The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

EMI Calculation Formula Explained: How EMI Is Computed

Understanding your monthly payments is crucial when taking out a loan. The EMI Calculation Formula Explained helps you determine how much you’ll pay each month, making budgeting easier and preventing surprises later on!

The EMI Calculation Formula Explained

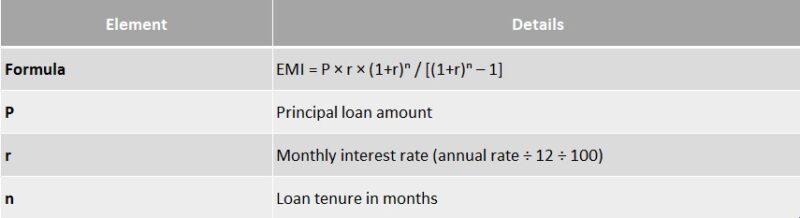

To calculate your Equated Monthly Installment (EMI), use the formula:

EMI = [P * r * (1 + r)^n] / [(1 + r)^n – 1]

Where:

- P = Principal loan amount

- r = Monthly interest rate (annual rate divided by 12)

- n = Loan tenure in months

This formula simplifies your payments into manageable parts!

Why Use a Personal Loan EMI Calculator?

A Personal Loan EMI Calculator makes this process easier by providing:

- Instant Results: Get your EMI quickly!

- Loan Comparisons: See how interest rates impact payments.

- Planning Tools: Adjust amounts and tenures to fit your budget.

With just a few clicks, you can better understand your financial commitments!

Key Factors Influencing Your EMI

Several factors affect your EMI:

- Interest Rate: Higher rates lead to higher EMIs.

- Loan Amount: More borrowed means more to repay.

- Tenure: Longer tenures lower monthly payments but increase total interest paid.

Understanding these factors helps you make informed decisions!

Conclusion

In summary, the EMI Calculation Formula Explained is vital for anyone considering a loan. By understanding how your EMI is computed, you can make smarter financial choices. Utilize tools like the Personal Loan EMI Calculator to stay ahead!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Factors Influence Your EMI Amount?

When you borrow money, understanding how your monthly payments are calculated is crucial. This is where the EMI Calculation Formula Explained comes into play. Knowing how your EMI is computed can help you manage your finances better and avoid surprises down the road.

Several key factors determine your EMI amount. Here’s a breakdown of the most important ones:

Loan Amount

The total amount you borrow directly affects your EMI. A larger loan means higher monthly payments, while a smaller loan results in lower payments. It’s like buying a bigger pizza; more slices mean more cost!

Interest Rate

The interest rate is another critical factor. A higher interest rate increases your EMI, while a lower rate decreases it. Think of it as the extra toppings on your pizza; they can make it more expensive!

Loan Tenure

The duration of your loan also plays a role. A longer tenure means smaller EMIs, but you’ll pay more interest overall. Conversely, a shorter tenure leads to higher EMIs but less interest paid. It’s all about finding the right balance! Using a Personal Loan EMI Calculator can help you visualize these factors and plan your finances accordingly. By adjusting the loan amount, interest rate, and tenure, you can see how each element impacts your monthly payments.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Step-by-Step Guide to Computing Your EMI

Understanding how your EMI is calculated is essential when taking a personal loan. The EMI Calculation Formula Explained helps you know your monthly payments, allowing for better budgeting and fewer surprises.

You can use a Personal Loan EMI Calculator, but knowing the formula is also helpful. The EMI formula is:

EMI = [P * r * (1 + r)^n] / [(1 + r)^n – 1]

Where:

- P = Principal loan amount

- r = Monthly interest rate (annual rate/12)

- n = Loan tenure in months

Steps to Calculate Your EMI

- Identify the Principal Amount: The total loan amount you wish to borrow.

- Determine the Interest Rate: Convert the annual interest rate to a monthly rate.

- Decide the Loan Tenure: Choose the repayment period in months.

- Plug in the Values: Use the formula to calculate your monthly payment.

By following these steps, you can easily compute your EMI and manage your finances effectively!

Benefits of Knowing Your EMI

- Budgeting: Helps plan monthly expenses.

- Financial Clarity: Provides a clear picture of repayment obligations.

- Loan Comparison: Simplifies comparing different loans.

Using a Personal Loan EMI Calculator

Using a Personal Loan EMI Calculator is quick and easy. Just enter the principal amount, interest rate, and tenure, and the calculator does the rest, giving you instant results.

Also Read: Personal Loan EMI Calculator: Find Your Monthly Installments

How to Use an EMI Calculator Effectively?

Understanding the EMI Calculation Formula is crucial for anyone considering a loan. It helps you grasp how much you’ll pay each month, making budgeting easier. Knowing how EMI is computed can save you from financial surprises down the road!

Using a Personal Loan EMI Calculator is simple and can be done in just a few steps. First, gather your loan amount, interest rate, and loan tenure. These are the key inputs needed to get accurate results. Here’s how to proceed:

Steps to Use an EMI Calculator:

- Input the Loan Amount: Enter the total amount you wish to borrow.

- Set the Interest Rate: Input the annual interest rate offered by your lender.

