The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Best Refinance Loan Offers in 2024: Compare & Save

Unlocking savings through refinancing can be a game-changer for many homeowners. As we step into 2024, understanding the Best Refinance Loan Offers in 2024 is crucial. With interest rates fluctuating, finding the right loan can help you save money and reduce monthly payments, making your financial journey smoother.

Why Refinance?

Refinancing your mortgage or personal loan can lead to significant savings. Here are some reasons why you should consider it:

- Lower Interest Rates: Many lenders are offering competitive rates this year.

- Improved Credit Score: If your credit score has improved, you might qualify for better terms.

- Cash-Out Options: Need cash for home improvements? Cash-out refinancing can help!

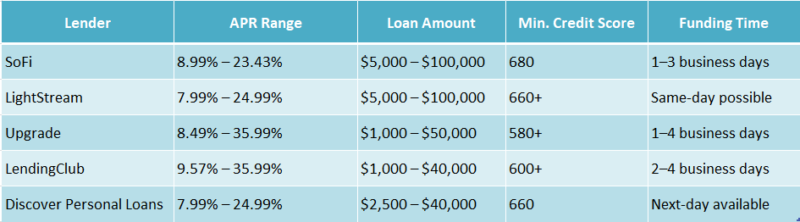

Top Personal Loan Refinance Options

When looking for the Best Refinance Loan Offers in 2024, consider these popular options:

- Fixed-Rate Loans: These provide stability with consistent monthly payments.

- Variable-Rate Loans: These can start lower but may increase over time.

- Shorter Loan Terms: Paying off your loan faster can save you money on interest.

- No Closing Costs: Some lenders offer options without upfront fees, making refinancing more accessible.

By comparing these options, you can find the best fit for your financial goals.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How to Choose the Right Refinance Loan for Your Needs

When it comes to refinancing, finding the Best Refinance Loan Offers in 2024 can make a huge difference in your financial journey. Refinancing can lower your monthly payments, reduce your interest rate, or even help you tap into your home’s equity. But how do you choose the right option for your needs? Let’s break it down!

Understand Your Goals

Before diving into the options, think about what you want to achieve. Are you looking to lower your monthly payments, or do you want to pay off your loan faster? Knowing your goals will help you narrow down your choices. Here are some common reasons to refinance:

- Lower interest rates

- Change loan terms

- Access cash from home equity

Explore Personal Loan Refinance Options

Next, consider the Personal Loan Refinance Options available to you. These can be great if you have high-interest debt. Look for loans with lower rates and favorable terms. Compare offers from different lenders to find the best fit. Remember, even a small difference in rates can save you a lot over time!

Compare Offers

Finally, don’t forget to compare the Best Refinance Loan Offers in 2024. Use online tools to check rates and terms. Pay attention to fees and closing costs, as these can impact your overall savings. By taking the time to research, you’ll be better equipped to make a smart financial decision.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Comparing Interest Rates: What to Look for in 2024

Finding the Best Refinance Loan Offers in 2024 is crucial for your financial health. With interest rates changing, knowing what to look for can help you save money. Here are key factors to consider when comparing offers.

Understanding Interest Rates

Interest rates determine the cost of borrowing. In 2024, seek competitive rates to lower your monthly payments. A lower rate means less money spent over time, benefiting your finances!

Key Factors to Consider

- Loan Terms: Choose flexible terms that align with your budget.

- Fees: Watch for hidden fees that can raise your overall costs.

- Lender Reputation: Research lenders for good reviews and customer service.

- Personal Loan Refinance Options: Explore various options that might better suit your needs than traditional loans.

Comparing Offers

When you have multiple refinance offers, compare them side by side. This helps identify the best overall deal, considering all loan aspects, not just the interest rate.

Use Online Tools

Online comparison tools can streamline your search. Input your details to receive tailored offers from various lenders, saving time and aiding informed decisions.

Ask Questions

Always ask lenders about their offers. Understanding terms and conditions is vital. Clarifying doubts can prevent surprises, ensuring you select the best option for your needs.

Also Read: Personal Loan Refinance Options: Best Ways to Lower Your Payments

Are You Eligible? Understanding Refinance Loan Requirements

Refinancing your loan can be a smart move, especially when looking for the Best Refinance Loan Offers in 2024. It’s all about saving money and making your financial life easier. But before you dive in, it’s crucial to understand if you qualify for these offers. Let’s break it down!

To qualify for a refinance loan, lenders typically look at a few key factors. Here’s what you need to know:

- Credit Score: A higher score can unlock better rates.

- Debt-to-Income Ratio: This shows how much of your income goes to debt payments.

- Employment History: Stable jobs can boost your chances.

- Home Equity: The more equity you have, the better your options!

Personal Loan Refinance Options

If you’re considering personal loans, refinancing can also be beneficial. Here are some options:

- Lower Interest Rates: Save money over time.

- Flexible Terms: Choose a plan that fits your budget.

