The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

The Hidden Dangers of Short Term Cash Solutions

In an urgent financial squeeze, a quick influx of cash can feel like a lifeline. The immediate relief of covering an unexpected bill or bridging a gap until payday is powerful. However, this short-term fix often comes with long-term consequences that are dangerously easy to overlook in a moment of panic. Understanding the full spectrum of risks of short term cash is critical for making a financially sound decision, not just a convenient one. This exploration goes beyond the surface-level warnings to examine the structural, psychological, and practical pitfalls that can trap even the most careful individuals.

For a free, confidential review of your safer financial alternatives, call 📞833-856-0496 or explore our resources at Explore Safer Alternatives.

Understanding the True Cost of Convenience

The most glaring risk of any short-term financial product is its cost, which is rarely as simple as a single fee. While the principal amount borrowed is clear, the effective cost is obscured by high annual percentage rates (APRs), origination fees, and potential penalties. A “small” fee for a two-week loan can translate to an APR in the triple digits, a fact that is often disclosed but seldom fully internalized by a borrower under stress. This cost structure is fundamentally different from traditional installment loans, where interest accrues over a longer period, spreading out the expense. For a comprehensive look at common structures, you can explore our detailed guide on short term loans and their typical terms.

This high-cost environment creates a cycle where the cost of the loan itself can become a new financial emergency. When repayment comes due, it often requires a significant portion of the borrower’s next paycheck, leaving them short again and potentially needing another loan to cover basic expenses. The convenience of quick access thus morphs into a recurring, expensive dependency. The math is stark: if you borrow $500 with a $75 fee due in two weeks, you are effectively paying $1,950 in interest if that pattern continued for a year. This isn’t just an expensive loan; it’s a wealth-destroying mechanism.

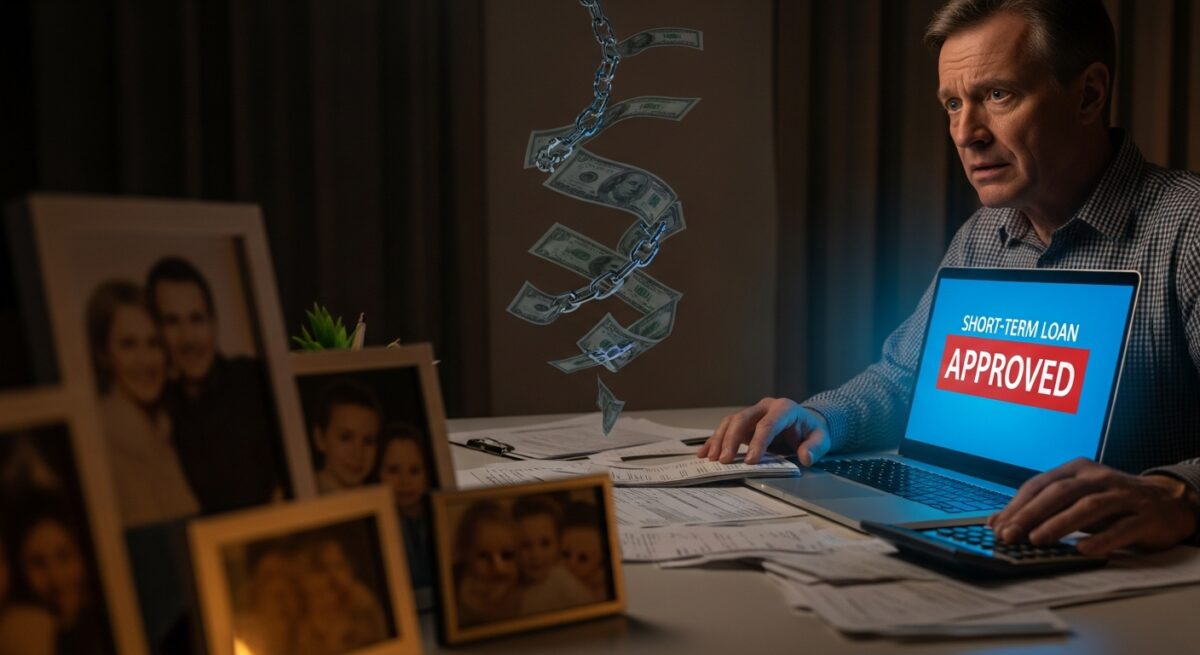

The Debt Trap and Cycle of Dependency

Beyond simple cost, the most pernicious risk is the structural trap these products can create. Short-term cash solutions are designed for acute, one-time emergencies, but their terms often make successful repayment difficult, leading to rollovers, renewals, or sequential borrowing. A rollover, where you pay a fee to extend the due date, adds new costs to the existing debt without reducing the principal. This can happen multiple times, with fees accumulating until they surpass the original amount borrowed.

The psychological effect is profound. The immediate relief of solving today’s crisis with borrowed money reinforces the behavior, while the stress of the looming repayment is deferred. This creates a pattern where borrowing becomes the default solution to any cash shortfall, preventing the development of long-term budgeting habits or emergency savings. The individual becomes reliant on the financial product as a permanent part of their cash flow management, rather than a true emergency tool. This cycle is particularly dangerous because it normalizes high-cost debt, making it seem like an unavoidable fact of life rather than a costly last resort.

How the Cycle Reinforces Itself

This dependency cycle is self-perpetuating. Each loan and its associated fees reduce disposable income for the next pay period. With less net income available for regular expenses and savings, the individual’s financial cushion erodes further. Their margin for error disappears, meaning any subsequent unexpected expense-a car repair, a medical co-pay, a higher utility bill-forces them back to the same high-cost solution. Breaking this cycle requires a lump sum of capital to pay off the debt and restore the monthly income buffer, which is exactly what the trapped borrower lacks. It’s a financial quicksand where the struggle to get out only leads to sinking deeper.

