The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Credit Score Requirements for Loan Approval

Credit Score Requirements for Loan Approval

Credit scores are important. They help lenders decide if they should approve your loan. Whether you’re applying for a personal loan, car loan, or home loan, your credit score plays a big role. A high score means you are more likely to get approved. A low score can make it harder.

In this blog, we’ll explain what credit score requirements for loan approval, what scores lenders look for, and how to improve your chances of loan approval. We’ll keep things simple and easy to understand.

What Is a Credit Score?

A credit score is a number that shows how good you are with money. It tells lenders if you pay your bills on time and how much debt you have. It usually ranges from 300 to 850. The higher your score, the better.

Why Credit Scores Matter

Lenders use credit scores to:

-

Decide if they will lend you money

-

Set your loan interest rate

-

Choose how much money you can borrow

A higher score usually means lower interest and better terms.

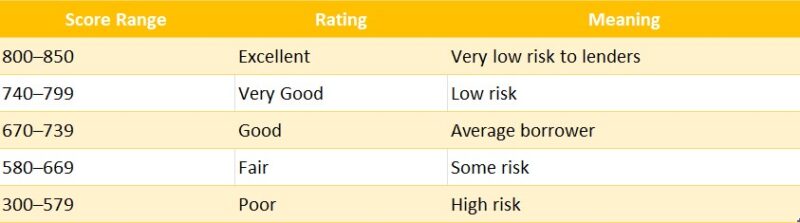

Credit Score Ranges

If your score is above 670, you’re in a good place for most loans.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Credit Score Is Needed for Loan Approval?

1. Personal Loans

Most lenders want a credit score of at least 600. Some lenders accept lower scores, but you may get higher interest rates.

| Loan Type | Minimum Score Needed |

|---|---|

| Unsecured Loan | 600–640+ |

| Secured Loan | 580+ |

| Bad Credit Loan | 300–580 |

ExpressCash offers personal loans even if your credit isn’t perfect.

2. Auto Loans

You can get a car loan with a low score, but it may cost more. Good credit helps you get better deals.

| Credit Score | Likely Outcome |

|---|---|

| 700+ | Low interest, easy approval |

| 620–699 | Average terms |

| Below 620 | May need a co-signer or big down payment |

3. Mortgage Loans

Home loans need higher credit scores. Lenders want to know you can handle a big debt.

| Loan Type | Minimum Score |

|---|---|

| FHA Loan | 580 (with 3.5% down) |

| VA Loan | 620+ |

| Conventional Loan | 620–640+ |

| USDA Loan | 640+ |

4. Credit Cards

For top rewards cards, you’ll need a higher score. But some credit cards accept lower scores.

| Card Type | Minimum Score |

|---|---|

| Secured Credit Card | 300+ |

| Store Credit Card | 580+ |

| Rewards Credit Card | 700+ |

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Other Factors Lenders Look At

Credit score is just one part. Lenders also check:

-

Income: Can you pay the loan back?

-

Employment: Do you have a steady job?

-

Debt-to-Income Ratio (DTI): Do you already owe a lot?

-

Loan Purpose: Why are you borrowing?

Even with a high score, these factors matter.

How to Check Your Credit Score

You can check your score for free:

-

On your credit card app

-

With free credit tools online

-

At AnnualCreditReport.com (for full reports)

Checking your score does not hurt it.

What If Your Score Is Too Low?

If your score is low, don’t worry. You can still get a loan, but your interest may be higher. Some lenders, like ExpressCash, offer loans for bad credit.

Tips to Improve Your Credit:

-

Pay bills on time

-

Keep credit card balances low

-

Don’t open too many new accounts

-

Check reports for errors

-

Use credit-building tools

Loan Approval Example Based on Score

Let’s see how loan terms can change with your credit score:

| Score | Loan Amount | Interest Rate | Monthly Payment (3 years) |

|---|---|---|---|

| 750 | $10,000 | 6% | $304 |

| 650 | $10,000 | 14% | $342 |

| 550 | $10,000 | 24% | $395 |

As your score drops, your loan becomes more expensive.