- Consolidation: Combine multiple loans into one for easier payments.

Understanding these requirements can help you navigate the refinancing process and find the best deals available. So, are you ready to explore your options?

Maximizing Your Savings: Tips for Securing the Best Offers

When it comes to managing your finances, finding the Best Refinance Loan Offers in 2024 can make a significant difference. Refinancing your loan can lower your monthly payments, reduce interest rates, and even help you pay off debt faster. But how do you secure the best deals? Let’s dive into some tips that can help you maximize your savings!

Understand Your Options

Before you start comparing offers, it’s essential to know what’s available. Look into various personal loan refinance options that suit your needs. Whether you’re refinancing a mortgage, auto loan, or personal loan, each type has unique benefits. Take the time to research and understand these options to make an informed decision.

Shop Around for Rates

Don’t settle for the first offer you see! Shopping around can lead to better rates. Here are some tips to consider:

- Compare multiple lenders: Check banks, credit unions, and online lenders.

- Look for special promotions: Some lenders offer discounts or lower rates for specific situations.

- Read the fine print: Ensure you understand any fees or penalties associated with refinancing.

By taking these steps, you can find the best refinance loan offers that fit your financial goals.

How ExpressCash Can Help You Find the Best Refinance Loan Offers in 2024

Finding the Best Refinance Loan Offers in 2024 is essential for anyone aiming to save money on loans. With fluctuating interest rates and new options, comparing offers ensures you secure the best deal. Refinancing can lower monthly payments, reduce interest rates, or help pay off loans faster. That’s where ExpressCash comes in!

How ExpressCash Can Help You

At ExpressCash, we simplify finding the best refinance loan offers. Our platform allows you to compare various lenders and their rates side by side, making it easy to spot the best personal loan refinance options for your needs. Here’s how we assist you:

- User-Friendly Comparison Tools: Filter loans based on your preferences, like interest rates and terms.

- Expert Insights: Access articles and guides that clarify the refinancing process, helping you make informed choices.

- Personalized Recommendations: We suggest the best refinance options tailored to your financial situation.

Why Compare Offers?

Comparing refinance offers is crucial as even a small difference in interest rates can lead to significant savings. Using ExpressCash, you can quickly see how different lenders compare, ensuring you make the best choice.

The Benefits of Refinancing

Refinancing offers several benefits, including:

- Lower Monthly Payments: Reduced interest rates lead to lower payments.

- Debt Consolidation: Combine multiple loans for easier management.

- Access to Cash: Tap into your home’s equity for expenses or investments.

Start Your Journey Today!

Ready to explore the best refinance loan offers in 2024? Visit ExpressCash today and take the first step towards saving money. With our tools and expert advice, you’ll be on your way to a better financial future!

Future Trends: What to Expect in Refinance Loans Beyond 2024

As we look ahead, understanding the Best Refinance Loan Offers in 2024 is crucial for homeowners and borrowers. Refinancing can save you money, lower your monthly payments, or even help you pay off debt faster. Knowing what to expect in the coming years can empower you to make informed decisions.

Increased Flexibility in Loan Options

In 2024 and beyond, we can expect more personal loan refinance options to emerge. Lenders are likely to offer tailored solutions that cater to individual financial situations. This means you might find loans with varying terms, rates, and repayment plans that fit your needs perfectly.

Technology-Driven Processes

Technology will play a significant role in the refinancing landscape. Expect faster approvals and streamlined applications thanks to online platforms. With just a few clicks, you can compare rates and find the Best Refinance Loan Offers in 2024 without the hassle of paperwork.

- Quick Comparisons: Easily compare multiple lenders.

- Instant Approvals: Get decisions in minutes, not days.

- User-Friendly Platforms: Navigate with ease and confidence.

Focus on Sustainability

As environmental awareness grows, lenders may introduce green refinancing options. These loans could offer better rates for energy-efficient homes or improvements. This trend not only helps the planet but also provides homeowners with a chance to save money while making eco-friendly choices.

FAQs

-

What should I look for in the best refinance loan offers?

Focus on low interest rates, minimal fees, flexible repayment terms, and quick processing time. Also, check for prepayment or foreclosure charges. -

Are 2024 refinance offers better than previous years?

Yes, many lenders have reduced rates and launched special refinance deals in 2024 due to increased competition and borrower demand. -

Which banks or lenders are offering top refinance deals in 2024?

Leading lenders include HDFC Bank, SBI, Axis Bank, ICICI Bank, and top NBFCs like Bajaj Finserv and Tata Capital, all offering competitive personal loan refinance rates. -

Can I refinance my loan with a different lender offering better rates?

Absolutely. If another lender is offering a lower interest rate or better terms, you can transfer your loan balance through refinancing. -

How do I know if a refinance offer is worth it?

Use a refinance calculator to compare your current loan with the new offer. If you save on interest or reduce EMIs, it’s likely a good deal.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.