The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

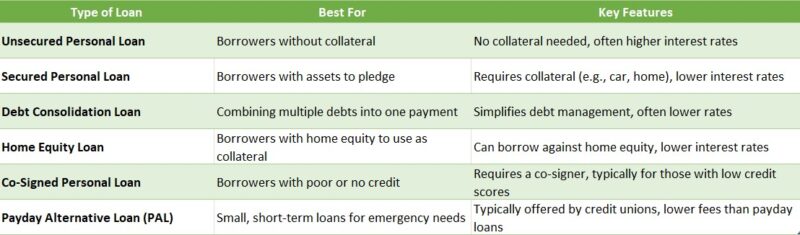

Types of Personal Loans: Which One Do You Need?

When it comes to borrowing money, understanding the different types of personal loans is crucial. Each type serves a unique purpose, and knowing which one fits your needs can save you time and money. So, let’s dive into the world of personal loans and find out which one is right for you!

Types of Personal Loans

Personal loans can be broadly categorized into two types: secured and unsecured loans.

Secured Loans

- Definition: These loans require collateral, like your car or home.

- Benefits: Lower interest rates and larger amounts.

- Risks: If you fail to repay, you could lose your asset.

Unsecured Loans

- Definition: No collateral is needed, making them riskier for lenders.

- Benefits: Easier to obtain and quicker approval.

- Risks: Higher interest rates and potential impact on credit score if you default.

Choosing the Right Loan

To choose the right personal loan, consider your financial situation and what you need the money for. Are you looking to consolidate debt, cover medical expenses, or fund a big purchase? Each type of personal loan has its advantages, so weigh them carefully before making a decision. Remember, the right loan can help you achieve your goals without breaking the bank!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Are Unsecured Personal Loans and How Do They Work?

When it comes to borrowing money, understanding the different types of personal loans is crucial. One popular option is the unsecured personal loan. But what exactly does that mean, and how does it work? Let’s dive in!

What Are Unsecured Personal Loans?

Unsecured personal loans are loans that don’t require any collateral. This means you don’t have to put up your house or car as security. Instead, lenders look at your creditworthiness to decide if they’ll lend you money. It’s like borrowing a book from a friend—you trust each other!

How Do They Work?

Here’s how unsecured personal loans typically work:

- Application: You fill out an application, providing details about your income and credit history.

- Approval: The lender reviews your information and decides if you qualify.

- Funds: If approved, you receive the money, usually as a lump sum.

- Repayment: You pay it back in monthly installments, often with interest.

This type of loan can be great for consolidating debt or covering unexpected expenses, but remember, since there’s no collateral, interest rates might be higher than secured loans. So, weigh your options carefully!

Exploring Secured Personal Loans: Are They Right for You?

When it comes to managing finances, understanding the types of personal loans available is crucial. One popular option is the secured personal loan. But what exactly is it, and could it be the right choice for you? Let’s dive in and explore!

What is a Secured Personal Loan?

A secured personal loan is a type of loan where you offer an asset, like your car or savings account, as collateral. This means if you can’t repay the loan, the lender can take your asset. It’s a bit like borrowing a friend’s video game but promising to give them your favorite toy if you don’t return it!

Benefits of Secured Personal Loans

Secured personal loans come with several advantages:

- Lower Interest Rates: Because you’re offering collateral, lenders often charge lower rates.

- Higher Loan Amounts: You might qualify for a larger loan since the lender has security.

- Improved Approval Chances: If you have a less-than-perfect credit score, collateral can help you get approved.

However, remember that with great benefits come great responsibilities. Always consider whether you can repay the loan to avoid losing your asset!

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

The Benefits of Debt Consolidation Loans: A Smart Choice?

When it comes to managing finances, understanding the types of personal loans available can make a big difference. One popular option is the debt consolidation loan, which can help simplify your payments and potentially save you money. But is it the right choice for you? Let’s explore!

Debt consolidation loans combine multiple debts into one single loan. This means instead of juggling several payments each month, you only have to worry about one. Here are some key benefits:

- Lower Interest Rates: Often, debt consolidation loans come with lower interest rates than credit cards. This can save you money in the long run.

- Simplified Payments: With just one payment to manage, it’s easier to stay organized and avoid missed payments.

- Improved Credit Score: By paying off high-interest debts, you may see an improvement in your credit score over time.

