work to improve it.

Use Credit Monitoring Services

Credit monitoring services can be your best friend. They alert you to changes in your credit report and help you understand your score. Some popular options include:

- Credit Karma

- Experian

- TransUnion

These services often provide free access to your credit score, making it easier to see how your efforts to improve your credit score for a personal loan are paying off.

Regularly Check Your Credit Report

It’s important to check your credit report regularly. You can get a free report once a year from each of the three major credit bureaus. Look for errors or accounts that don’t belong to you. Disputing inaccuracies can help boost your score. Remember, every little bit counts!

Set Goals and Celebrate Small Wins

Set specific goals for your credit score. For example, aim to increase your score by 20 points in three months. Celebrate when you reach these milestones! This keeps you motivated and focused on improving your credit score for a personal loan.

FAQs

-

How does my credit score affect personal loan approval?

A higher credit score improves your chances of approval and helps you qualify for lower interest rates. -

What’s the fastest way to improve my credit score?

The quickest methods include paying bills on time, reducing credit card balances, and avoiding new debt before applying. -

Can checking my credit score lower it?

No—checking your own credit score is a soft inquiry and does not affect your score in any way. -

How long does it take to build a good credit score?

It can take 3–6 months of consistent on-time payments and low credit utilization to see a noticeable improvement. -

Will paying off existing loans help boost my score?

Yes—closing debts responsibly shows lenders you’re a reliable borrower and can improve your credit profile over time.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.