- Choose the Tenure: Select how long you want to repay the loan, usually in months.

- Hit Calculate: Click the calculate button to see your monthly EMI!

Benefits of Using an EMI Calculator:

- Instant Results: Get your EMI amount in seconds!

- Compare Options: Try different amounts and interest rates to find the best deal.

- Plan Your Budget: Knowing your EMI helps you manage your finances better.

Common Mistakes in EMI Calculation You Should Avoid

Understanding the EMI Calculation Formula Explained is essential for anyone considering a personal loan. It helps you determine your monthly payments, ensuring you stay within budget. However, many borrowers make common mistakes that can lead to confusion and financial strain.

Ignoring the Interest Rate

A significant mistake is overlooking the interest rate. Even a small change can greatly impact your EMI. Always verify the rate before using a Personal Loan EMI Calculator for accurate results.

Not Considering the Loan Tenure

Another error is not factoring in the loan tenure. While a longer tenure results in lower EMIs, it increases the total interest paid. Balance your monthly budget with the overall loan cost to avoid surprises.

Forgetting Additional Fees

Don’t forget about additional fees like processing charges, which can inflate your total loan amount and affect your EMI. Include these in your calculations for a clearer financial picture.

Relying Solely on Online Calculators

Although a Personal Loan EMI Calculator is useful, relying solely on it can lead to errors. Always cross-check your calculations manually or consult a financial advisor for accuracy.

Not Reviewing Your Credit Score

Your credit score significantly influences your interest rate. Failing to check it before applying can lead to unexpected costs. Always review your score to secure the best deal.

Overlooking Prepayment Options

Lastly, consider prepayment options. If you plan to pay off your loan early, check for penalties. This can save you money and reduce your EMI burden.

Why Accurate EMI Calculation Matters for Your Finances

Understanding the EMI Calculation Formula is essential for anyone considering a loan. Knowing how your Equated Monthly Installment (EMI) is computed helps you manage your finances effectively, avoiding surprises and allowing for better budgeting.

Clarity in Budgeting

Using a Personal Loan EMI Calculator provides a clear picture of your monthly payments. This clarity enables wise allocation of funds, ensuring you can cover expenses without stress.

Avoiding Financial Strain

Accurate EMI calculations help prevent financial strain. Knowing your EMI amount allows you to avoid taking on more debt than you can handle, keeping your financial health in check and maintaining a good credit score.

Planning for the Future

Understanding the EMI Calculation Formula allows you to plan for future expenses, whether saving for a vacation or an emergency fund. Knowing your monthly obligations helps you set aside money for what truly matters.

Making Informed Decisions

Grasping how your EMI is calculated empowers you to make informed borrowing decisions. You can assess if loan terms are favorable or if better options exist, leading to wiser choices.

Reducing Financial Stress

Accurate EMI calculations significantly reduce financial stress. Knowing your monthly payment amount helps avoid anxiety over unexpected expenses, providing invaluable peace of mind.

Enhancing Financial Literacy

Finally, understanding the EMI Calculation Formula enhances your financial literacy, equipping you to navigate the financial landscape and make smarter choices in the long run.

How ExpressCash Can Simplify Your EMI Calculation Process

Understanding the EMI calculation formula is crucial for anyone looking to take out a loan. It helps you know how much you’ll pay each month, making budgeting easier. But don’t worry! With ExpressCash, this process becomes a breeze. Let’s dive into how we simplify your EMI calculation process.

Calculating your EMI can seem complicated, but it doesn’t have to be. Here’s how ExpressCash makes it easy:

- User-Friendly Interface: Our Personal Loan EMI Calculator is designed for everyone. Just enter your loan amount, interest rate, and tenure, and voila! You get your EMI instantly.

- Instant Results: No more waiting around for calculations. Get your results in seconds, allowing you to make informed decisions quickly.

Benefits of Using ExpressCash

Using our EMI calculator has several advantages:

- Clarity: Understand how much you’ll pay each month.

- Flexibility: Adjust loan amounts and tenures to see how they affect your EMI.

- No Hidden Fees: What you see is what you get—no surprises!

With ExpressCash, you can confidently navigate your loan journey, knowing exactly what to expect.

FAQs

-

What is the EMI calculation formula?

The EMI formula is:

EMI=P×R×(1+R)N(1+R)N−1EMI = \frac{P \times R \times (1 + R)^N}{(1 + R)^N – 1}

where P = loan amount, R = monthly interest rate, and N = total number of months. -

How do I calculate the monthly interest rate (R)?

Divide the annual interest rate by 12 and convert it to a decimal. For example, 12% annually becomes 0.01 monthly (12% ÷ 12 ÷ 100). -

What does the EMI formula help me understand?

It shows your fixed monthly payment, including both principal and interest, making it easier to plan your repayment schedule. -

Is the EMI formula the same for all loans?

Yes, it’s commonly used for personal loans, home loans, auto loans, and other fixed-rate installment loans. -

Can I skip the manual formula and use an EMI calculator?

Absolutely! EMI calculators are fast, accurate, and eliminate the need for manual calculations, especially helpful for comparing loan options.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.