The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Impact of Loan Prepayment on EMI: Save on Interest

When you take out a loan, understanding the impact of loan prepayment on EMI can save you a lot of money. Prepayment means paying off your loan early, which can reduce your monthly payments and the total interest you pay. This is important because every little bit saved can help you in the long run!

How Prepayment Works

When you make a prepayment, you lower the principal amount of your loan. This means your Personal Loan EMI Calculator will show a reduced EMI amount. It’s like cutting down the size of a pizza; the smaller the pizza, the less you have to eat!

Benefits of Prepayment

- Lower Interest Costs: Paying off your loan early means you pay less interest overall.

- Reduced EMI: A smaller loan balance leads to a lower EMI, making monthly payments easier.

- Financial Freedom: Paying off your loan early gives you peace of mind and more money for other things!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Does Loan Prepayment Affect Your Interest Payments?

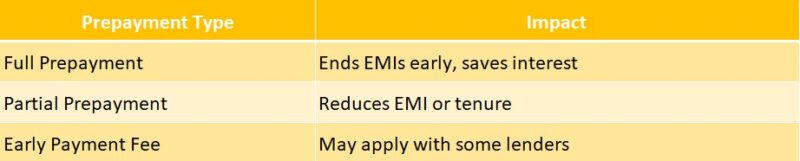

When you take out a loan, you commit to repaying it over time through monthly installments known as EMIs. However, what if you could pay it off sooner and save money? This is where the impact of loan prepayment on EMI becomes important. Prepaying your loan means paying off part or all of it before the due date, which can significantly lower your interest payments.

Understanding Loan Prepayment

Prepayment reduces your total interest cost. By paying extra, you decrease the principal amount, leading to interest calculated on a smaller sum. This can result in considerable savings over time. Additionally, a Personal Loan EMI Calculator can show you potential savings from prepayment.

Benefits of Prepayment

- Lower Interest Payments: Early repayment reduces total interest owed.

- Shorter Loan Term: You can pay off your loan faster.

- Improved Credit Score: Paying off debt positively affects your credit score.

In summary, grasping the impact of loan prepayment on EMI empowers you to make better financial choices. Prepaying your loan not only saves on interest but also brings peace of mind as you move towards being debt-free.

Is Early Loan Repayment Worth It?

When you take out a loan, you might wonder about the impact of loan prepayment on EMI. Early repayment can be a smart move, especially if you want to save on interest. But is it really worth it? Let’s dive into this topic and find out!

Understanding Loan Prepayment Benefits

Prepaying your loan means paying off part or all of it before the due date. This can lead to lower EMIs (Equated Monthly Installments) and less interest paid overall. Here are some benefits:

- Reduced Interest Costs: Paying early can significantly cut down the total interest you owe.

- Lower EMIs: With a smaller principal amount, your monthly payments can decrease, making budgeting easier.

Using a Personal Loan EMI Calculator

To see how prepayment affects your finances, try using a personal loan EMI calculator. This tool helps you visualize how much you can save by paying off your loan early. Just input your loan amount, interest rate, and tenure to see the magic happen! Remember, every little bit counts when it comes to saving money.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

The Financial Benefits of Prepaying Your Loan

When it comes to loans, many people wonder about the impact of loan prepayment on EMI. Prepaying your loan can be a smart financial move, especially if you want to save on interest. Understanding how this works can help you make better decisions about your finances.

Save on Interest

Prepaying your loan means you pay off part of the principal amount early. This reduces the total interest you’ll pay over time. For example, if you use a personal loan EMI calculator, you can see how much you could save by making extra payments.

Lower Monthly Payments

By reducing the principal, your monthly EMI can also decrease. This means more money in your pocket each month, which can be used for other expenses or savings.

Financial Freedom

Imagine being debt-free sooner than expected! Prepaying your loan can lead to financial freedom, allowing you to focus on your future goals without the burden of debt.

In conclusion, the impact of loan prepayment on EMI is significant. It’s a simple way to save money and achieve your financial dreams faster.

Also Read: Personal Loan EMI Calculator: Find Your Monthly Installments

Strategies for Effective Loan Prepayment

When you think about loans, you might focus on monthly payments. But have you considered the Impact of Loan Prepayment on EMI? Prepaying your loan can significantly reduce your interest costs, making it a smart financial move. Let’s explore some strategies to make the most of your prepayment options.

Understanding Loan Prepayment Benefits

Prepaying your loan means paying off part of it before the due date. This can lead to lower EMIs or a shorter loan tenure. Here are some benefits:

- Save on Interest: Less principal means less interest over time.

- Financial Freedom: Paying off your loan early can free up your budget for other needs.

