The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Personal Loan EMI Adjustments: How to Change Your Payment

When you take out a personal loan, you agree to pay back the money in monthly installments, known as EMIs (Equated Monthly Installments). However, life can be unpredictable, and sometimes you may need to adjust your payment plan. Understanding Personal Loan EMI Adjustments is crucial because it can help you manage your finances better and avoid any unnecessary stress.

Why Adjust Your EMI?

There are several reasons you might want to change your EMI. Maybe you got a new job with a higher salary, or perhaps your expenses have increased. Adjusting your EMI can help you:

- Reduce your monthly burden

- Align payments with your current financial situation

- Avoid late fees or penalties

How to Calculate Your New EMI

To figure out how much your new EMI will be, you can use a Personal Loan EMI Calculator. This handy tool lets you input your loan amount, interest rate, and tenure to see how changes will affect your payments. It’s simple and can save you a lot of time! In conclusion, Personal Loan EMI Adjustments can be a helpful way to manage your loan payments. Whether you need to lower your monthly payment or adjust the tenure, knowing your options is key. Always communicate with your lender to explore the best solutions for your situation. Remember, staying informed is the first step to financial freedom!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Why Consider Changing Your Personal Loan EMI?

When unexpected challenges arise, managing finances can become difficult. This is where Personal Loan EMI Adjustments come in. Changing your monthly payment can relieve financial stress and help you regain control over your budget. But why should you consider these adjustments?

Flexibility in Payments

Financial situations can change due to new jobs or unexpected expenses. Adjusting your EMI can help you navigate these changes smoothly, acting as a safety net!

Lowering Your Monthly Burden

If your current EMI feels too high, reducing it can free up cash for other essential expenses. Using a Personal Loan EMI Calculator can help you find a payment that fits your budget perfectly!

Avoiding Default

Missing payments can lead to penalties and damage your credit score. By adjusting your EMI, you can avoid these issues and maintain your financial health. Always communicate with your lender to stay on track.

Improving Financial Planning

Adjusting your EMI can also enhance your future financial planning. A lower payment allows you to allocate funds to savings or investments, preparing you for life’s surprises.

Steps to Adjust Your EMI

- Contact Your Lender: Reach out to your bank for guidance.

- Provide Necessary Documents: Share your financial details.

- Use a Personal Loan EMI Calculator: Calculate potential new EMIs.

- Confirm Changes: Get written confirmation of the new terms.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Step-by-Step Guide to Adjusting Your Personal Loan EMI

Adjusting your Personal Loan EMI might seem daunting, but it’s a manageable process! Whether due to unexpected expenses or a desire to ease your monthly budget, Personal Loan EMI Adjustments can be beneficial. Here’s a simple guide to help you change your payment effectively.

1. Assess Your Current Situation

Start by evaluating your financial situation. Are your expenses higher than anticipated, or have you received a raise? Understanding your needs will help you determine the necessary adjustments.

2. Use a Personal Loan EMI Calculator

Utilize a Personal Loan EMI Calculator to see how different adjustments affect your payments. Enter your loan amount, interest rate, and tenure to understand how changes impact your monthly EMI, allowing for informed decisions.

3. Contact Your Lender

After assessing your situation and using the calculator, reach out to your lender. Explain your circumstances and inquire about options for adjusting your EMI. They may suggest extending your loan tenure or restructuring your payment plan.

4. Review the Terms

If your lender agrees to adjustments, carefully review the new terms. Ensure you understand any changes in interest rates or additional fees, as these will affect your overall repayment.

5. Confirm the Changes

Finally, once satisfied with the new terms, confirm the changes in writing. This ensures clarity between you and your lender. Adjusting your Personal Loan EMI can provide financial relief and better manage your finances!

Also Read: Personal Loan EMI Calculator: Find Your Monthly Installments

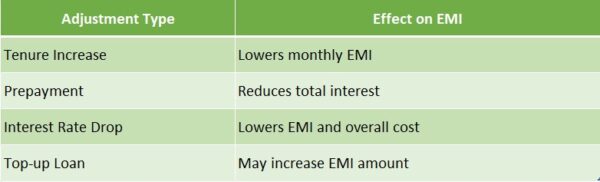

What Factors Influence Your Personal Loan EMI Adjustments?

When you take out a personal loan, managing your monthly payments is crucial. Personal Loan EMI Adjustments can help you navigate financial changes, ensuring you stay on track without stress. Understanding what influences these adjustments can empower you to make informed decisions about your finances.

Interest Rates

One of the biggest factors is the interest rate. If your lender changes the rate, your EMI might go up or down. Using a Personal Loan EMI Calculator can help you see how these changes affect your payments.

Loan Tenure

The duration of your loan also plays a role. A longer tenure usually means lower EMIs, but you’ll pay more interest overall. Adjusting your tenure can be a smart way to manage your budget.