Credit Score Implications and Future Opportunities

Many borrowers assume that because some short-term lenders don’t perform a hard credit check, their credit score is safe. This is a dangerous misconception. While access might not require good credit, the consequences of use can severely damage it. First, if the loan is not repaid and goes to collections, that collection account will be reported to credit bureaus and can remain on your report for seven years, dragging down your score. Second, the high utilization of your available cash and the recurring debt payments can affect your debt-to-income ratio, a key metric considered by lenders for mortgages, auto loans, and even some rentals.

Furthermore, reliance on these products signals to future potential lenders that you are a high-risk borrower who uses last-resort financing. Even if you repay on time, a history of numerous short-term loans on a banking statement review can lead to denied applications for more advantageous credit products later. You are, in effect, trading your future financial flexibility and lower interest rates for cash today. Protecting your credit score is an investment in your future borrowing power, and jeopardizing it for a temporary fix can cost tens of thousands in higher interest over a lifetime.

Security Risks and Predatory Practices

The landscape of short-term lending, particularly online, is rife with security concerns and potentially predatory behavior. To secure a loan quickly, applicants are often required to provide direct access to sensitive financial data, such as online banking credentials, or to pre-authorize automatic withdrawals from their checking account. This access grants the lender tremendous power. While reputable companies use it for seamless repayment, less scrupulous actors can misuse it, leading to unauthorized withdrawals or difficulty stopping payments even after a dispute.

For a free, confidential review of your safer financial alternatives, call 📞833-856-0496 or explore our resources at Explore Safer Alternatives.

Predatory practices can also manifest in opaque terms, pressure tactics, and loan flipping-encouraging you to take a new, larger loan to pay off an existing one, thereby resetting the fee cycle. The combination of a desperate borrower, high-pressure sales, and complex legal documents creates an environment ripe for exploitation. It is crucial to understand all the terms, know your rights under your state’s lending laws, and recognize the hallmarks of a predatory lender. These include evasive answers to direct questions about APR and total repayment cost, demands for upfront fees before loan disbursement, and a lack of clear contact information or physical address. Understanding what constitutes a legitimate short term cash loan versus a predatory scheme is a vital line of defense.

Alternatives to High-Risk Short Term Borrowing

Recognizing the risks is only half the battle; having a plan to avoid them is the other. Before resorting to a high-cost cash solution, a systematic review of alternatives is essential. This process requires shifting your mindset from immediate panic to strategic problem-solving, even under pressure.

First, exhaust all internal options. This includes a rigorous review of your budget for any non-essential expenses that can be paused or eliminated for the month. Next, look to assets you may have overlooked:

- Negotiate payment plans directly with the creditor (utility company, medical provider, landlord). They often have hardship programs and prefer a partial payment plan to no payment.

- Sell unused items of value through online marketplaces or consignment shops for a quick, debt-free cash infusion.

- Use a credit card cash advance cautiously. While still expensive, its APR is typically far lower than that of a payday loan.

- Explore a payroll advance from your employer, which is usually an interest-free advance on earned wages.

- Seek assistance from local community organizations, charities, or religious institutions that offer emergency hardship grants or no-interest loans.

If borrowing is unavoidable, prioritize products with lower structural risk. A personal loan from a credit union or online lender, even with less-than-perfect credit, will have a longer term and a lower APR, resulting in manageable payments that don’t consume your entire paycheck. The key is to break the two-week, high-fee cycle. Building a small emergency fund, even $500, is the ultimate defense against these risks, breaking the dependency before it starts.

Frequently Asked Questions

Are all short-term cash loans bad?

Not inherently, but they are high-risk financial tools designed for very specific, acute emergencies when no other option exists. The problem lies in their frequent misuse for recurring budget shortfalls, which their expensive structure exacerbates. They should be a true last resort, not a regular planning tool.

What’s the difference between a payday loan and an installment loan?

A payday loan is typically due in full (principal + fee) on your next payday, usually in 2-4 weeks. An installment loan, like the short term loans we discuss, is repaid over a set period (e.g., 3-24 months) in regular, scheduled payments. Installment loans generally carry lower APRs and pose less risk of a single, unmanageable lump-sum payment.

Can I be sued for not repaying a short-term loan?

Yes. If you default, the lender can sell the debt to a collection agency, which can pursue legal action to obtain a judgment against you. This could lead to wage garnishment or a lien on your property, depending on state law.

How can I get out of a cycle of short-term loan dependency?

The most effective method is a “debt avalanche” approach: prioritize paying off the highest-APR loan first while making minimum payments on others. Simultaneously, contact a non-profit credit counseling agency. They can help you create a budget and may facilitate a Debt Management Plan (DMP) to consolidate payments and potentially reduce interest rates with creditors.

Do these loans help build credit?

Most traditional payday lenders do not report to the major credit bureaus, so on-time payments won’t help your score. However, default and subsequent collection will severely damage it. Some newer online installment lenders do report payments, but the high cost and risk typically outweigh this potential minor benefit.

The allure of fast cash is potent, especially when faced with a pressing financial need. However, the immediate solution can become a long-term burden. By looking beyond the temporary relief to the structural costs, the threat to your credit health, and the potential for a debilitating cycle of debt, you empower yourself to make a choice that solves today’s problem without creating a larger one tomorrow. The most powerful financial tool is not a loan, but the informed judgment to use all available options strategically and with full awareness of their true consequences.

For a free, confidential review of your safer financial alternatives, call 📞833-856-0496 or explore our resources at Explore Safer Alternatives.