The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

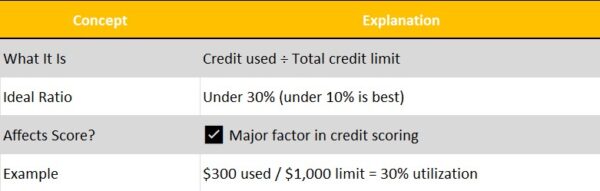

Credit Utilization Ratio Explained: Why It Matters

Understanding your Credit Utilization Ratio is crucial for anyone looking to improve their financial health. This ratio measures how much credit you’re using compared to your total available credit. Essentially, it helps lenders see how responsibly you manage your credit. A good understanding of this ratio can significantly impact your ability to secure a personal loan.

What is Credit Utilization Ratio?

The Credit Utilization Ratio Explained is simple: it’s the percentage of your total credit limits that you’re currently using. For example, if you have a credit limit of $10,000 and you owe $3,000, your ratio is 30%. Keeping this number low is key to maintaining a healthy credit score!

Why Does It Matter?

- Lender’s Perspective: Lenders often look at this ratio to gauge your creditworthiness. A lower ratio suggests you’re less risky to lend to.

- Credit Score Impact: It accounts for about 30% of your credit score. So, improving your credit utilization can help you improve your credit score for a personal loan.

- Financial Health: A lower ratio means you’re not overly reliant on credit, which is a sign of good financial management.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How is Your Credit Utilization Ratio Calculated?

Understanding your Credit Utilization Ratio is crucial because it plays a significant role in your overall credit score. This ratio measures how much credit you’re using compared to your total available credit. A lower ratio can help you improve your credit score for a personal loan, making it easier to secure financing when you need it.

To calculate your Credit Utilization Ratio, follow these simple steps:

- Add up your credit card balances: This includes all the amounts you owe on your credit cards.

- Find your total credit limit: This is the maximum amount you can borrow across all your credit cards.

- Divide your total balances by your total credit limit: Multiply the result by 100 to get a percentage.

For example, if you owe $2,000 and your limit is $10,000, your ratio is 20%. A good rule of thumb is to keep your ratio below 30%. This shows lenders that you manage your credit responsibly, which can help you improve your credit score for a personal loan.

Why Does Credit Utilization Matter for Your Credit Score?

Understanding your credit utilization ratio is crucial for managing your credit score. This ratio measures how much of your available credit you’re using. A lower ratio often indicates responsible credit use, which can positively impact your credit score. So, why does credit utilization matter for your credit score?

The Impact of Credit Utilization on Your Score

When lenders evaluate your creditworthiness, they look at your credit utilization ratio. A high ratio can signal that you might be over-relying on credit, which can be a red flag. Conversely, keeping your ratio below 30% is generally seen as a sign of good financial health. This can help you improve your credit score for a personal loan.

Key Takeaways

- Lower is Better: Aim for a credit utilization ratio below 30%.

- Monitor Regularly: Keep an eye on your credit card balances.

- Use Credit Wisely: Only charge what you can afford to pay off each month.

By managing your credit utilization wisely, you not only protect your credit score but also enhance your chances of securing loans with favorable terms.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

What is Considered a Good Credit Utilization Ratio?

Understanding your Credit Utilization Ratio is crucial for managing your finances. This ratio shows how much of your available credit you’re using. A high ratio can signal to lenders that you might be a risky borrower, which can impact your ability to secure loans or credit cards. So, what is considered a good credit utilization ratio?

A good credit utilization ratio is typically below 30%. This means if you have a credit limit of $1,000, you should aim to keep your balance under $300. Keeping your ratio low not only helps maintain a healthy credit score but also makes it easier to improve your credit score for a personal loan.

Key Insights:

- Below 30%: Ideal for maintaining a good credit score.

- Between 30% and 50%: May start to affect your score negatively.

- Above 50%: Considered high risk by lenders.

By managing your credit utilization wisely, you can boost your credit score and improve your chances of getting favorable loan terms.

Common Misconceptions About Credit Utilization Explained

Understanding the Credit Utilization Ratio is crucial for anyone looking to improve their credit score. Many people think it’s just about paying bills on time, but it’s more than that. The ratio measures how much credit you’re using compared to your total available credit. This section will clear up some common misconceptions about it.

Misconception 1: It Only Matters for Credit Cards

Some believe the Credit Utilization Ratio only applies to credit cards. However, it also includes lines of credit. Whether it’s a personal loan or a credit card, keeping your utilization low is key to a healthy score.

Misconception 2: A Zero Balance is Best

Another myth is that having a zero balance is ideal. While it sounds good, it can actually hurt your score. Lenders want to see that you can manage credit responsibly. A small balance paid on time can show you’re a reliable borrower.

