The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

How to Avoid Refinance Loan Scams: Red Flags to Watch For

Understanding how to avoid refinance loan scams is crucial for anyone considering personal loan refinance options. Scammers often prey on those looking to save money or improve their financial situation. By recognizing the red flags, you can protect yourself and your hard-earned money.

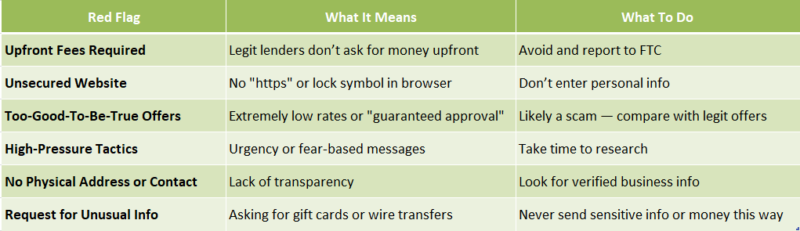

Red Flags to Watch For

- Too Good to Be True Offers: If a lender promises extremely low rates or guaranteed approval, be cautious. These offers often come with hidden fees or terms that are unfavorable.

- Pressure Tactics: Legitimate lenders won’t rush you into making a decision. If you feel pressured to act quickly, it’s a sign to step back and reassess.

- Lack of Transparency: A trustworthy lender will provide clear information about fees, terms, and conditions. If they’re vague or evasive, it’s a red flag.

Protect Yourself

To avoid falling victim to refinance loan scams, always do your research. Check reviews, ask for references, and compare multiple lenders. Remember, taking your time can save you from a costly mistake. Stay informed and trust your instincts!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How to Identify Red Flags in Refinance Offers

When considering a refinance loan, it’s crucial to know how to avoid refinance loan scams. Scammers often prey on those looking for better personal loan refinance options, making it essential to recognize the warning signs. By being aware of these red flags, you can protect yourself and your finances.

1. Unsolicited Offers: If you receive a refinance offer out of the blue, be cautious. Legitimate lenders typically don’t reach out without prior contact.

2. Pressure Tactics: If someone is pushing you to act quickly, it’s a major red flag. Take your time to research and compare options.

3. Upfront Fees: Be wary of lenders asking for payment before you receive any services. Reputable lenders will not charge you upfront fees for a loan application.

Additional Tips

- Check Reviews: Look for customer reviews and ratings online. This can help you gauge the lender’s reputation.

- Verify Licensing: Ensure the lender is licensed in your state. You can usually check this through your state’s financial regulatory agency.

- Read the Fine Print: Always read the terms and conditions carefully. If something seems off, trust your instincts and walk away.

Are You Being Pressured? Recognizing High-Pressure Tactics

When it comes to refinancing your loan, knowing how to avoid refinance loan scams is crucial. Scammers often use high-pressure tactics to push you into making quick decisions. Recognizing these tactics can save you from financial loss and stress.

Common Signs of Pressure

- Urgency: If someone tells you that you must act immediately, be cautious. Legitimate lenders will give you time to think.

- Limited Time Offers: Scammers often create fake deadlines to rush you into a decision. Always take your time to research.

- Overly Friendly Behavior: If a lender seems too eager to help, it might be a red flag. Trust your instincts and ask questions.

Remember, when exploring personal loan refinance options, take a step back if you feel rushed. A trustworthy lender will respect your need for time and clarity. Always do your homework and consult with trusted friends or family before making any commitments.

The Importance of Research: Verifying Lenders and Offers

When it comes to refinancing your loan, knowing how to avoid refinance loan scams is crucial. Scammers often prey on those looking for better financial options, making it essential to stay informed. By understanding the importance of research, you can protect yourself and your finances.

Check for Reviews

Before choosing a lender, look for reviews online. Websites like Trustpilot or the Better Business Bureau can provide insights into a lender’s reputation. If you see many negative reviews, it’s a red flag!

Verify Licensing

Make sure the lender is licensed in your state. You can usually find this information on their website or by contacting your state’s financial regulatory agency. A legitimate lender will be transparent about their credentials.

Watch for Unusual Offers

If a lender promises unusually low rates or asks for upfront fees, be cautious. These are common tactics used in scams. Always compare personal loan refinance options to ensure you’re getting a fair deal.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Common Scams: What Fraudulent Refinance Loans Look Like

When it comes to refinancing your loan, it’s crucial to know how to avoid refinance loan scams. Scammers often prey on those looking for better personal loan refinance options, making it essential to recognize the red flags. Understanding these warning signs can save you time, money, and stress.

Unbelievably Low Rates

If a lender offers rates that seem too good to be true, they probably are. Always compare rates from multiple lenders to ensure you’re getting a fair deal. Remember, legitimate lenders won’t pressure you into making quick decisions.

