The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

EMI Interest Rate Calculation Guide: Understand Your Cost

Understanding your EMI is crucial when taking out a loan. It stands for Equated Monthly Installment, which is the amount you pay every month to repay your loan. This EMI includes both the principal amount and the interest. Knowing how to calculate this can help you manage your finances better, making the EMI Interest Rate Calculation Guide essential for anyone considering a personal loan.

Why EMI Matters

EMI matters because it affects your monthly budget. If your EMI is too high, it can strain your finances. Using a Personal Loan EMI Calculator can help you find a comfortable EMI amount. Here are some reasons why understanding your EMI is important:

- Budgeting: Helps you plan your monthly expenses.

- Loan Affordability: Ensures you don’t borrow more than you can repay.

- Financial Planning: Aids in future investments and savings.

How is EMI Calculated?

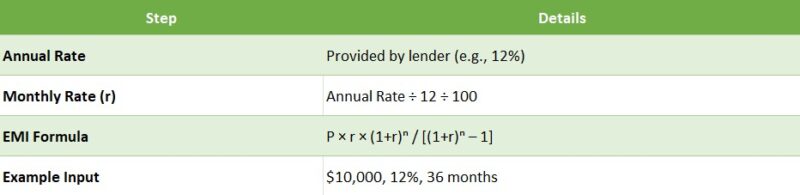

Calculating your EMI involves a simple formula, but it can seem tricky at first. The formula takes into account the loan amount, interest rate, and loan tenure. Here’s a quick breakdown:

- Loan Amount: The total money you borrow.

- Interest Rate: The cost of borrowing, expressed as a percentage.

- Tenure: The duration over which you repay the loan.

Using these factors, you can easily determine your monthly payment. Remember, understanding this calculation can save you from financial surprises!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How to Calculate Your EMI Interest Rate Effectively?

Understanding how to calculate your EMI interest rate is crucial for anyone considering a personal loan. It helps you grasp the total cost of borrowing and plan your finances better. With the right tools, like a Personal Loan EMI Calculator, you can easily figure out what your monthly payments will look like.

To calculate your EMI interest rate, follow these simple steps:

- Know Your Loan Amount: This is the total money you wish to borrow. For example, if you need $10,000, that’s your loan amount.

- Determine the Interest Rate: This is the percentage charged by the lender. Let’s say it’s 10% per annum.

- Choose Your Loan Tenure: This is how long you plan to repay the loan. It could be 1 year, 2 years, or more. For instance, if you choose 2 years, that’s 24 months.

- Use the Formula: The EMI can be calculated using the formula: EMI = [P * r * (1 + r)^n] / [(1 + r)^n – 1], where P is the loan amount, r is the monthly interest rate, and n is the number of months.

- Utilize a Personal Loan EMI Calculator: If math isn’t your strong suit, don’t worry!

Just plug your numbers into an online calculator, and it will do the work for you. This makes understanding your costs much easier! By following these steps, you can effectively calculate your EMI interest rate and make informed financial decisions. Remember, knowing your costs upfront can save you from surprises later!

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Factors Influencing Your EMI Interest Rate

Understanding your EMI interest rate is crucial for managing your finances effectively. The EMI Interest Rate Calculation Guide helps you grasp how much you’ll pay each month for a personal loan. Knowing the factors that influence your interest rate can save you money and stress in the long run.

Credit Score

Your credit score plays a significant role in determining your EMI interest rate. A higher score often means lower rates, as lenders see you as a reliable borrower.

Loan Amount and Tenure

The amount you borrow and the duration of the loan also impact your interest rate. Generally, larger loans or longer tenures may come with higher rates.

Lender Policies

Different lenders have varying policies. Some may offer competitive rates to attract borrowers, while others might have stricter criteria. Always compare rates using a Personal Loan EMI Calculator to find the best deal.

Economic Conditions

Interest rates can fluctuate based on economic factors. When the economy is strong, rates may rise, while they might drop during a recession. Staying informed can help you time your loan application better.

Type of Interest Rate

Lastly, consider whether you choose a fixed or floating interest rate. Fixed rates remain constant, while floating rates can change over time, affecting your EMI. Understanding these factors can empower you to make informed decisions about your loans.

Also Read: Personal Loan EMI Calculator: Find Your Monthly Installments

The Role of Credit Score in EMI Calculations

Understanding your EMI interest rate is crucial when taking out a personal loan. It helps you know how much you will pay each month and how much interest you’ll incur over time. This is where our EMI Interest Rate Calculation Guide comes in handy, making the process clearer and simpler for everyone.

Your credit score plays a significant role in determining your EMI interest rate. Lenders use this score to assess your creditworthiness. A higher score often leads to lower interest rates, which means lower EMIs. Here’s why it matters:

- Better Rates: A good credit score can help you secure a lower interest rate on your personal loan.

