The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Factors Affecting Credit Score You Should Know

Understanding your credit score is crucial, especially if you’re planning to apply for a personal loan. The factors affecting credit score can make a big difference in whether you get approved or not. Let’s dive into what influences your score and how you can improve it!

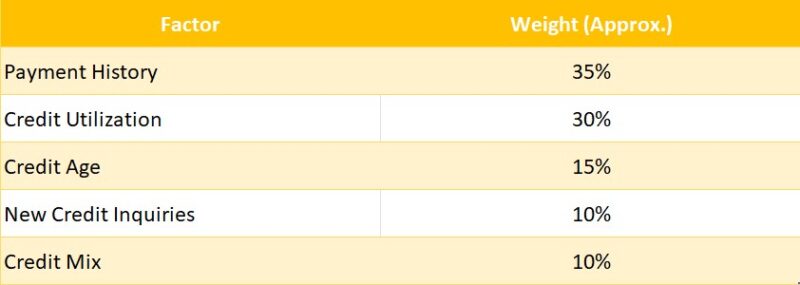

Key Factors That Influence Your Credit Score

- Payment History: This is the most significant factor. Paying your bills on time shows lenders you’re responsible.

- Credit Utilization: This refers to how much of your available credit you’re using. Keeping it below 30% is ideal.

- Length of Credit History: The longer your credit history, the better. It shows lenders you have experience managing credit.

- Types of Credit: Having a mix of credit types, like credit cards and loans, can positively impact your score.

- New Credit Inquiries: Too many inquiries can hurt your score. Limit how often you apply for new credit.

How to Improve Your Credit Score for a Personal Loan

Improving your credit score is possible! Here are some tips:

- Pay Bills on Time: Set reminders or automate payments.

- Reduce Debt: Work on paying down existing debts to lower your credit utilization.

- Check Your Credit Report: Look for errors and dispute them if necessary.

- Avoid New Credit Applications: Focus on maintaining your current accounts instead.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Payment History Impacts Your Credit Score

Understanding how your credit score works is essential, especially if you’re planning to apply for a personal loan. One of the most significant Factors Affecting Credit Score is your payment history. This part of your credit report shows lenders how reliably you pay your bills, and it can make or break your chances of getting that loan you need.

The Importance of Timely Payments

Your payment history accounts for about 35% of your credit score. This means that making payments on time is crucial. If you miss a payment, it can hurt your score significantly. Think of it like a report card; consistent good grades lead to a better overall score!

Tips to Improve Your Payment History

- Set Up Reminders: Use your phone or calendar to remind you when bills are due.

- Automate Payments: Consider setting up automatic payments for regular bills. This way, you won’t forget!

- Catch Up on Missed Payments: If you’ve missed payments in the past, try to catch up as soon as possible. This can help improve your credit score for a personal loan.

The Role of Credit Utilization in Your Financial Health

Understanding the factors affecting your credit score is crucial for your financial health. One key element is credit utilization, which can significantly impact your score. By managing this wisely, you can improve your credit score for a personal loan and open doors to better financial opportunities.

What is Credit Utilization?

Credit utilization refers to the amount of credit you’re using compared to your total available credit. It’s usually expressed as a percentage. For example, if you have a credit limit of $10,000 and you owe $3,000, your credit utilization is 30%.

Why Does It Matter?

Keeping your credit utilization low is essential. Here are some reasons why:

- Better Credit Score: A lower percentage can boost your credit score.

- Loan Approval: Lenders prefer borrowers with lower utilization rates.

- Interest Rates: A higher score can lead to lower interest rates on loans.

Tips to Manage Credit Utilization

To maintain a healthy credit utilization rate, consider these tips:

- Pay Off Balances: Try to pay off your credit card balances each month.

- Increase Credit Limits: Requesting a higher limit can lower your utilization percentage.

- Use Multiple Cards: Spread your spending across different cards to keep individual utilization low.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Why Length of Credit History Matters for Your Score

When it comes to understanding the factors affecting credit score, one crucial aspect is the length of your credit history. This might sound boring, but it’s actually quite important! Think of your credit history as a storybook of your financial life. The longer the story, the more trustworthy you appear to lenders. They want to see how you’ve handled credit over time before deciding if they should lend you money.

Why Length of Credit History Matters

A longer credit history shows that you have experience managing credit. Here are some key points to consider:

- Trustworthiness: Lenders feel more confident lending to someone with a long history of on-time payments.

- Credit Mix: A varied credit history, like having credit cards and loans, can boost your score.

- Time is Key: Even if you have a few late payments, a long history can still help your score stay strong.

