The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Documents Required for Loan Refinancing: What You Need to Apply

When considering loan refinancing, understanding the Documents Required for Loan Refinancing is crucial. These documents help lenders assess your financial situation and determine your eligibility for better rates or terms. Having everything ready can make the process smoother and faster.

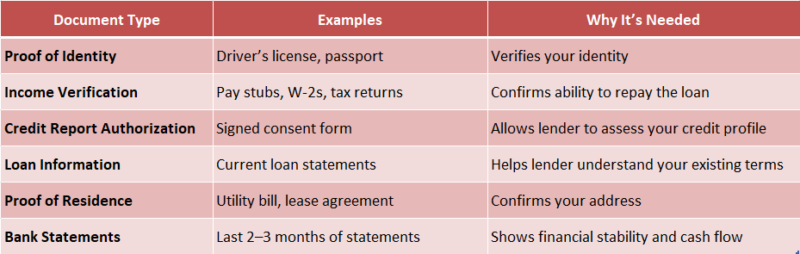

Key Documents You’ll Need

To get started, gather these essential documents:

- Proof of Income: This can include pay stubs, tax returns, or bank statements.

- Credit Report: Lenders will check your credit score, so knowing it beforehand can help.

- Loan Information: Details about your current loan, including balance and terms, are necessary.

- Identification: A government-issued ID like a driver’s license or passport is typically required.

Why These Documents Matter

Having the right Documents Required for Loan Refinancing not only speeds up your application but also strengthens your case for better Personal Loan Refinance Options. It shows lenders that you are organized and serious about refinancing, which can lead to more favorable terms.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Why You Need to Gather Your Financial Documents

When considering a loan refinance, gathering the right documents is crucial. The Documents Required for Loan Refinancing can make or break your application. Having everything ready not only speeds up the process but also helps you secure better terms. So, let’s dive into why this matters!

Key Documents You’ll Need

To get started, here are some essential documents you should gather:

- Proof of Income: Pay stubs or tax returns to show your earnings.

- Credit Report: Lenders want to see your credit history.

- Loan Information: Details about your current loan, including balance and terms.

- Personal Identification: A government-issued ID to verify your identity.

Benefits of Being Prepared

By collecting these documents early, you can explore various Personal Loan Refinance Options. This preparation not only boosts your chances of approval but can also lead to lower interest rates. Remember, being organized is key to a smooth refinancing experience!

Essential Personal Identification for Loan Refinancing

When considering loan refinancing, understanding the documents required for loan refinancing is crucial. These documents help lenders assess your financial situation and determine the best personal loan refinance options available to you. Having everything ready can speed up the process and make it smoother.

Essential Personal Identification

To start, you’ll need to gather some essential personal identification. This typically includes:

- Government-issued ID: A driver’s license or passport works well.

- Social Security Number: This helps verify your identity.

- Proof of Residence: A utility bill or lease agreement can serve this purpose.

These documents help lenders confirm who you are and where you live, which is a key step in the refinancing process.

Financial Documentation

In addition to personal identification, you’ll also need financial documents. These might include:

- Pay stubs: To show your income.

- Tax returns: Usually for the last two years.

- Bank statements: To demonstrate your savings and spending habits.

Having these documents ready not only helps with your application but also shows lenders that you’re serious about refinancing.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

How to Prepare Your Income Verification Documents

When you’re thinking about refinancing your loan, understanding the Documents Required for Loan Refinancing is crucial. These documents help lenders assess your financial situation and determine your eligibility for better rates or terms. So, let’s dive into how to prepare your income verification documents effectively!

Gather Your Income Verification Documents

To start, you’ll need to collect a few key documents. These typically include:

- Recent Pay Stubs: These show your current earnings and help verify your income.

- Tax Returns: Providing the last two years of tax returns gives lenders a clear picture of your financial history.

- W-2 Forms: These forms confirm your annual income and are essential for self-employed individuals too!

Additional Tips for Smooth Processing

Make sure all your documents are up-to-date and accurate. If you’re self-employed, consider including profit and loss statements. This preparation can speed up the process and improve your chances of securing favorable Personal Loan Refinance Options. Remember, a little organization goes a long way!

Also Read: Personal Loan Refinance Options: Best Ways to Lower Your Payments

The Importance of Credit Reports in Loan Refinancing

When considering loan refinancing, understanding the Documents Required for Loan Refinancing is crucial. One of the most important documents you’ll need is your credit report. This report plays a significant role in determining your eligibility for better rates and terms. So, let’s dive into why your credit report matters!

Why Credit Reports Matter

Your credit report is like a report card for your financial behavior. It shows lenders how responsible you are with borrowing money. A good credit score can open doors to personal loan refinance options with lower interest rates. Conversely, a poor score might limit your choices.

Key Insights About Credit Reports

- Accuracy is Key: Ensure your credit report is accurate. Mistakes can hurt your score.

- Check Regularly: Review your report at least once a year to catch any issues early.

