The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

EMI Payment FAQs for Loan Borrowers: Get Key Answers

Understanding your EMI, or Equated Monthly Installment, is crucial for every loan borrower. It helps you manage your finances better and ensures you can repay your loan without stress. In this section, we will explore some common EMI Payment FAQs for Loan Borrowers, giving you the key answers you need.

What is EMI?

EMI is the fixed amount you pay every month to repay your loan. It includes both the principal and interest. Knowing how it works can help you plan your budget effectively. You can use a Personal Loan EMI Calculator to see how different loan amounts and interest rates affect your monthly payments.

Why is it important to understand EMI?

Understanding EMI helps you:

- Budget effectively: Knowing your monthly payment allows you to plan your expenses.

- Avoid defaults: By understanding your EMI, you can ensure timely payments and avoid penalties.

- Make informed decisions: You can compare different loans and choose the best one for your needs.

By grasping these concepts, you empower yourself as a borrower!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How is EMI Calculated? A Simple Breakdown

Understanding how your EMI is calculated is essential for anyone taking out a loan. This knowledge helps you plan your finances and avoid surprises. In this section, we’ll simplify the EMI calculation process, providing you with the answers you need in the EMI Payment FAQs for Loan Borrowers!

The Formula

To calculate your EMI, use the formula:

EMI = [P * r * (1 + r)^n] / [(1 + r)^n – 1]

Where:

- P = Principal loan amount

- r = Monthly interest rate (annual rate/12)

- n = Number of monthly installments

Using a Personal Loan EMI Calculator

If math isn’t your strong suit, a Personal Loan EMI Calculator can help. Just enter your loan amount, interest rate, and tenure, and you’ll get your EMI instantly!

Key Insights

- Principal Amount: The total money you borrow.

- Interest Rate: The cost of borrowing, expressed as a percentage.

- Tenure: The duration over which you’ll repay the loan.

By grasping these components, you can make informed decisions about your loan and manage your finances effectively.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

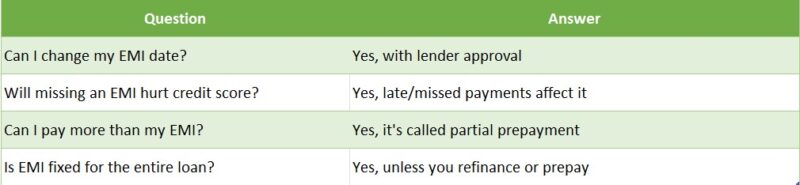

Common EMI Payment FAQs for Loan Borrowers

Understanding your EMI (Equated Monthly Installment) is crucial for loan borrowers. It helps you manage your finances better and avoid surprises. In this section, we’ll address some common EMI Payment FAQs for Loan Borrowers, ensuring you have all the key answers you need.

What is an EMI?

An EMI is a fixed payment amount made by a borrower to a lender at a specified date each calendar month. It includes both principal and interest. Knowing how it works can help you plan your budget effectively.

How can I calculate my EMI?

You can easily calculate your EMI using a Personal Loan EMI Calculator. Just enter the loan amount, interest rate, and tenure. The calculator will provide you with the exact amount you need to pay each month, making it simpler to manage your finances.

Also Read: Personal Loan EMI Calculator: Find Your Monthly Installments

What Happens If You Miss an EMI Payment?

Missing an EMI can lead to penalties and affect your credit score. It’s essential to communicate with your lender if you’re facing difficulties. They may offer solutions to help you avoid defaulting on your loan.

Missing an EMI payment can be stressful, but understanding the consequences can help you navigate the situation better. In our EMI Payment FAQs for Loan Borrowers, we aim to provide clear answers to your pressing questions. Knowing what happens if you miss a payment is crucial for managing your finances effectively.

When you miss an EMI payment, several things can occur:

- Late Fees: Most lenders impose a late fee, which can increase your overall loan cost.

- Credit Score Impact: Missing payments can negatively affect your credit score, making future loans more expensive or harder to get.

- Loan Default Risk: If you miss multiple payments, your loan may go into default, leading to serious consequences like legal action or asset seizure.

To avoid these issues, consider using a Personal Loan EMI Calculator. This tool helps you plan your payments and budget effectively, ensuring you stay on track with your loan obligations. Remember, communication with your lender is key if you’re facing difficulties.

Can You Prepay Your Loan? Key Considerations

Understanding your loan options is crucial, especially when it comes to prepaying your loan. This is part of our EMI Payment FAQs for Loan Borrowers: Get Key Answers. Prepayment can save you money on interest, but it’s essential to know the ins and outs before making a decision.

Can You Prepay Your Loan?

Prepaying your loan means paying off part or all of your loan before the due date. Here are some key considerations:

- Check for Prepayment Penalties: Some lenders charge fees for early repayment.

- Interest Savings: Prepaying can reduce the total interest you pay over time.

- Loan Terms: Understand how prepayment affects your loan terms and EMI amounts.