Pros and Cons of High Credit Scores

| Pros | Cons |

|---|---|

| Low interest rates | Takes time to build |

| More loan options | Requires discipline |

| Higher approval odds | Easy to damage with one mistake |

| Better credit card rewards | Temptation to take on more debt |

Can You Get a Loan with No Credit Score?

Yes. Some lenders offer loans to people with no credit history. They may use:

-

Employment history

-

Income proof

-

Bank statements

These are called “alternative data” lenders.

Secured vs Unsecured Loans

If your credit score is low, a secured loan might help.

Secured Loan

-

Needs collateral like a car or savings

-

Lower interest rate

-

Easier to get approved

Unsecured Loan

-

No collateral needed

-

Based mostly on credit score

-

May have higher rates

Lender Types and Score Requirements

| Lender Type | Credit Score Needed | Notes |

|---|---|---|

| Banks | 670+ | Best terms for high scores |

| Credit Unions | 600+ | Flexible, member-based |

| Online Lenders | 580+ | Fast and convenient |

| Payday Lenders | None | Very high interest, risky |

| Peer-to-Peer | 600+ | Based on investor approval |

Can a Co-Signer Help?

Yes. If your credit is low, a co-signer with good credit can:

-

Help you get approved

-

Lower your interest rate

-

Share responsibility for the loan

Be sure your co-signer understands the risk.

How Long Does It Take to Improve a Score?

Improving your credit score takes time. But it’s worth it.

| Action | Time to See Results |

|---|---|

| Pay off credit card debt | 1–2 months |

| Dispute credit report errors | 1 month |

| On-time payments | 3–6 months |

| Lower credit usage | 1–2 billing cycles |

Does Loan Rejection Affect Your Credit Score?

Not directly. But the hard inquiry from applying may lower your score by a few points. Too many rejections in a short time can make lenders cautious.

What Is a Good Debt-to-Income Ratio?

DTI = monthly debt ÷ monthly income.

Lenders prefer a DTI of below 36%. A high DTI means you already owe too much.

| DTI Ratio | Risk Level |

|---|---|

| Under 36% | Low |

| 37%–49% | Medium |

| 50%+ | High |

Paying off loans and credit cards can lower your DTI quickly.

Loan Pre-Approval vs Final Approval

Pre-approval means the lender thinks you qualify. They do a soft check.

Final approval means the lender has checked all your documents and credit. That includes a hard check.

Getting pre-approved helps you shop with confidence, but it’s not a guarantee.

Using ExpressCash for Loans

ExpressCash offers personal loans that don’t require perfect credit. You can apply online and get an answer quickly.

Why Choose ExpressCash?

-

Fast approval

-

Fair rates

-

No need for excellent credit

-

Helps in emergencies

It’s a good option if your credit score is holding you back.

Conclusion

Your credit score is important, but it’s not everything. Many lenders look at the full picture, including income, job, and current debts. Even if your score is low, you still have loan options.

Know what score you need, work to improve it, and apply smartly. Avoid too many hard inquiries and keep your debt low. If you need help, ExpressCash is ready to assist with fair loan options, even for those with less-than-perfect credit.

FAQs: Credit Score Requirements for Loan Approval

1. What’s the minimum credit score for a personal loan?

Most lenders want at least 600, but some accept scores as low as 580.

2. Can I get a loan with a credit score under 600?

Yes. Some lenders specialize in bad credit loans. You may pay more in interest.

3. What’s the fastest way to raise my credit score?

Pay down credit cards and make all payments on time.

4. Does getting denied for a loan hurt my score?

No, but the hard inquiry might lower your score by a few points.

5. Can I get a loan without a credit score?

Yes. Some lenders use your income and job history instead of a credit score.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.