Using a Personal Loan EMI Calculator

To see how prepayment affects your finances, use a Personal Loan EMI Calculator. This tool helps you visualize potential savings. Just input your loan amount, interest rate, and tenure, then adjust for prepayments. You’ll see how your EMI changes, making it easier to plan your finances effectively.

What to Consider Before Prepaying Your Loan

When considering a loan, many borrowers wonder about the impact of loan prepayment on EMI. Prepaying your loan can be a smart move, especially if you want to save on interest payments. But before you rush into it, there are some important factors to think about.

Understand Your Loan Terms

Before making any decisions, check your loan agreement. Some loans have prepayment penalties, which could negate your savings. Knowing the terms helps you avoid surprises later on.

Use a Personal Loan EMI Calculator

A personal loan EMI calculator can be your best friend here. It helps you see how much you can save by prepaying your loan. Just input your loan details, and it will show you the new EMI and total interest after prepayment.

Timing is Key

Consider the timing of your prepayment. If you’re close to the end of your loan term, the interest savings might be minimal. Prepaying earlier can lead to more significant savings. So, plan wisely!

How ExpressCash Can Help You Save on Loan Interest

When it comes to loans, understanding the impact of loan prepayment on EMI can make a big difference in your finances. Prepaying your loan means you pay off part of it before the due date, which can significantly reduce the interest you owe. This is important because less interest means more savings for you!

At ExpressCash, we believe in empowering you with the right tools. Our Personal Loan EMI Calculator helps you see how prepaying your loan can lower your monthly payments. By entering your loan details, you can visualize the savings and make informed decisions.

Key Benefits of Prepayment

- Lower Interest Payments: Paying off your loan early reduces the total interest you pay.

- Shorter Loan Tenure: You can finish paying off your loan sooner, freeing up your finances.

- Improved Credit Score: A lower outstanding balance can positively impact your credit score.

By using our tools, you can easily calculate how much you can save and take control of your financial future!

Common Myths About Loan Prepayment Debunked

When it comes to loans, many people have questions about prepayment. Understanding the impact of loan prepayment on EMI can help you save a significant amount on interest. Let’s clear up some common myths surrounding this topic so you can make informed decisions about your finances.

Myth 1: Prepayment Always Leads to Penalties

Some believe that prepaying a loan will always incur hefty penalties. While some lenders do charge fees, many offer flexible options. Always check your loan agreement or use a personal loan EMI calculator to see how prepayment can benefit you without extra costs.

Myth 2: Prepayment Doesn’t Affect EMI

Another misconception is that prepaying a loan won’t change your EMI. In reality, prepayment can reduce your outstanding principal, leading to lower EMIs or a shorter loan tenure. This means more money in your pocket each month!

Myth 3: It’s Better to Invest Than Prepay

Many think investing extra cash is smarter than prepaying loans. However, if your loan interest rate is higher than potential investment returns, prepaying can save you more in the long run. Always weigh your options carefully.

The Long-Term Effects of Prepaying Your Loan on Financial Health

When you think about loans, you might only focus on the monthly payments. But have you ever considered the impact of loan prepayment on EMI? Prepaying your loan can significantly reduce your interest costs and improve your financial health in the long run. Let’s explore how this works!

Understanding Loan Prepayment Benefits

Prepaying your loan means paying off a part of it before the due date. This can lead to:

- Lower EMIs: By reducing the principal amount, your monthly payments can decrease.

- Interest Savings: Less principal means less interest over time.

- Faster Debt Freedom: You can pay off your loan sooner, freeing up money for other goals!

Using a Personal Loan EMI Calculator

To see how prepayment affects your finances, try a personal loan EMI calculator. This tool helps you visualize:

- How much you can save by prepaying.

- The new EMI amounts after prepayment.

- The total interest saved over the loan term.

By understanding these factors, you can make informed decisions about your loans and enhance your financial well-being!

FAQs

-

What is loan prepayment?

Loan prepayment is when you repay part or all of your loan amount before the scheduled tenure, reducing interest outgo. -

How does prepayment affect my EMI?

After prepayment, you can choose to either reduce your EMI or shorten your loan tenure, depending on your lender’s options. -

Will I save on interest by prepaying my loan?

Yes, prepayment typically results in significant interest savings, especially if done early in the loan term. -

Are there any charges for prepaying a loan?

Some lenders charge a prepayment penalty, while others allow it free of cost, especially for floating interest rate loans. -

How do I decide between reducing EMI or tenure after prepayment?

Reducing tenure saves more on interest, while reducing EMI lowers your monthly financial burden—choose based on your goals.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.