To improve your credit score for a personal loan, focus on building your credit history. Start by keeping old accounts open, even if you don’t use them much. This way, you add more time to your credit story. Remember, every little bit helps when it comes to boosting your score!

Are New Credit Inquiries Hurting Your Credit Score?

Understanding the Factors Affecting Credit Score is crucial for anyone looking to manage their finances wisely. One common concern is how new credit inquiries can impact your score. If you’re thinking about applying for a personal loan, knowing this can help you make informed decisions.

When you apply for credit, lenders usually check your credit report. This is called a hard inquiry. While one hard inquiry might only drop your score slightly, multiple inquiries can add up. Here’s what you should know:

Key Points to Consider:

- Hard Inquiries vs. Soft Inquiries: Hard inquiries affect your score, while soft inquiries do not. Soft inquiries occur when you check your own credit or when companies pre-approve you for offers.

- Time Matters: Hard inquiries stay on your report for two years but only impact your score for about a year. So, if you’re planning to apply for a loan, timing your applications can help minimize damage.

- Improving Your Score: To improve your credit score for a personal loan, focus on paying bills on time and reducing existing debt. This can offset the impact of new inquiries.

The Influence of Credit Mix on Your Overall Score

Understanding the factors affecting your credit score is crucial, especially if you’re planning to apply for a personal loan. One key element that plays a significant role is your credit mix. This refers to the variety of credit accounts you have, such as credit cards, mortgages, and installment loans. Having a diverse credit mix can positively influence your overall score, making it easier to improve your credit score for a personal loan.

The Influence of Credit Mix on Your Overall Score

A healthy credit mix shows lenders that you can manage different types of credit responsibly. Here are some important points to consider:

- Variety Matters: A mix of revolving credit (like credit cards) and installment loans (like car loans) can enhance your score.

- Credit Utilization: Keeping your credit card balances low while managing loans effectively can boost your score further.

- Payment History: Consistently making on-time payments across various accounts demonstrates reliability, which lenders appreciate.

In summary, while credit mix is just one of the factors affecting your credit score, it can make a big difference. By diversifying your credit types and managing them well, you can improve your credit score for a personal loan. Remember, a strong credit score opens doors to better loan terms and interest rates!

How Negative Marks Can Affect Your Credit Score

Understanding how negative marks can affect your credit score is crucial for anyone looking to borrow money. Your credit score is like a report card for your financial behavior. It can determine whether you get approved for loans, credit cards, or even a rental agreement. So, knowing the factors affecting credit score is essential!

How Negative Marks Impact Your Score

Negative marks, such as late payments or defaults, can significantly lower your credit score. Here’s how:

- Late Payments: Missing a payment can drop your score by 100 points or more. This can make it harder to improve credit score for a personal loan.

- Bankruptcies: A bankruptcy can stay on your credit report for up to 10 years, making it tough to secure future loans.

- Collections: If a debt goes to collections, it can severely impact your score. Even one collection account can cause a significant drop.

Moving Forward

While negative marks can hurt your credit score, there are ways to recover. Regularly checking your credit report, making timely payments, and reducing debt can help you bounce back. Remember, understanding these factors is the first step to improving your financial health!

Discover How ExpressCash Can Help You Improve Your Credit Score

Understanding the factors affecting your credit score is crucial, especially if you’re looking to improve your credit score for a personal loan. A good credit score can open doors to better loan terms and lower interest rates. So, let’s dive into how ExpressCash can help you navigate this important aspect of your financial life.

Key Factors Affecting Credit Score

- Payment History: This is the most significant factor. Always pay your bills on time to keep your score healthy.

- Credit Utilization: Try to use less than 30% of your available credit. This shows lenders you’re responsible with credit.

- Length of Credit History: The longer your credit history, the better. Keep old accounts open, even if you don’t use them often.

How ExpressCash Can Help

At ExpressCash, we provide personalized tips and tools to help you improve your credit score. Our resources can guide you on how to manage your payments and credit utilization effectively. Plus, we offer insights tailored to your financial situation, making it easier to achieve your goals.

FAQs

-

What are the main factors that impact my credit score?

The key factors include payment history, credit utilization ratio, length of credit history, credit mix, and new credit inquiries. -

Does missing one payment lower my credit score?

Yes, even a single missed or late payment can negatively affect your score, especially if it’s over 30 days overdue. -

How does credit utilization affect my score?

Using more than 30% of your available credit can lower your score. Keeping usage low shows responsible credit behavior. -

Do multiple loan applications hurt my credit?

Yes, several hard inquiries in a short time can signal risk to lenders and may temporarily reduce your score. -

Can closing old credit accounts impact my score?

Yes, closing older accounts can reduce your credit age and limit available credit, which may lower your score.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.