Upfront Fees

Watch out for lenders asking for large upfront fees before processing your refinance. Reputable lenders typically deduct fees from your loan amount at closing. If they demand payment before you even sign, it’s a major red flag!

Lack of Transparency

A trustworthy lender will be open about their terms and conditions. If you find yourself confused or if they avoid answering your questions, it’s time to walk away. Always read the fine print and don’t hesitate to ask for clarification.

Also Read: Personal Loan Refinance Options: Best Ways to Lower Your Payments

How to Avoid Refinance Loan Scams: Essential Tips for Homeowners

Refinancing your home can be a great financial move, but knowing how to avoid refinance loan scams is essential. Scammers often target homeowners seeking better personal loan refinance options, so it’s vital to stay vigilant. Recognizing red flags can help protect your finances and home.

Spotting Red Flags

Watch for these signs that a refinance offer may be a scam:

- Too Good to Be True: Unrealistically low interest rates should raise suspicion.

- Pressure Tactics: If you feel rushed to make a decision, take a step back.

- Unlicensed Lenders: Always verify that the lender is licensed in your state; if not, it’s best to walk away.

Verify Before You Trust

Do your research before signing any documents. Look up the lender online, read reviews, and seek recommendations from friends or family. Trust your instincts when you spot red flags. Staying informed and cautious will help you navigate the refinancing process successfully and find the best personal loan refinance options without falling victim to scams.

Spotting Unusual Fees: What to Watch Out For

When considering a refinance loan, it’s crucial to know how to avoid refinance loan scams. Scammers often hide their tricks behind unusual fees that can catch you off guard. By recognizing these red flags, you can protect yourself and make informed decisions about your personal loan refinance options.

1. Unexplained Charges

If you see fees that don’t make sense, like a “processing fee” or “administrative fee,” ask for clarification. Legitimate lenders will explain every charge clearly.

2. High Upfront Costs

Be cautious of lenders asking for large sums upfront. This could be a sign of a scam. A trustworthy lender will typically deduct fees from your loan amount instead of requiring payment before closing.

Conclusion

By keeping an eye out for these unusual fees, you can better navigate the refinancing process. Remember, if something feels off, trust your instincts and seek advice. Protecting yourself is key to successfully managing your personal loan refinance options.

Protecting Your Personal Information: Best Practices

When considering a refinance loan, it’s crucial to know how to avoid refinance loan scams. Scammers often target those looking for personal loan refinance options, making it essential to protect your personal information. Let’s explore some best practices to keep your data safe.

Stay Informed About Lenders

Always research the lender before sharing any personal information. Look for reviews and check their credentials. Legitimate lenders will have a solid online presence and positive feedback from customers. If something feels off, trust your instincts.

Watch for Red Flags

Be cautious of offers that seem too good to be true. Here are some red flags to watch for:

- Pressure Tactics: If a lender rushes you to make a decision, it’s a warning sign.

- Unsolicited Offers: Be wary of unexpected calls or emails about refinancing.

- Lack of Transparency: Legitimate lenders will provide clear terms and conditions. If they are vague, walk away.

How ExpressCash.com Can Help You Stay Informed and Safe

When it comes to refinancing your loan, knowing how to avoid refinance loan scams is crucial. Scammers often prey on those looking for better personal loan refinance options, making it essential to stay informed. By recognizing the red flags, you can protect yourself and your finances.

Stay Updated on Scams

At ExpressCash.com, we provide regular updates on the latest scams. This way, you can learn about new tactics used by fraudsters and how to avoid them. Knowledge is your best defense against scams!

Recognize the Warning Signs

Here are some red flags to watch for:

- Too Good to Be True Offers: If a deal sounds amazing, it probably is.

- Pressure Tactics: Scammers often rush you to make quick decisions.

- Unlicensed Lenders: Always check if the lender is licensed in your state.

By being aware of these signs, you can make safer choices when considering personal loan refinance options.

FAQs

-

What are common signs of a refinance loan scam?

Watch out for guaranteed approvals, upfront fees, pressured decisions, no physical address, and unprofessional communication. -

Is it safe to share personal documents online for refinancing?

Only if the lender is legitimate and uses secure, encrypted platforms. Avoid emailing documents to unknown sources. -

Do real lenders ask for money before disbursing a refinance loan?

No. Genuine lenders deduct processing fees from the loan amount or charge them after approval—not before. -

How can I verify if a refinance lender is legitimate?

Check if the lender is registered with the relevant financial authority, look for reviews, and verify their business address and contact info. -

What should I do if I suspect a refinance scam?

Stop all communication, report the scam to authorities (like the FTC or your local financial regulator), and monitor your bank accounts for suspicious activity.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.