- Improve Your Score: Pay down debts and make payments on time to boost your score before applying for refinancing.

What Property Documents Are Needed for Refinancing?

When refinancing your loan, knowing the documents required for loan refinancing is essential. Having the right paperwork can streamline the process, much like studying for a test improves your performance!

To begin, gather these key documents:

- Proof of Income: Pay stubs or tax returns.

- Credit Report: Lenders review your credit history.

- Property Title: Confirms your ownership of the property.

- Home Appraisal: Estimates your home’s current value.

- Debt Information: Details about your existing loans and debts.

These documents will help you explore various personal loan refinance options effectively!

Why These Documents Matter

Each document is crucial in the refinancing process. For example, proof of income helps lenders evaluate your repayment ability, while the home appraisal ensures you don’t borrow more than your property’s worth. Understanding these requirements will empower you to navigate your refinancing journey with confidence!

Are There Any Additional Documents Required for Specific Loans?

When considering a loan refinance, understanding the documents required for loan refinancing is crucial. These documents help lenders assess your financial situation and determine your eligibility for better rates. But did you know that specific loans might require additional paperwork? Let’s dive into what you might need!

Common Additional Documents

- For FHA Loans: You may need proof of employment history and additional income documentation.

- For VA Loans: A Certificate of Eligibility is often required.

- For Jumbo Loans: You might need more extensive financial statements and asset documentation.

These extra documents ensure that lenders have a complete picture of your financial health, especially for personal loan refinance options that can vary significantly.

Why It Matters

Having the right documents ready can speed up the refinancing process. It not only helps you avoid delays but also increases your chances of securing favorable terms. So, gather your paperwork and get ready to take the next step towards financial freedom!

How to Organize Your Documents for a Smooth Application Process

When you’re considering refinancing your loan, knowing the documents required for loan refinancing is crucial. Having everything organized not only speeds up the process but also makes it less stressful. Imagine trying to find your favorite book in a messy room; it’s the same with paperwork!

Gather Your Financial Documents

To start, you’ll need to collect some key financial documents. These include:

- Proof of income: Pay stubs or tax returns

- Credit report: A recent copy to show your creditworthiness

- Current loan details: Information about your existing loan

Having these ready will help you explore various personal loan refinance options effectively.

Keep Everything Accessible

Next, organize your documents in a folder or a digital file. This way, when your lender asks for something, you can quickly provide it. Think of it like having your backpack ready for school; it makes everything easier! By staying organized, you’ll ensure a smooth application process and avoid unnecessary delays.

Common Mistakes to Avoid When Submitting Your Loan Documents

When you’re ready to refinance your loan, understanding the documents required for loan refinancing is crucial. Submitting the right paperwork can make the process smoother and faster. However, many people make common mistakes that can delay their application. Let’s explore how to avoid these pitfalls!

Common Mistakes to Avoid

- Incomplete Documentation: Always double-check that you have all the necessary documents. Missing even one can slow down your application.

- Outdated Information: Ensure your financial details are current. Lenders need accurate information to assess your personal loan refinance options effectively.

- Neglecting to Organize: Keep your documents organized. A messy submission can confuse lenders and lead to delays.

By avoiding these common mistakes, you can streamline your refinancing process. Remember, the documents required for loan refinancing are not just a formality; they are essential for getting the best rates and terms. So, take your time, gather everything needed, and submit a complete application!

How ExpressCash.com Can Help You Navigate the Loan Refinancing Process

When considering loan refinancing, knowing the documents required for loan refinancing is crucial. Having the right paperwork ready can make the process smoother and faster. It’s like packing your bag before a trip; the better prepared you are, the more enjoyable the journey will be!

Key Documents You’ll Need

To get started, here are some essential documents you should gather:

- Proof of Income: Pay stubs or tax returns to show your earnings.

- Credit Report: Lenders want to see your credit history.

- Loan Statements: Current statements from your existing loans.

- Identification: A government-issued ID to verify your identity.

How ExpressCash.com Can Help

Navigating the world of personal loan refinance options can be overwhelming. That’s where ExpressCash.com comes in! We provide guidance on what documents you need and how to prepare them. Plus, our resources help you understand the refinancing process, making it easier to achieve your financial goals.

FAQs

-

What documents are needed to refinance a personal loan?

Typically, you’ll need a valid government-issued ID, income proof (like payslips or bank statements), existing loan documents, and address proof. -

Do I need to show credit history for refinancing?

Yes, most lenders will conduct a credit check and may request your credit report or score during the refinancing process. -

Are bank statements mandatory for loan refinancing?

Yes, 3–6 months of recent bank statements are usually required to verify income, spending patterns, and financial stability. -

Can I refinance my loan without income proof?

It’s rare. Most lenders require proof of stable income, such as salary slips, tax returns, or income statements if you’re self-employed. -

What if my original loan documents are missing?

You may need to contact your current lender for a copy or account statement. Lenders usually need details of your existing loan balance and terms.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.