The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

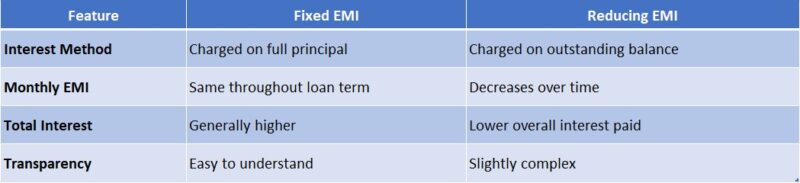

Fixed vs. Reducing EMI Comparison: Which Saves More?

When it comes to loans, understanding the difference between fixed and reducing EMI is crucial. This knowledge can save you money and help you make informed decisions. So, let’s dive into the Fixed vs. Reducing EMI Comparison: Which Saves More?

What is Fixed EMI?

With a fixed EMI, your monthly payments remain the same throughout the loan tenure. This predictability makes budgeting easier. You know exactly how much to set aside each month, which can be a relief for many borrowers.

What is Reducing EMI?

On the other hand, reducing EMI means your payments decrease over time. This happens because interest is calculated on the outstanding principal. As you pay off your loan, the interest amount reduces, leading to lower EMIs in later months. This can save you money in the long run!

Key Takeaways:

- Fixed EMI: Consistent payments, easier budgeting.

- Reducing EMI: Decreasing payments, potential savings over time.

- Use a Personal Loan EMI Calculator to see how these options affect your finances.

Choosing between fixed and reducing EMI depends on your financial situation and preferences. Do you prefer stability or potential savings?

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Fixed EMIs Provide Stability in Your Budget

When considering a loan, understanding the Fixed vs. Reducing EMI Comparison is essential. Many borrowers are curious about which option saves more money in the long run. Fixed EMIs provide stability, making it easier to plan your monthly budget without unexpected surprises.

Predictable Payments

With fixed EMIs, your monthly payments remain constant throughout the loan tenure. This predictability helps you manage your finances effectively. Using a Personal Loan EMI Calculator can show you your monthly payments, aiding in budgeting.

Easier Financial Planning

Knowing your exact monthly payment allows you to allocate funds for other expenses. This stability is particularly beneficial for families or individuals on tight budgets, as it eliminates worries about fluctuating payments and facilitates saving or investing.

Less Stress

Fixed EMIs can significantly reduce financial stress. With a consistent payment amount, you can focus on other life aspects, providing peace of mind during uncertain times when unexpected expenses may arise.

Long-Term Budgeting

Fixed payments enable better future planning. Whether saving for a vacation or setting aside money for emergencies, knowing your monthly EMI helps create a solid financial plan, leading to improved financial health overall.

Conclusion

In summary, fixed EMIs offer stability and predictability, making them an excellent choice for many borrowers. Utilizing a Personal Loan EMI Calculator allows you to see how these fixed payments fit into your budget, aiding in informed financial decisions.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

The Benefits of Reducing EMIs: Is It Worth the Risk?

When considering a loan, understanding the Fixed vs. Reducing EMI Comparison is crucial. It can significantly impact your finances. Fixed EMIs remain constant, while reducing EMIs decrease over time. This difference can affect how much you pay in total and how quickly you can pay off your loan.

Lower Total Interest Payments

One of the main benefits of reducing EMIs is that you pay less interest over time. As your principal amount decreases, the interest calculated on it also drops. This means you could save a substantial amount in the long run!

Flexibility in Budgeting

Reducing EMIs can also offer flexibility. Since your payments decrease, it can be easier to manage your monthly budget. You might find it easier to save or invest the extra money you have each month.

Use a Personal Loan EMI Calculator

To see how much you can save, try using a Personal Loan EMI Calculator. This tool helps you compare fixed and reducing EMIs, giving you a clearer picture of your financial future. It’s a simple way to make informed decisions!

Also Read: Personal Loan EMI Calculator: Find Your Monthly Installments

Fixed vs. Reducing EMI Comparison: Which Option Saves You More?

When considering a personal loan, understanding the Fixed vs. Reducing EMI Comparison is crucial. Choosing the right EMI option can significantly impact your finances. So, which one saves you more? Let’s break it down in simple terms!

Fixed EMI: The Steady Choice

With a fixed EMI, your monthly payments remain the same throughout the loan term. This means you can easily budget your expenses. However, the total interest paid can be higher compared to reducing EMI. It’s like having a steady ride on a smooth road!

Reducing EMI: The Flexible Option

On the other hand, reducing EMI means your payments decrease over time as you pay off the principal. This can lead to lower overall interest costs. It’s like climbing a hill and then enjoying a downhill ride!

Key Insights:

- Fixed EMI: Predictable payments, higher total interest.