In conclusion, if you’re feeling overwhelmed by multiple debts, a debt consolidation loan might be a smart choice. It’s one of the many types of personal loans that can help you regain control of your finances. Always consider your options and choose what works best for your situation!

How to Choose the Right Personal Loan for Your Needs

When borrowing money, understanding the types of personal loans is essential. The right loan can significantly impact your financial journey, whether for a big purchase, debt consolidation, or unexpected expenses. Knowing your options allows for informed decisions.

Assess Your Financial Situation

Before exploring types of personal loans, evaluate your financial health. Consider how much you need and your credit score. These factors will help you identify the best loan type for your needs.

Explore Your Options

Common types of personal loans include:

- Unsecured Personal Loans: No collateral needed, but often come with higher interest rates.

- Secured Personal Loans: Require collateral, usually offering lower rates.

- Debt Consolidation Loans: Designed for combining multiple debts into one payment.

- Payday Loans: Short-term, high-interest loans; best avoided unless necessary.

Compare Interest Rates

After identifying potential loan types, compare interest rates from different lenders. Shopping around can save you money, so seek the best deal that fits your budget.

Check Loan Terms

Understanding loan terms is crucial. Review the repayment period and any fees. A longer term may lower monthly payments but could increase total interest paid.

Read the Fine Print

Before signing, read the fine print to understand penalties for late or early payments. This knowledge helps avoid surprises and ensures a sound decision.

Why You Should Consider a Co-Signer for Your Personal Loan

When exploring the types of personal loans, understanding the role of a co-signer can be a game-changer. A co-signer is someone who agrees to take responsibility for the loan if you can’t make payments. This can significantly improve your chances of approval, especially if your credit score isn’t stellar. So, why should you consider having a co-signer?

Benefits of Having a Co-Signer

- Better Approval Odds: Lenders feel more secure when there’s a co-signer, which can lead to higher approval rates.

- Lower Interest Rates: With a co-signer, you might qualify for lower interest rates, saving you money in the long run.

- Building Credit: If you make timely payments, both you and your co-signer can improve your credit scores. This is especially helpful if you’re just starting out.

Who Should Be Your Co-Signer?

Choosing the right co-signer is crucial. Ideally, they should have a strong credit history and a stable income. This could be a parent, sibling, or close friend who trusts you. Just remember, they’re taking a risk too, so it’s essential to communicate openly about your repayment plans. By considering a co-signer, you can navigate the types of personal loans more effectively and secure the best deal for your needs.

How ExpressCash Can Help You Navigate the Types of Personal Loans

When it comes to personal finance, understanding the types of personal loans available can make a huge difference. Choosing the right loan can help you achieve your goals, whether it’s consolidating debt, funding a big purchase, or covering unexpected expenses. At ExpressCash, we’re here to help you navigate these options with ease.

Types of Personal Loans Explained

Personal loans come in various forms, each designed for specific needs. Here are some common types you might consider:

- Unsecured Personal Loans: These loans don’t require collateral, making them accessible but often with higher interest rates.

- Secured Personal Loans: Backed by an asset, these loans usually offer lower rates but put your property at risk if you default.

- Debt Consolidation Loans: Perfect for combining multiple debts into one, simplifying your payments and potentially lowering your interest rate.

- Medical Loans: Specifically for healthcare expenses, these can help you manage costs without draining your savings.

How ExpressCash Can Assist You

At ExpressCash, we simplify the process of finding the right personal loan. Our resources guide you through each type, helping you weigh the pros and cons. Plus, our expert tips can empower you to make informed decisions, ensuring you choose a loan that fits your financial situation perfectly.

FAQs

-

What are the main types of personal loans?

The most common types include unsecured loans, secured loans, debt consolidation loans, co-signed loans, and personal lines of credit. -

What is the difference between secured and unsecured personal loans?

Secured loans require collateral (like a car or savings), while unsecured loans don’t. Unsecured loans usually have higher interest rates due to increased lender risk. -

What is a debt consolidation loan?

A debt consolidation loan combines multiple debts into one loan, often with a lower interest rate, making it easier to manage and pay off existing balances. -

Can I get a personal loan with a co-signer?

Yes. A co-signed loan involves another person agreeing to repay the loan if you can’t. This can help you qualify for better terms if you have poor or limited credit. -

What is a personal line of credit?

A personal line of credit allows you to borrow up to a set limit as needed, similar to a credit card. You only pay interest on the amount you use, offering flexible access to funds.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.