Misconception 3: It Doesn’t Affect Personal Loans

Lastly, some think credit utilization doesn’t impact personal loans. In reality, a lower ratio can help improve your credit score, making it easier to qualify for a personal loan. So, keeping your utilization low is essential!

Tips to Improve Your Credit Utilization Ratio

Understanding your Credit Utilization Ratio is crucial for managing your finances. This ratio shows how much credit you’re using compared to your total available credit. A lower ratio can help you improve your credit score, which is essential when applying for a personal loan. Let’s explore some tips to improve your credit utilization ratio!

- Keep Balances Low: Aim to use less than 30% of your available credit. This shows lenders you can manage your credit responsibly.

- Increase Credit Limits: If possible, ask for a credit limit increase. This can lower your utilization ratio, provided you don’t increase your spending.

- Pay Off Balances Early: Try to pay off your credit card balances before the billing cycle ends. This keeps your reported balance low and helps improve your credit score for a personal loan.

By following these simple tips, you can effectively manage your credit utilization ratio. Remember, a better ratio not only boosts your credit score but also opens doors to better loan options. Start making these changes today for a brighter financial future!

How Credit Utilization Affects Loan Applications

Understanding the Credit Utilization Ratio is crucial for anyone looking to apply for a loan. This ratio measures how much credit you’re using compared to your total available credit. A lower ratio can indicate responsible credit management, which lenders love to see!

When you apply for a loan, lenders will check your credit score. Here’s how your credit utilization plays a role:

Key Points to Remember:

- Lower Ratios Are Better: Aim for a credit utilization ratio below 30%. This shows lenders that you’re not overly reliant on credit.

- Improving Your Score: To improve your credit score for a personal loan, pay down existing debts or increase your credit limits. Both actions can lower your utilization ratio.

- Long-Term Impact: Keeping your credit utilization low over time can lead to better loan terms and lower interest rates. This means more savings for you!

In summary, maintaining a healthy credit utilization ratio is a simple yet effective way to boost your chances of securing a loan. So, keep an eye on that ratio and watch your financial opportunities grow!

The Role of Credit Utilization in Financial Health

Understanding the Credit Utilization Ratio is crucial for anyone looking to manage their finances effectively. This ratio measures how much of your available credit you are using. A lower ratio indicates better financial health, which can lead to a higher credit score. So, let’s dive into why this matters!

What is Credit Utilization Ratio?

The Credit Utilization Ratio is simply the amount of credit you’re using compared to your total available credit. For example, if you have a credit limit of $10,000 and you’re using $3,000, your ratio is 30%. Experts recommend keeping this ratio below 30% to maintain a healthy credit score.

Why It Matters

- Improves Credit Score: A lower ratio can help you improve your credit score for a personal loan.

- Financial Stability: It shows lenders that you can manage your credit responsibly.

- Better Loan Terms: A good credit score can lead to lower interest rates and better loan terms.

In summary, keeping an eye on your Credit Utilization Ratio is essential for your financial health and future borrowing opportunities!

How ExpressCash Can Help You Manage Your Credit Utilization

Understanding your credit utilization ratio is crucial because it directly impacts your credit score. A high ratio can signal to lenders that you might be a risky borrower, which can affect your chances of getting approved for loans. So, knowing how to manage it is essential!

Simple Tools for Tracking

With ExpressCash, you can easily track your credit utilization ratio. Our user-friendly dashboard shows you how much credit you’re using compared to your total credit limit. This way, you can see if you’re on the right track to improve your credit score for a personal loan.

Tips for Improvement

- Pay Down Balances: Regularly paying off your credit card balances can help lower your ratio.

- Increase Credit Limits: Requesting a higher limit can also improve your ratio, as long as you don’t increase your spending.

- Monitor Regularly: Keep an eye on your ratio to ensure it stays healthy.

By using ExpressCash, you can take control of your credit utilization and boost your chances of securing that personal loan you need!

FAQs

-

What is a credit utilization ratio?

It’s the percentage of your available credit you’re currently using, calculated by dividing your credit card balance by your credit limit. -

Why is credit utilization important?

It accounts for 30% of your credit score, making it one of the most significant factors lenders consider. -

What is a good credit utilization ratio?

A ratio below 30% is generally considered good, while under 10% is ideal for maximizing your credit score. -

Does credit utilization apply to all types of credit?

No, it mainly applies to revolving credit like credit cards, not installment loans such as personal loans or car loans. -

How can I lower my credit utilization ratio?

You can pay down existing balances, increase your credit limit, or spread charges across multiple cards to keep usage low.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.