The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Secured Personal Loans Explained: How They Work

Understanding Secured Personal Loans is crucial for anyone looking to borrow money. These loans are ideal for big purchases or debt consolidation. But how do they work? Let’s explore!

What Are Secured Personal Loans?

Secured personal loans are backed by collateral, such as your car or savings account. If you can’t repay the loan, the lender can take your collateral, similar to borrowing a friend’s video game with a promise to return it.

Why Choose Secured Personal Loans?

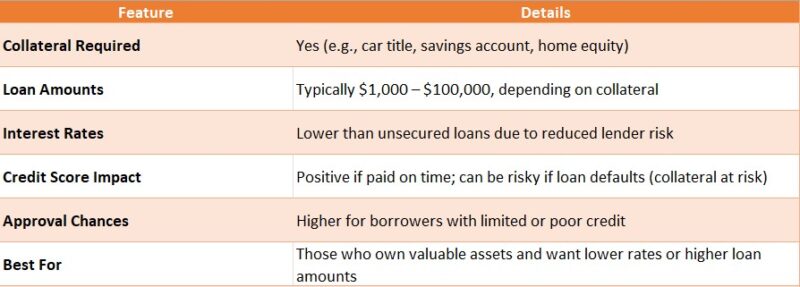

Here are some benefits of secured personal loans:

- Lower Interest Rates: They’re less risky for lenders, resulting in better rates.

- Higher Loan Amounts: You can borrow more compared to unsecured loans.

- Improved Approval Chances: Collateral can help if you have a lower credit score.

These advantages can help you make informed financial decisions!

How Do Secured Personal Loans Work?

When applying, you’ll provide details about your collateral. The lender evaluates its value to determine how much they can lend you, adding security for them.

Types of Personal Loans

Types include:

- Unsecured Personal Loans: No collateral, but higher interest rates.

- Secured Personal Loans: Backed by collateral, offering lower rates.

- Debt Consolidation Loans: For combining multiple debts into one payment.

Understanding these types helps you choose the right loan!

Things to Consider

Before getting a secured personal loan, consider:

- Your Ability to Repay: Ensure you can afford monthly payments.

- Value of Collateral: Make sure it’s worth enough to cover the loan.

- Loan Terms: Understand interest rates and repayment periods.

These steps lead to a smoother borrowing experience!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Do Secured Personal Loans Work? A Step-by-Step Guide

When it comes to borrowing money, understanding how secured personal loans work is crucial. These loans can be a great option if you need funds but want to keep your interest rates lower. Let’s break it down simply so you can see how they function and why they might be right for you.

Secured personal loans explained involve using an asset, like your car or home, as collateral. This means if you can’t repay the loan, the lender can take your asset. Here’s how it typically works:

- Choose Your Asset: First, you need to decide what you’ll use as collateral. Common choices include vehicles, savings accounts, or even property.

- Apply for the Loan: Next, you fill out an application with your lender. They’ll check your credit and the value of your collateral.

- Receive Your Funds: If approved, you’ll get the loan amount, usually at a lower interest rate than unsecured loans. This is because the lender has less risk with your asset backing the loan.

- Repay the Loan: Finally, you’ll make monthly payments. If you pay on time, you keep your asset. If not, the lender can take it.

Secured personal loans can be a smart choice, especially if you’re looking for lower rates and manageable payments. Just remember, the risk is higher since you’re putting your property on the line!

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

The Benefits of Choosing Secured Personal Loans: Why They Might Be Right for You

When considering a loan, understanding the options available is crucial. Secured Personal Loans Explained: How They Work can help you make informed decisions. These loans are backed by collateral, which can lead to better terms and lower interest rates. But what makes them a great choice for many borrowers?

Lower Interest Rates

One of the biggest advantages of secured personal loans is the lower interest rates. Since these loans are backed by an asset, lenders feel more secure. This means you might save money over time compared to unsecured loans.

Easier Approval Process

Secured loans often have a simpler approval process. Lenders are more willing to approve loans when they have collateral. This can be especially helpful if you have a limited credit history or lower credit score.

Larger Loan Amounts

With secured personal loans, you can often borrow more money. Because the loan is backed by your asset, lenders may offer larger amounts than they would for unsecured loans. This can be beneficial for significant expenses like home renovations or debt consolidation.

What Are the Risks Involved with Secured Personal Loans?

When considering a secured personal loan, understanding the associated risks is crucial. Secured Personal Loans Explained: How They Work emphasizes that these loans require collateral, meaning you could lose your asset if you default. Let’s explore the potential risks involved.

Potential Risks of Secured Personal Loans

- Loss of Collateral: The most significant risk is losing your asset if you fail to repay the loan.

- Debt Cycle: Borrowing beyond your means can lead to a cycle of debt, forcing you to take out more loans if you struggle with payments.

