The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

EMI Calculator for Different Loan Amounts: Try It Now

When considering a loan, understanding how much you will pay each month is crucial. This is where the EMI Calculator for Different Loan Amounts comes into play. It helps you estimate your Equated Monthly Installment (EMI) based on the loan amount, interest rate, and tenure. Knowing your EMI can help you plan your finances better and avoid surprises.

Why Use an EMI Calculator?

Using a Personal Loan EMI Calculator is simple and beneficial. Here’s why you should try it now:

- Easy Planning: You can adjust the loan amount and see how it affects your monthly payments.

- Budgeting: Knowing your EMI helps you budget your expenses effectively.

- Comparison: You can compare different loan amounts and terms to find what suits you best.

How to Use the EMI Calculator

Using the EMI calculator is straightforward:

- Enter the loan amount you wish to borrow.

- Input the interest rate offered by your lender.

- Choose the tenure or duration for repayment.

- Click ‘Calculate’ to see your EMI.

By trying the EMI calculator for different loan amounts, you can make informed decisions and choose the best loan option for your needs.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How to Use an EMI Calculator Effectively

Using an EMI Calculator for Different Loan Amounts is a smart way to plan your finances. It helps you understand how much you’ll pay each month for a loan. Knowing your EMI can make a big difference in your budgeting, ensuring you don’t overspend.

To get started, simply enter the loan amount you need. For example, if you’re considering a personal loan, input the total amount you wish to borrow. This is the first step in using a Personal Loan EMI Calculator. Next, you’ll need to add the interest rate. This is usually a percentage that the bank charges for lending you money. Don’t forget to include the loan tenure, which is how long you plan to take to repay the loan. Once you have all this information, hit the calculate button!

Key Benefits of Using an EMI Calculator

- Easy Planning: It helps you plan your monthly budget effectively.

- Comparison: You can compare different loan amounts and interest rates.

- Clarity: It gives you a clear picture of your financial commitments.

Using an EMI calculator is like having a financial guide right at your fingertips!

What Factors Influence Your EMI Calculation?

When considering a loan, understanding your Equated Monthly Installment (EMI) is crucial. The EMI Calculator for Different Loan Amounts helps you visualize how much you’ll pay each month. This tool is essential for budgeting and planning your finances effectively. So, why not try it now?

Several factors play a role in determining your EMI. Here are the key ones:

- Loan Amount: The more you borrow, the higher your EMI will be. For example, a personal loan EMI calculator shows that a larger loan leads to larger monthly payments.

- Interest Rate: A lower interest rate means a lower EMI. Always compare rates before choosing a loan.

- Loan Tenure: The duration of your loan affects your EMI. A longer tenure results in smaller EMIs but more interest paid overall.

Understanding these factors can empower you to make informed decisions. By using the Personal Loan EMI Calculator, you can experiment with different amounts and see how changes affect your monthly payments. This way, you can choose a loan that fits your budget perfectly.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

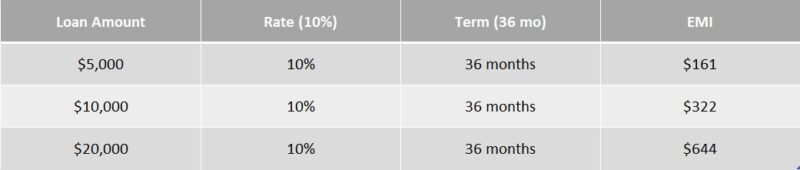

Comparing EMIs for Various Loan Amounts: A Quick Guide

When considering a loan, understanding your monthly payments is crucial. That’s where the EMI Calculator for Different Loan Amounts comes into play. It helps you estimate your Equated Monthly Installments (EMIs) based on the loan amount, interest rate, and tenure. This tool is essential for budgeting and planning your finances effectively.

Why Use an EMI Calculator?

Using a Personal Loan EMI Calculator is simple and beneficial. It allows you to visualize how different loan amounts affect your monthly payments. By adjusting the loan amount, you can see how your EMI changes, helping you make informed decisions.

Key Benefits of Using an EMI Calculator:

- Quick Estimates: Instantly see how much you’ll pay each month.

- Budgeting Help: Plan your finances better by knowing your EMIs in advance.

- Comparison Tool: Easily compare different loan amounts and terms to find what suits you best.

In just a few clicks, you can try it out and discover the best loan amount for your needs. So, why wait? Try the EMI Calculator for Different Loan Amounts now and take control of your financial future!

Also Read: Personal Loan EMI Calculator: Find Your Monthly Installments

Why You Should Try an EMI Calculator Before Taking a Loan

When you’re thinking about taking a loan, understanding how much you’ll pay each month is super important. That’s where the EMI Calculator for Different Loan Amounts comes in handy! It helps you figure out your Equated Monthly Installment (EMI) based on the loan amount, interest rate, and tenure. This tool can save you from surprises later on.

