The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

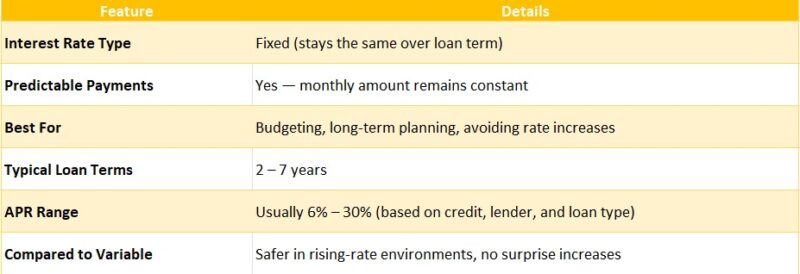

Fixed-Rate Personal Loans Overview: Pros and Cons

Understanding the Fixed-Rate Personal Loans Overview: Pros and Cons is essential when considering a loan. These loans offer predictable payments, making financial management easier. However, they come with both advantages and disadvantages that you should be aware of.

What Are Fixed-Rate Personal Loans?

Fixed-rate personal loans have a constant interest rate throughout the loan term, ensuring that your monthly payments remain unchanged. This stability is appealing to borrowers who value predictable budgeting.

Pros of Fixed-Rate Personal Loans

- Predictable Payments: Know exactly how much to pay each month.

- Budget-Friendly: Simplifies financial planning without unexpected costs.

- Long-Term Security: Shields you from future interest rate increases.

Cons of Fixed-Rate Personal Loans

- Higher Initial Rates: Often start with higher rates than variable loans.

- Less Flexibility: You miss out on lower rates unless you refinance.

- Fees and Penalties: Some loans may include additional fees that increase overall costs.

In conclusion, understanding the Fixed-Rate Personal Loans Overview allows you to evaluate these pros and cons, helping you choose the best personal loan for your financial situation.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

The Benefits of Fixed-Rate Personal Loans: Are They Right for You?

When considering a loan, understanding the Fixed-Rate Personal Loans Overview: Pros and Cons is crucial. These loans can be a great option for many, but they come with their own set of benefits and drawbacks. Let’s dive into what makes them unique and whether they might be the right choice for you.

Benefits of Fixed-Rate Personal Loans

- Predictable Payments: With a fixed-rate personal loan, your interest rate stays the same throughout the loan term. This means your monthly payments won’t change, making budgeting easier.

- Stability in Uncertain Times: In a fluctuating economy, having a fixed rate protects you from rising interest rates. You’ll know exactly what to expect each month.

- Variety of Uses: Fixed-rate personal loans can be used for various purposes, from consolidating debt to funding a big purchase, making them versatile among the types of personal loans available.

Are They Right for You?

Before deciding, consider your financial situation. If you prefer stability and have a clear repayment plan, a fixed-rate personal loan might be a perfect fit. However, if you think interest rates might drop, you might want to explore other options. Always weigh your choices carefully!

Weighing the Drawbacks: What Are the Cons of Fixed-Rate Personal Loans?

When considering a Fixed-Rate Personal Loan, it’s essential to weigh the pros and cons. Understanding the Fixed-Rate Personal Loans Overview helps you make informed decisions about borrowing. While these loans offer stability, they also come with certain drawbacks that can impact your financial journey.

Higher Interest Rates

One significant downside is that fixed-rate personal loans often have higher interest rates compared to variable-rate loans. This means you might pay more over time, especially if market rates drop after you secure your loan.

Less Flexibility

Another con is the lack of flexibility. Once you lock in your rate, you can’t take advantage of lower rates that may arise later. This can be frustrating if you’re looking for ways to save money on your loan payments.

Potential Fees

Lastly, some fixed-rate personal loans come with fees, such as origination fees or prepayment penalties. These can add to the overall cost of borrowing, making it crucial to read the fine print before signing any agreements.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

How Fixed-Rate Personal Loans Compare to Variable-Rate Options

When considering a loan, understanding the Fixed-Rate Personal Loans Overview is crucial. These loans can provide stability in your finances, especially when compared to variable-rate options. Knowing the pros and cons helps you make an informed decision that suits your needs.

Stability vs. Uncertainty

Fixed-rate personal loans offer a consistent interest rate throughout the loan term. This means your monthly payments remain the same, making budgeting easier. In contrast, variable-rate loans can fluctuate, leading to unexpected payment increases.

Pros of Fixed-Rate Loans

- Predictable Payments: You know exactly what to expect each month.

- Long-Term Planning: Easier to budget for future expenses.

Cons of Fixed-Rate Loans

- Higher Initial Rates: They may start higher than variable options.

- Less Flexibility: If rates drop, you miss out on lower payments.

In summary, while fixed-rate personal loans provide security, variable-rate loans might offer lower initial costs. Weighing these factors is key in choosing the right type of personal loan for your situation.

Key Factors to Consider Before Choosing a Fixed-Rate Personal Loan

When considering a Fixed-Rate Personal Loan, it’s essential to understand the pros and cons. This type of loan offers a stable interest rate, which means your monthly payments will remain the same throughout the loan term. This predictability can be a lifesaver for budgeting and planning your finances.

- Stability: With fixed rates, you won’t have to worry about rising interest rates. This can provide peace of mind, especially in uncertain economic times.

- Loan Amounts: Fixed-rate personal loans can vary widely in amounts, making them suitable for different needs, whether it’s for a vacation, home improvement, or debt consolidation.

- Repayment Terms: These loans typically come with various repayment terms, allowing you to choose one that fits your financial situation best.