- Loan Approval: Lenders are more likely to approve your loan if you have a strong credit history.

- Negotiation Power: With a high score, you can negotiate better terms with lenders.

To calculate your EMI accurately, you can use a Personal Loan EMI Calculator. This tool considers your loan amount, interest rate, and tenure, giving you a clear picture of your monthly payments. Remember, a good credit score not only eases the loan process but also saves you money in the long run.

Common Mistakes to Avoid When Calculating EMI

Understanding your EMI is crucial when taking a personal loan. An EMI Interest Rate Calculation Guide helps you grasp how much you will pay monthly. However, many people make mistakes that can lead to unexpected costs. Let’s explore some common pitfalls to avoid!

Not Using a Personal Loan EMI Calculator

One of the biggest mistakes is not utilizing a Personal Loan EMI Calculator. This handy tool allows you to input your loan amount, interest rate, and tenure to see your monthly payments. Skipping this step can lead to surprises later on!

Ignoring the Total Cost of the Loan

Another common error is focusing solely on the EMI amount without considering the total cost of the loan. Remember, the interest adds up! Always check how much you will pay in total over the loan period. This helps you make informed decisions.

Overlooking Prepayment Options

Many borrowers forget to check for prepayment options. If you have extra cash, paying off your loan early can save you money on interest. Always ask your lender about any penalties or fees associated with prepayment. This can significantly impact your overall cost!

How ExpressCash Can Simplify Your EMI Interest Rate Calculations

Understanding your EMI interest rates is essential when taking a personal loan. It helps you plan your finances effectively and avoid unexpected costs. With the right tools, calculating your EMI can be straightforward! Our EMI Interest Rate Calculation Guide simplifies this process for you.

Easy-to-Use Personal Loan EMI Calculator

At ExpressCash, we provide a user-friendly Personal Loan EMI Calculator. Simply enter the loan amount, interest rate, and tenure to receive instant results, making it easier to grasp your monthly payments.

Key Benefits of Using Our Calculator

- Quick Results: No more tedious manual calculations.

- Accurate Estimates: Get precise EMI amounts based on your loan details.

- Budget Planning: Know your monthly obligations for effective financial planning.

Our guide also breaks down complex loan terms into simple language, helping you understand how interest rates and tenure affect your EMI. We include real-life examples to illustrate how different rates impact payments, making it easier to visualize your commitments. Additionally, our guide offers tips for lowering your EMI, such as negotiating interest rates or choosing a longer tenure. Staying informed about market trends can help you secure better rates, allowing you to make timely decisions that enhance your financial health.

Tips for Reducing Your EMI Interest Rate

Understanding your EMI interest rate is essential for effective financial management. The EMI Interest Rate Calculation Guide helps you see how much you’ll pay over time. A lower interest rate results in lower monthly payments, easing your financial burden and improving budgeting.

Shop Around for the Best Rates

Don’t accept the first offer. Different lenders have varying rates. Use a Personal Loan EMI Calculator to compare options and find the best deal.

Improve Your Credit Score

A higher credit score can lead to lower rates. Pay bills on time and reduce debts to boost your score and become a more attractive borrower.

Opt for a Shorter Loan Tenure

While this results in higher EMIs, it can significantly lower total interest paid. Shorter tenures often come with lower rates, so consider your budget carefully.

Negotiate with Lenders

Don’t hesitate to negotiate. Lenders may offer better rates if you ask. Highlight your creditworthiness and any existing relationship with the bank.

Consider a Secured Loan

If you have collateral, a secured loan can offer lower rates, reducing the lender’s risk and saving you money.

Make Extra Payments

Whenever possible, make extra payments towards your principal. This reduces the overall loan amount and interest paid over time.

Keep an Eye on Market Trends

Interest rates fluctuate. Stay informed about trends, and if rates drop, consider refinancing your loan for a better rate.

FAQs

-

How is the interest rate used in EMI calculation?

The annual interest rate is converted into a monthly rate by dividing it by 12 and then by 100 before applying it in the EMI formula. -

What is the formula to calculate EMI with interest?

EMI = P×R×(1+R)NP × R × (1 + R)^N / (1+R)N–1(1 + R)^N – 1

Where P = principal, R = monthly interest rate, and N = loan tenure in months. -

Does a higher interest rate mean a higher EMI?

Yes, the higher the interest rate, the higher your EMI will be, as more of your monthly payment goes toward interest. -

Can I calculate EMI manually without a calculator?

Yes, by using the EMI formula, but it can be complex—online EMI calculators are quicker and reduce the chance of errors. -

Does the EMI interest rate change over time?

For fixed-rate loans, the interest rate stays the same. For floating-rate loans, the EMI or tenure may change if the rate is adjusted by the lender.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.