- Reducing EMI: Decreasing payments, lower total interest.

To see how these options affect your finances, you can use a Personal Loan EMI Calculator. It’s a handy tool that helps you visualize your payments and savings!

Key Factors to Consider When Choosing Between Fixed and Reducing EMIs

When it comes to borrowing money, understanding the difference between fixed and reducing EMIs is crucial. This decision can significantly impact your finances over time. So, let’s dive into the Fixed vs. Reducing EMI Comparison and see which option might save you more money in the long run.

Understanding Fixed EMIs

With fixed EMIs, your monthly payment remains the same throughout the loan tenure. This predictability can help you budget better. However, you might end up paying more in interest over time compared to reducing EMIs.

Exploring Reducing EMIs

On the other hand, reducing EMIs mean your monthly payments decrease as you pay off the principal amount. This can lead to lower overall interest costs, making it a potentially cheaper option in the long run.

Key Factors to Consider

- Loan Amount: The size of your loan can influence which EMI type is better for you.

- Interest Rates: Compare the interest rates offered for both types of EMIs.

- Loan Tenure: A longer tenure may favor fixed EMIs, while a shorter one might benefit from reducing EMIs.

Using a Personal Loan EMI Calculator can help you visualize these differences. By inputting your loan details, you can see how each EMI type affects your total repayment amount. This way, you can make a more informed decision that suits your financial situation.

Real-Life Scenarios: When to Choose Fixed or Reducing EMIs

Understanding the difference between fixed and reducing EMIs is crucial for borrowers. The question, “Fixed vs. Reducing EMI Comparison: Which Saves More?” can significantly affect your monthly budget and financial health. Let’s dive into real-life scenarios to help you decide.

Fixed EMIs: A Steady Path

Fixed EMIs remain constant throughout the loan tenure, allowing for easy budgeting. For instance, if you take a personal loan of $10,000 at a fixed rate, your EMI stays the same, providing predictability for those on a tight budget.

Reducing EMIs: A Flexible Option

In contrast, reducing EMIs decrease over time as you pay off the principal, leading to lower interest payments. For example, with a $10,000 loan, your initial payments may be higher, but they will decrease, ultimately saving you money. A Personal Loan EMI Calculator can help illustrate these differences.

Key Considerations

When choosing between fixed and reducing EMIs, assess your financial situation. Fixed EMIs offer stability, while reducing EMIs may save you money if you can manage higher initial payments.

Example Scenarios

- Fixed EMI: Sarah borrows $15,000 with a fixed EMI of $300, making budgeting straightforward.

- Reducing EMI: John takes the same amount but starts at $350, decreasing to $250 after a year, saving him money over time.

Conclusion

Your choice between fixed and reducing EMIs should align with your financial goals. Utilize a Personal Loan EMI Calculator to evaluate how each option impacts your budget, helping you make the best decision.

How ExpressCash Can Help You Make the Right EMI Choice

When it comes to choosing the right EMI for your personal loan, understanding the Fixed vs. Reducing EMI Comparison is crucial. This decision can significantly impact your finances over time. So, how do you know which option saves you more? Let’s explore how ExpressCash can guide you in making the best choice.

Understanding Fixed and Reducing EMIs

- Fixed EMI: Your monthly payment stays the same throughout the loan term. This means you can budget easily without surprises.

- Reducing EMI: Your payment decreases over time as you pay off the principal. This can lead to savings on interest but may require more planning.

Why Choose ExpressCash?

Using a Personal Loan EMI Calculator on ExpressCash can simplify your decision. You can easily compare both options by inputting your loan amount, interest rate, and tenure. This tool helps you visualize how much you’ll pay each month and overall, making it easier to choose the right EMI for your needs. By understanding the differences between fixed and reducing EMIs, you can make an informed choice. ExpressCash not only provides the tools you need but also offers insights and tips to help you save money in the long run. So, take the first step towards financial clarity today!

FAQs

-

What is the difference between fixed and reducing EMI?

Fixed EMI stays the same throughout the loan, while reducing EMI decreases over time as the interest is calculated on the outstanding principal. -

Which type of EMI results in lower total interest paid?

Reducing EMI usually leads to lower overall interest payments, especially for longer loan tenures, since interest is charged only on the remaining balance. -

Why do some lenders offer fixed EMI instead of reducing EMI?

Fixed EMIs are easier to budget and offer predictable monthly payments, which some borrowers prefer for financial planning. -

Are reducing EMIs more common for personal loans?

Yes, many banks and NBFCs use the reducing balance method for personal loans, but it’s best to confirm with your lender. -

How can I compare fixed vs. reducing EMIs for the same loan?

Use a loan comparison calculator that shows side-by-side EMI amounts, total interest, and total payment for both options.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.