- Impact on Credit Score: Missing payments can harm your credit score, making future borrowing more challenging and costly.

Conclusion

It’s essential to weigh the risks of secured personal loans against your financial situation. Always assess your ability to repay before committing to any personal loan.

Additional Considerations

Before taking out a secured personal loan, evaluate your financial stability. Can you manage the monthly payments? If not, consider other options.

Alternatives to Secured Personal Loans

- Unsecured Personal Loans: These loans don’t require collateral but typically have higher interest rates.

- Credit Cards: For smaller amounts, credit cards may be a better option if you can pay them off quickly.

Seeking Professional Advice

If you’re uncertain about secured personal loans, consulting a financial advisor can help clarify your options and guide you toward the best choice.

Secured Personal Loans Explained: Who Can Qualify?

When considering a loan, understanding who can qualify for secured personal loans is crucial. These loans can be a great option for those who may not qualify for unsecured loans due to credit issues. So, let’s dive into the details of secured personal loans explained and see who can benefit from them.

What is a Secured Personal Loan?

A secured personal loan is backed by collateral, like your car or savings account. This means if you can’t repay the loan, the lender can take your asset. This security often makes it easier for people to qualify, even if their credit isn’t perfect.

Who Can Qualify?

Many people can qualify for secured personal loans, including:

- Homeowners: If you own a home, you can use it as collateral.

- Car Owners: Your vehicle can also serve as security.

- Individuals with Steady Income: Lenders look for proof of income to ensure you can repay the loan.

- Those with Poor Credit: Since the loan is secured, lenders may be more lenient with credit scores.

Understanding these factors can help you determine if a secured personal loan is right for you. Remember, it’s essential to weigh the risks and benefits before proceeding!

How to Use Secured Personal Loans Wisely: Tips for Borrowers

When considering a secured personal loan, understanding how to use it wisely is crucial. Secured personal loans explained can help you make informed decisions. These loans can be beneficial, but they also come with risks. Knowing how to navigate them can lead to financial success.

Tips for Borrowers

- Assess Your Needs: Before applying, determine how much you need and why. This clarity will help you choose the right loan type.

- Choose the Right Collateral: Common types of personal loans include those backed by vehicles or savings accounts. Ensure your collateral is something you can afford to lose if needed.

- Read the Fine Print: Always understand the terms and conditions. Look for interest rates, fees, and repayment terms to avoid surprises later.

- Create a Repayment Plan: Plan how you will repay the loan. A solid strategy can prevent missed payments and protect your collateral.

- Avoid Overborrowing: Only borrow what you can comfortably repay. This helps maintain your financial health and credit score.

Using secured personal loans wisely means being informed and prepared. By following these tips, you can take advantage of the benefits while minimizing risks. Remember, secured personal loans can be a helpful tool when used correctly, leading to better financial outcomes.

How ExpressCash Can Help You Navigate Secured Personal Loans

Understanding secured personal loans is vital for anyone looking to borrow money using an asset as collateral. But navigating this process can be tricky. That’s where ExpressCash comes in!

At ExpressCash, we simplify the complexities of secured personal loans. Our mission is to help you understand the various types of personal loans available and provide you with clear information and resources for informed decision-making.

Key Benefits of Using ExpressCash

- Expert Guidance: Our team offers insights into secured loans, so you know what to expect.

- Comparative Analysis: We assist you in comparing different personal loans to find the best fit.

- Step-by-Step Support: We guide you through each stage, from application to approval. Understanding the terms of secured personal loans is essential. We make these details easy to grasp, helping you avoid surprises later on.

Why Choose Secured Personal Loans?

- Lower Interest Rates: Backed by collateral, these loans often come with lower rates.

- Higher Borrowing Limits: You can typically borrow more than with unsecured loans.

- Improved Approval Chances: Collateral increases your chances of approval, making it a safer option for lenders.

With ExpressCash, navigating secured personal loans becomes manageable. We provide valuable resources and support to empower you in making the right financial choices.

FAQs

-

What is a secured personal loan?

A secured personal loan is a type of loan backed by collateral, such as a car, savings account, or other asset, which the lender can claim if you default. -

What can I use as collateral for a secured loan?

Common forms of collateral include vehicles, home equity, certificates of deposit (CDs), savings accounts, or other valuable assets like jewelry or investments. -

Are interest rates lower on secured personal loans?

Yes. Since the lender takes on less risk, secured loans usually offer lower interest rates compared to unsecured personal loans. -

What happens if I can’t repay a secured loan?

If you default, the lender has the legal right to seize your collateral to recover the unpaid loan balance, which can also impact your credit score. -

Is it easier to get approved for a secured loan?

Generally, yes. Lenders are more likely to approve secured loans, even for borrowers with poor or limited credit, because of the collateral guarantee.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.