Prepayment Options

If you have extra cash, consider prepaying part of your loan. This can lower your EMI or reduce the loan tenure. Always check with your lender about any prepayment penalties.

Financial Situation

Lastly, your personal financial situation matters. If you face unexpected expenses, you might need to adjust your EMI. Communicating with your lender can lead to flexible options that suit your needs.

Can You Negotiate Your Personal Loan EMI with Lenders?

Unexpected expenses can make managing a Personal Loan challenging. This is where Personal Loan EMI Adjustments become essential. Knowing how to change your payment can alleviate financial stress and help you stick to your budget.

Yes! Many lenders are open to negotiation if you explain your situation. Here are some tips:

Key Points to Remember:

- Communicate Early: Contact your lender as soon as you feel overwhelmed. They may offer options to adjust your EMI.

- Use a Personal Loan EMI Calculator: This tool helps you see how adjustments affect your payments, making it easier to visualize your options.

- Be Honest: Sharing your financial challenges can encourage lenders to help you more willingly.

- Explore Options: Inquire about extending your loan term or temporarily lowering your EMI to ease your monthly budget.

Negotiating your Personal Loan EMI can create a more manageable payment plan. Lenders often want to keep you as a customer, so they may be flexible if you ask politely.

Benefits of Negotiating Your EMI:

- Lower Monthly Payments: Adjusting your EMI can free up cash for other expenses.

- Avoiding Default: A manageable EMI helps you stay on track and avoid missed payments.

- Improved Financial Health: Lower payments can reduce stress and enhance your overall financial situation.

How ExpressCash Can Help You Navigate Personal Loan EMI Adjustments

Managing finances, especially personal loans, can be challenging. Understanding how to make Personal Loan EMI Adjustments is essential for keeping your payments manageable. Whether you’re dealing with unexpected expenses or want to reduce your monthly payments, knowing how to adjust your EMI can significantly ease your financial burden.

At ExpressCash, we recognize that life can be unpredictable. We provide tools and resources to help you effectively manage your Personal Loan EMI Adjustments. Our Personal Loan EMI Calculator is a great starting point, allowing you to see how various adjustments affect your monthly payments, enabling informed decisions.

Key Benefits of Using ExpressCash

- Easy Calculations: Quickly determine how your EMI changes with different terms.

- Personalized Advice: Receive tailored recommendations based on your financial situation.

- Step-by-Step Guidance: Understand the adjustment process clearly.

With these resources, navigating your personal loan becomes easier!

Understanding Your Options

Knowing your options for Personal Loan EMI Adjustments is crucial. You can extend your loan tenure or negotiate a lower interest rate, each with its pros and cons. We’re here to help you evaluate these choices.

Simple Steps to Adjust Your EMI

- Review Your Current Loan Terms: Understand your existing EMI and interest rate.

- Use Our EMI Calculator: Input new terms to see potential changes.

- Contact Your Lender: Discuss adjustment options directly with them.

Why Adjusting Your EMI Matters

Adjusting your EMI can provide immediate relief and help you manage your budget, especially during tough times. Remember, even a small change can lead to significant savings!

Common Mistakes to Avoid When Adjusting Your Personal Loan EMI

Adjusting your Personal Loan EMI can be a smart move, especially if your financial situation changes. However, many borrowers make mistakes during this process that can lead to more stress and confusion. Understanding these common pitfalls can help you navigate your loan adjustments smoothly and avoid unnecessary complications.

Ignoring the Personal Loan EMI Calculator

One of the biggest mistakes is not using a Personal Loan EMI Calculator. This handy tool helps you see how changes in your interest rate or loan tenure affect your monthly payments. By ignoring it, you might end up with a payment plan that doesn’t fit your budget.

Not Communicating with Your Lender

Another common mistake is failing to communicate with your lender. Always discuss your situation openly. They can provide options you might not be aware of, such as extending your loan tenure or reducing your interest rate. This can make your payments more manageable.

Overlooking Fees and Charges

Lastly, don’t forget to consider any fees associated with adjusting your EMI. Some lenders may charge a fee for changing your payment plan. Make sure to ask about these costs upfront to avoid surprises later on. By being informed, you can make better financial decisions.

FAQs

-

Can I change my EMI amount after the loan starts?

Some lenders allow EMI adjustments through tenure extension or part prepayment, but changes depend on the lender’s policy. -

What happens if I miss an EMI payment?

Missing an EMI can result in late fees, credit score impact, and increased interest, unless you request a grace period or reschedule with your lender. -

Can I reduce my EMI by paying a lump sum?

Yes, a part-prepayment lowers the principal, which can lead to reduced EMI or shorter tenure based on your preference. -

Is it possible to increase EMIs for faster repayment?

Yes, some lenders let you increase your EMI to repay the loan faster and save on total interest. -

How do EMI changes affect my credit score?

Adjusting EMIs via formal requests doesn’t hurt your credit, but missed or delayed payments can negatively affect your score.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.