The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

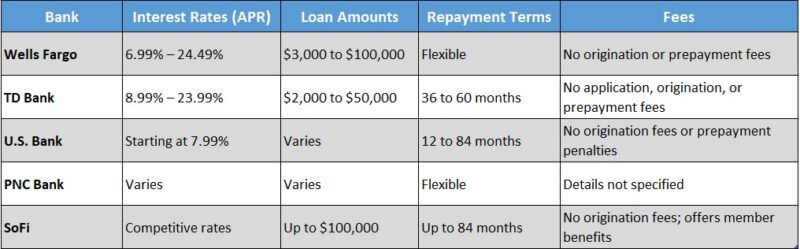

Top Banks Offering Low Loan Rates: Compare & Apply

Discover the Top Banks Offering Low Loan Rates

When it comes to borrowing money, finding the right loan can feel overwhelming. That’s why knowing the Top Banks Offering Low Loan Rates is crucial. Lower rates mean less money paid over time, making it easier to manage your finances. Let’s dive into how you can compare and apply for these loans effectively.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Comparing bank loan rates vs. online loan rates is essential. Banks often provide competitive rates, but online lenders can sometimes offer better deals. Understanding both options helps you make an informed choice.

Key Benefits of Low Loan Rates

- Save Money: Lower interest means lower monthly payments.

- Flexible Terms: Many banks offer customizable loan terms to fit your needs.

- Trustworthy Institutions: Established banks often provide reliable customer service and support.

How to Apply for a Loan

- Research: Start by checking the rates from various banks.

- Pre-qualify: Many banks allow you to see potential rates without affecting your credit score.

- Gather Documents: Have your financial information ready for a smooth application process.

By exploring the Top Banks Offering Low Loan Rates, you can find the best deal that suits your financial situation. Happy borrowing!

How to Compare Loan Rates Effectively

When you’re on the hunt for a loan, understanding how to compare loan rates effectively can save you a lot of money. With so many options available, knowing the Top Banks Offering Low Loan Rates is crucial. This can help you make informed decisions and find the best deal for your needs.

Understand the Basics

Start by knowing the difference between Bank Loan Rates vs. Online Loan Rates. Banks often have lower rates due to their established trust and stability. However, online lenders can offer competitive rates and faster approvals. So, weigh your options carefully!

Key Steps to Compare Rates

- Research: Look at multiple banks and online lenders.

- Check Fees: Some loans come with hidden fees that can increase your overall cost.

- Read Reviews: Customer experiences can provide insight into the lender’s reliability.

- Use Comparison Tools: Websites can help you see rates side by side, making it easier to choose.

By following these steps, you can find the best loan rates that suit your financial goals.

What Makes a Bank Stand Out in Loan Offers?

When searching for a loan, understanding what makes a bank stand out is crucial. The Top Banks Offering Low Loan Rates can save you money and make borrowing easier. But how do you know which bank is right for you? Let’s explore the key factors that can help you make an informed decision.

Key Factors to Consider

- Interest Rates: Compare bank loan rates vs. online loan rates. Banks often have competitive rates, but online lenders might offer lower options for specific loans.

- Customer Service: A bank that provides excellent customer support can make your loan experience smoother. Look for reviews and ratings to gauge their service quality.

- Loan Terms: Different banks offer various loan terms. Check if they provide flexible repayment options that suit your financial situation.

Benefits of Choosing the Right Bank

- Lower Monthly Payments: A bank with lower rates means smaller payments each month.

- Faster Approval: Some banks can process loans quicker than others, getting you the funds when you need them.

- Trust and Security: Established banks often have a reputation for reliability, giving you peace of mind. Choosing wisely can lead to significant savings and a better borrowing experience!

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

The Benefits of Choosing Low Loan Rates

When it comes to borrowing money, choosing the right bank can make a huge difference. That’s why understanding the Top Banks Offering Low Loan Rates is essential. Low loan rates can save you money over time, making your financial journey smoother and more manageable.

Low loan rates can significantly reduce your monthly payments. This means more money in your pocket for other expenses. Here are some key benefits to consider:

- Lower Monthly Payments: With lower rates, you pay less each month.

- Less Interest Paid Overall: Over the life of the loan, you’ll pay less in interest, saving you money in the long run.

When comparing Bank Loan Rates vs. Online Loan Rates, it’s important to weigh your options. Banks often offer stability and personalized service, while online lenders might provide quicker approvals. Ultimately, choosing a lender with low rates can lead to a more affordable loan experience.

Read Also: Bank Loan Rates vs. Online Loan Rates: Which Is Cheaper?

Step-by-Step Guide to Applying for a Loan

When you’re looking for a loan, understanding the options available is crucial. The Top Banks Offering Low Loan Rates can help you save money over time. With so many choices, comparing these rates can make a big difference in your financial journey. Let’s explore how to apply for a loan step-by-step!