Why Use an EMI Calculator?

Using a Personal Loan EMI Calculator is like having a financial buddy. It shows you how different loan amounts affect your monthly payments. For example, if you borrow more, your EMI goes up. But if you choose a longer tenure, your EMI might be lower. This way, you can plan your budget better!

Key Benefits of Trying an EMI Calculator:

- Budgeting Made Easy: You can see how much you can afford to pay each month.

- Compare Options: Check different loan amounts and interest rates to find the best fit.

- Avoid Over-Borrowing: Knowing your EMI helps you avoid taking on too much debt.

- Instant Results: Get quick calculations without any hassle!

So, why wait? Try the EMI calculator now and take the first step towards making informed financial decisions!

Real-Life Scenarios: EMI Calculations for Different Loan Amounts

When considering a loan, understanding your monthly payments is essential. The EMI Calculator for Different Loan Amounts helps you visualize your monthly payments, making financial planning easier. Let’s see how this tool can aid your decision-making!

For a personal loan of $10,000 at a 10% interest rate over 5 years, your monthly EMI would be around $212. This insight helps determine if the loan fits your budget. If you increase the loan to $20,000, the EMI rises to about $424, emphasizing the importance of knowing your limits before committing.

Understanding the Impact of Loan Amounts

Loan amounts significantly affect your EMI. For example, a $30,000 loan could result in a monthly payment of approximately $636 at the same interest rate and term. This illustrates the necessity of calculating your payments beforehand!

Benefits of Using an EMI Calculator

- Clarity: Gain a clear picture of your monthly financial commitment.

- Budgeting: Plan your expenses effectively.

- Comparison: Compare different loan amounts and terms easily.

Try It Now!

Don’t wait to understand your financial future. Use the EMI Calculator for Different Loan Amounts today! It’s quick, easy, and can prevent unexpected surprises later. Just input your desired amount and see the results instantly.

How ExpressCash Simplifies Your Loan EMI Calculations

When it comes to taking out a loan, understanding your monthly payments is crucial. That’s where the EMI Calculator for Different Loan Amounts comes into play. It helps you visualize how much you’ll need to pay each month, making budgeting easier and less stressful. With just a few clicks, you can see how different loan amounts affect your EMI, helping you make informed decisions.

Easy-to-Use Interface

Using our Personal Loan EMI Calculator is a breeze! Simply enter the loan amount, interest rate, and tenure. Instantly, you’ll see your monthly EMI, which takes the guesswork out of your financial planning.

Key Benefits of Using Our EMI Calculator:

- Quick Calculations: Get instant results without any complicated formulas.

- Compare Different Scenarios: Adjust the loan amount and tenure to see how it impacts your EMI.

- Budget Better: Knowing your EMI helps you plan your finances effectively, ensuring you don’t overspend.

By trying out our EMI Calculator for Different Loan Amounts, you empower yourself with knowledge. This tool is not just a calculator; it’s your financial companion, guiding you through the loan process with ease. So why wait? Try it now and take the first step towards smarter borrowing!

Maximizing Your Savings: Tips for Lower EMIs

When it comes to loans, understanding your monthly payments is crucial. That’s where the EMI Calculator for Different Loan Amounts comes into play. It helps you see how much you’ll pay each month, making budgeting easier and smarter. Let’s dive into some tips to maximize your savings!

Know Your Loan Amount

Before using the Personal Loan EMI Calculator, determine how much you really need. Borrowing more than necessary can lead to higher EMIs, which might strain your finances. Always aim for a loan amount that fits your budget comfortably.

Choose the Right Tenure

The tenure of your loan affects your EMI. A longer tenure means lower EMIs but more interest paid overall. Conversely, a shorter tenure means higher EMIs but less interest. Use the EMI calculator to find a balance that works for you!

Compare Interest Rates

Different lenders offer various interest rates. Use the EMI Calculator for Different Loan Amounts to see how these rates impact your monthly payments. Even a small difference in interest can lead to significant savings over time!

Make Extra Payments

If possible, make extra payments towards your loan principal. This can reduce your overall interest and lower your EMIs. The Personal Loan EMI Calculator can help you see how extra payments affect your loan duration and total cost.

FAQs

-

How does an EMI calculator work for different loan amounts?

It computes your monthly EMI based on the loan amount, interest rate, and tenure, allowing you to compare options easily. -

Can I compare EMIs for multiple loan amounts at once?

Yes, many calculators let you input and compare multiple loan amounts to see how they affect your EMI and total repayment. -

What factors change with different loan amounts?

A higher loan amount typically means higher EMIs and more total interest, assuming the same rate and tenure. -

Does the interest rate stay the same across all loan amounts?

Not always—some lenders offer tiered interest rates, so larger loans might come with different interest terms. -

How do I choose the best loan amount for my budget?

Use the calculator to find an EMI that fits your monthly budget without straining your finances, and check the total cost before deciding.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.