However, there are some downsides to consider. Fixed-Rate Personal Loans often have higher interest rates compared to variable-rate loans. Additionally, if interest rates drop, you won’t benefit from lower payments unless you refinance. It’s crucial to weigh these factors carefully before making a decision.

The Application Process for Fixed-Rate Personal Loans: A Step-by-Step Guide

Understanding the application process for a Fixed-Rate Personal Loan is essential. This loan type provides stability with fixed monthly payments, making budgeting easier. Here’s a step-by-step guide to help you navigate the application confidently.

Step 1: Research Your Options

Begin by exploring various types of personal loans. Compare interest rates, terms, and lenders to find the best fit for your financial situation. Not all loans are the same!

Step 2: Gather Necessary Documents

Before applying, collect essential documents like your ID, proof of income, and credit history. Being prepared will speed up the process and impress lenders.

Step 3: Fill Out the Application

Complete the loan application, often available online. Ensure your information is honest and accurate to avoid delays, as lenders will check your credit score and financial history.

Step 4: Review Loan Offers

After submitting your application, review the loan offers you receive. Take your time to find the best terms that align with your budget—this decision is important!

Step 5: Accept and Finalize

Once you choose a loan, accept the offer and finalize the paperwork. After approval, the funds will be disbursed, allowing you to use your loan as intended. You’re on your way to financial empowerment!

How ‘ExpressCash’ Can Help You Find the Best Fixed-Rate Personal Loan

When considering a personal loan, grasping the Fixed-Rate Personal Loans Overview: Pros and Cons is essential. These loans provide a stable interest rate, simplifying budgeting. However, they come with both advantages and disadvantages. Let’s see how ‘ExpressCash’ can assist you in this journey.

Key Benefits of Fixed-Rate Personal Loans

- Predictable Payments: Monthly payments stay consistent, aiding financial planning.

- Long-Term Stability: Fixed rates protect you from market fluctuations.

- Variety of Uses: These loans can finance anything from home improvements to debt consolidation.

Potential Drawbacks

- Higher Initial Rates: Fixed rates may begin higher than variable rates.

- Less Flexibility: If interest rates decrease, you won’t benefit unless you refinance.

Understanding these pros and cons allows for informed decisions. ‘ExpressCash’ offers resources and comparisons to help you find the best Fixed-Rate Personal Loans suited to your needs. Navigating loan options can be daunting, but ‘ExpressCash’ makes it easier with user-friendly tools and expert guidance, ensuring you select a loan that aligns with your financial goals.

Real-Life Scenarios: When to Opt for a Fixed-Rate Personal Loan

When considering a Fixed-Rate Personal Loan, it’s essential to understand its pros and cons. This type of loan can provide stability in your monthly payments, making budgeting easier. However, it’s not always the best fit for everyone. Let’s explore real-life scenarios to see when opting for this loan makes sense.

When to Choose a Fixed-Rate Personal Loan

- Planning for a Big Purchase: If you’re planning to buy a car or make home improvements, a fixed-rate loan can help you manage your budget effectively. You’ll know exactly how much you need to pay each month.

- Long-Term Financial Goals: If you have a long-term project, like funding education, a fixed-rate loan can provide peace of mind with consistent payments over time.

Pros and Cons at a Glance

Pros:

- Predictable monthly payments

- Easier budgeting

- Protection against interest rate increases

Cons:

- Potentially higher interest rates than variable loans

- Less flexibility if rates drop later.

In conclusion, understanding the Fixed-Rate Personal Loans Overview helps you make informed decisions. Whether it’s for a big purchase or a long-term goal, knowing when to choose this type of loan can lead to better financial outcomes.

Making an Informed Decision: Is a Fixed-Rate Personal Loan Worth It?

When considering a personal loan, understanding the Fixed-Rate Personal Loans Overview: Pros and Cons is crucial. These loans can help you manage expenses, but they come with their own set of advantages and disadvantages. Knowing these can guide you in making a smart financial choice.

Pros of Fixed-Rate Personal Loans

- Predictable Payments: Your monthly payments stay the same, making budgeting easier.

- Stable Interest Rates: You won’t be affected by market fluctuations, which can save you money in the long run.

- Long-Term Planning: Fixed rates allow you to plan your finances without surprises.

Cons of Fixed-Rate Personal Loans

- Higher Initial Rates: Fixed rates can start higher than variable rates, which might not be ideal for everyone.

- Less Flexibility: If interest rates drop, you won’t benefit unless you refinance.

- Fees and Penalties: Some loans may come with fees that can add to your overall cost.

In conclusion, weighing these pros and cons will help you decide if a fixed-rate personal loan fits your needs. Remember, it’s all about what works best for your financial situation!

FAQs

-

What is a fixed-rate personal loan?

A fixed-rate personal loan has an interest rate that stays the same for the entire loan term, meaning your monthly payments remain consistent. -

What are the benefits of a fixed-rate loan?

The biggest advantages are predictable monthly payments, easier budgeting, and protection from rising interest rates. -

Are fixed-rate loans better than variable-rate loans?

Fixed-rate loans are ideal if you want stability and plan to repay over a longer term, while variable-rate loans might offer lower initial rates but can fluctuate over time. -

Can I refinance a fixed-rate personal loan?

Yes, you can refinance to a lower fixed rate or switch to a variable rate if market conditions improve and you’re eligible. -

How is the fixed rate on my loan determined?

Lenders consider your credit score, income, debt-to-income ratio, and overall financial profile when setting your interest rate.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.