1. Research Your Options

Start by checking out the bank loan rates vs. online loan rates. Banks often have lower rates, but online lenders can be quicker. Make a list of your top choices!

2. Gather Your Documents

Before applying, collect necessary documents like your ID, income proof, and credit score. This will speed up the process and help you get the best rates.

3. Fill Out the Application

Once you’ve chosen a bank, fill out their loan application. Be honest and thorough to avoid delays.

4. Wait for Approval

After submitting, be patient! The bank will review your application and let you know if you’re approved.

5. Review the Terms

If approved, carefully read the loan terms. Make sure you understand the interest rates and repayment schedule before signing.

Following these steps can lead you to the best loan options available!

Customer Reviews: Which Banks Are Most Trusted?

When it comes to borrowing money, finding the right bank is crucial. Many people want to know which banks offer the best loan rates. This is where customer reviews come in handy. They can help you understand which banks are most trusted and why. After all, Top Banks Offering Low Loan Rates can make a big difference in your financial journey.

What Customers Are Saying

- Bank A: Customers love their quick approval process and friendly service. Many say they felt supported throughout their loan journey.

- Bank B: Known for low loan rates, but some reviews mention slow customer service. However, the rates often make it worth the wait.

- Bank C: Offers competitive rates and has a reputation for transparency. Customers appreciate clear communication about fees and terms.

Comparing Bank Loan Rates vs. Online Loan Rates

While traditional banks often have lower loan rates, online lenders can be more flexible. Customers frequently share their experiences comparing these options. Some prefer the personal touch of a bank, while others enjoy the convenience of online applications. Ultimately, it’s about finding what works best for you!

Understanding the Fine Print of Loan Agreements

When considering a loan, understanding the fine print of loan agreements is crucial. The Top Banks Offering Low Loan Rates can provide great deals, but hidden fees or terms can turn a good rate into a bad deal. Always read the details before signing!

Key Terms to Look For

- Interest Rate: This is the cost of borrowing. Compare bank loan rates vs. online loan rates to find the best deal.

- APR: This includes the interest rate plus any fees. A lower APR means you pay less overall.

- Loan Term: This is how long you have to repay the loan. Shorter terms usually mean higher payments but less interest paid over time.

Benefits of Understanding the Fine Print

- Avoid Surprises: Knowing the terms helps you avoid unexpected costs.

- Better Decision Making: With clear information, you can choose the best loan for your needs.

- Negotiation Power: Understanding the details can help you negotiate better terms with lenders.

How ExpressCash Can Help You Find the Best Rates

Finding the right loan can feel overwhelming, especially with so many options available. That’s where understanding the Top Banks Offering Low Loan Rates becomes crucial. By comparing these rates, you can save money and make informed decisions about your financial future. Let’s explore how ExpressCash can guide you through this process.

Easy Comparisons

With ExpressCash, you can easily compare bank loan rates vs. online loan rates. This means you can see which option offers the best deal without spending hours researching each bank individually.

User-Friendly Tools

Our user-friendly tools allow you to filter loans based on your needs. Whether you’re looking for a mortgage, personal loan, or auto loan, we’ve got you covered!

Expert Insights

Plus, we provide expert insights and tips to help you understand the fine print. This way, you can avoid hidden fees and make the best choice for your situation.

By using ExpressCash, you’re not just finding a loan; you’re making a smart financial decision!

Tips for Securing the Lowest Loan Rates Possible

When it comes to borrowing money, finding the Top Banks Offering Low Loan Rates can make a huge difference in your financial journey. Lower rates mean you pay less over time, which is why comparing options is so important. Let’s explore some tips to help you secure the best rates available.

Understand Your Credit Score

Your credit score plays a big role in determining your loan rates. The higher your score, the better the rates you can get. Check your score before applying, and if it’s low, consider improving it first. This can save you a lot of money in the long run!

Compare Bank Loan Rates vs. Online Loan Rates

Don’t just settle for the first offer. Compare bank loan rates vs. online loan rates to see which one suits you better. Sometimes, online lenders offer competitive rates, but traditional banks might have better customer service. Make sure to weigh both options before deciding.

FAQs

-

Which banks currently offer the lowest loan interest rates?

Banks like Punjab National Bank, Bank of Maharashtra, ICICI Bank, HDFC Bank, Axis Bank, and IDFC FIRST Bank offer some of the lowest loan rates, depending on your eligibility. -

How can I qualify for the lowest personal loan rates?

A high credit score, stable income, low debt-to-income ratio, and a strong banking relationship can help you secure lower interest rates. -

Do online lenders offer better loan rates than traditional banks?

Some online lenders may offer competitive rates, but banks typically provide more stability, customer service, and better terms for existing customers. -

Are personal loan rates fixed or variable?

Most personal loans come with fixed interest rates, but some banks offer variable rates that change based on market conditions. -

What should I check before applying for a low-interest loan?

Review the bank’s eligibility criteria, processing fees, repayment terms, and hidden charges to ensure you’re getting the best deal.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.