Using a Personal Loan EMI Calculator

A Personal Loan EMI Calculator can help you see the impact of prepayment. By entering your loan amount, interest rate, and tenure, you can visualize how much you could save. This tool is handy for planning your finances and making informed decisions about prepaying your loan.

The Impact of Interest Rates on Your EMI Payments

Understanding how interest rates affect your EMI payments is crucial for loan borrowers. This knowledge can help you make informed decisions about your finances. In our EMI Payment FAQs for Loan Borrowers, we aim to provide clear answers that can guide you through the complexities of loans and repayments.

When you take out a loan, the interest rate plays a significant role in determining your Equated Monthly Installment (EMI). Higher interest rates mean higher EMIs, which can strain your budget. Conversely, lower rates can make your monthly payments more manageable. Here’s how it works:

Key Points to Remember:

- Fixed vs. Floating Rates: Fixed rates remain constant, while floating rates can change. This affects your EMI over time.

- Loan Tenure: A longer tenure can lower your EMI but may increase the total interest paid.

- Personal Loan EMI Calculator: Use this tool to see how different interest rates impact your monthly payments. It’s a handy way to plan your finances!

How to Manage Your EMI Payments Effectively

Managing your EMI payments is crucial for maintaining financial health. Understanding the EMI Payment FAQs for Loan Borrowers can help you navigate your loan journey with confidence. Knowing how to calculate and plan your payments ensures you stay on track and avoid any surprises.

Use a Personal Loan EMI Calculator

Using a Personal Loan EMI Calculator is a smart first step. It helps you estimate your monthly payments based on the loan amount, interest rate, and tenure. This way, you can budget accordingly and avoid any financial strain.

Set Up Automatic Payments

Setting up automatic payments can save you time and stress. By scheduling your EMI payments, you ensure they are paid on time, which helps maintain a good credit score. Plus, you won’t have to worry about missing a payment!

Keep Track of Your Payments

Always keep track of your EMI payments. You can use a simple spreadsheet or a budgeting app. This will help you see how much you’ve paid and how much is left. Staying organized makes managing your finances much easier!

How ExpressCash Can Help You Navigate EMI Payments

Understanding EMI Payment FAQs for Loan Borrowers is crucial for anyone looking to manage their finances effectively. When you take out a loan, knowing how your Equated Monthly Installments (EMIs) work can save you from unexpected surprises. That’s where ExpressCash comes in, guiding you through the maze of EMI payments with ease.

At ExpressCash, we provide clear answers to your EMI Payment FAQs for Loan Borrowers. Our resources help demystify complex terms and calculations, making it easier for you to plan your repayments. Plus, our Personal Loan EMI Calculator is a handy tool that lets you estimate your monthly payments based on your loan amount and interest rate.

Key Benefits of Using ExpressCash:

- Easy-to-Understand Guides: We break down the jargon into simple terms.

- Personal Loan EMI Calculator: Quickly find out how much you need to pay each month.

- Expert Tips: Learn strategies to manage your EMIs effectively.

With these tools, you can confidently navigate your loan journey and make informed decisions about your finances.

Tips for First-Time Borrowers: Navigating EMI Payments

Understanding EMI Payment FAQs for Loan Borrowers is crucial for anyone stepping into the world of loans. It helps demystify the process and ensures you make informed decisions. Knowing how to manage your Equated Monthly Installments (EMIs) can save you from financial stress later on.

Key Questions to Consider

When you’re new to borrowing, you might have several questions about EMIs. Here are some common queries:

- What is an EMI? An EMI is a fixed payment amount made by a borrower to a lender at a specified date each calendar month.

- How is EMI calculated? You can use a Personal Loan EMI Calculator to determine your monthly payments based on the loan amount, interest rate, and tenure.

Tips for Managing Your EMIs

Managing your EMIs effectively can lead to a smoother borrowing experience. Here are some tips:

- Budget Wisely: Always ensure your monthly budget can accommodate your EMI.

- Stay Informed: Regularly check your loan details and payment schedules to avoid surprises.

- Communicate with Your Lender: If you face difficulties, don’t hesitate to reach out to your lender for assistance.

FAQs

-

What does EMI stand for in loans?

EMI stands for Equated Monthly Installment, which is the fixed payment made by a borrower each month to repay a loan. -

How is EMI calculated?

EMI is calculated using a formula based on the loan amount, interest rate, and loan tenure, usually via an EMI calculator. -

Can I change my EMI amount after loan approval?

Generally, EMIs are fixed, but you can increase or decrease them by changing the loan tenure or opting for loan restructuring. -

What happens if I miss an EMI payment?

Missing an EMI may lead to penalty charges, a lower credit score, and potential legal action if defaults continue. -

Can I pay more than my EMI amount in a month?

Yes, most lenders allow prepayments or extra payments, which reduce your outstanding balance and can lower future EMIs or shorten the loan term.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.