The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Loan Refinance Pros and Cons: Is It Right for You?

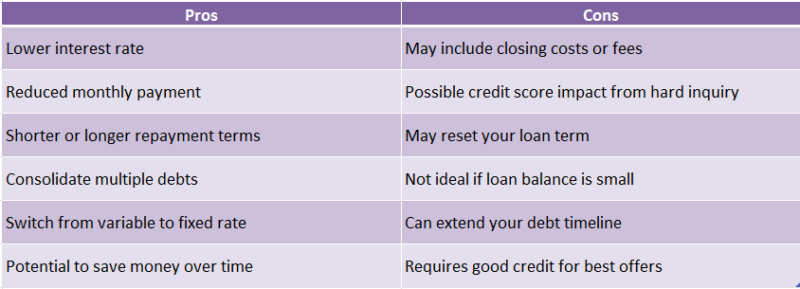

When considering a loan refinance, it’s essential to weigh the Loan Refinance Pros and Cons. This decision can significantly impact your financial future. Refinancing can lower your monthly payments or help you pay off your loan faster. But is it the right choice for you? Let’s explore!

The Benefits of Refinancing

- Lower Interest Rates: If rates have dropped since you took out your loan, refinancing can save you money.

- Reduced Monthly Payments: A lower interest rate means smaller payments, freeing up cash for other expenses.

- Debt Consolidation: You can combine multiple loans into one, making it easier to manage your finances.

The Drawbacks of Refinancing

- Closing Costs: Refinancing often comes with fees that can add up.

- Longer Loan Terms: Extending your loan term might lower payments but can increase the total interest paid.

- Potential for Higher Rates: If your credit score has dropped, you might not get the best rates.

In summary, understanding the Loan Refinance Pros and Cons is crucial. By considering your personal loan refinance options, you can make an informed decision that aligns with your financial goals.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

The Major Loan Refinance Pros and Cons Explained

When considering a loan refinance, it’s crucial to weigh the Loan Refinance Pros and Cons. This decision can significantly impact your financial future. Understanding these factors helps you determine if refinancing is the right choice for you, especially when exploring various Personal Loan Refinance Options.

Pros of Loan Refinancing

- Lower Interest Rates: One of the biggest advantages is the potential for lower interest rates, which can save you money over time.

- Reduced Monthly Payments: Refinancing can lead to lower monthly payments, easing your budget.

- Access to Cash: If you have equity in your home, refinancing can provide cash for other needs, like home improvements or debt consolidation.

Cons of Loan Refinancing

- Closing Costs: Refinancing often comes with closing costs, which can add up quickly.

- Longer Loan Terms: You might end up extending your loan term, meaning you could pay more interest in the long run.

- Potential for Higher Rates: If your credit score has dropped, you might not get the best rates, making refinancing less beneficial.

In conclusion, weighing these Loan Refinance Pros and Cons is essential. By understanding both sides, you can make an informed decision that aligns with your financial goals.

Is Loan Refinancing Right for Your Financial Situation?

When considering a loan refinance, it’s essential to weigh the Loan Refinance Pros and Cons. Understanding these factors can help you decide if refinancing is the right move for your financial situation. Refinancing can offer lower interest rates or better terms, but it also comes with potential drawbacks that you should be aware of.

Benefits of Loan Refinancing

- Lower Monthly Payments: Refinancing can reduce your monthly payments, freeing up cash for other expenses.

- Better Interest Rates: If your credit score has improved, you might qualify for a lower rate.

- Debt Consolidation: You can combine multiple loans into one, simplifying your payments.

Drawbacks of Loan Refinancing

- Closing Costs: Refinancing often involves fees that can add up, so it’s crucial to calculate if the savings outweigh these costs.

- Longer Loan Terms: Extending your loan term can mean paying more interest over time, which might not be ideal for everyone.

- Impact on Credit Score: Applying for a new loan can temporarily lower your credit score, which is something to consider before making a decision.

In conclusion, evaluating the Loan Refinance Pros and Cons is vital. If you’re considering Personal Loan Refinance Options, think about your current financial situation and long-term goals. It’s always a good idea to consult with a financial advisor to ensure you’re making the best choice for your future.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

How to Determine If You Should Refinance Your Loan

When considering a loan refinance, it’s essential to weigh the Loan Refinance Pros and Cons: Is It Right for You? Understanding these factors can help you make an informed decision that suits your financial goals. Refinancing can lower your monthly payments or help you pay off your loan faster, but it’s not always the best choice for everyone.

Key Factors to Consider

- Interest Rates: If current rates are lower than your existing loan, refinancing could save you money.

- Loan Terms: Shorter terms can mean higher payments but less interest paid over time.

- Fees and Costs: Always check if the costs of refinancing outweigh the benefits.

Personal Loan Refinance Options

- Fixed-Rate Loans: These provide stability with consistent payments.

- Variable-Rate Loans: These can start lower but may increase over time, affecting your budget.

Ultimately, deciding whether to refinance your loan comes down to your unique situation. Ask yourself: Are you looking for lower payments, or do you want to pay off your debt faster? By evaluating the Loan Refinance Pros and Cons, you can choose the path that aligns with your financial future.

Also Read: Personal Loan Refinance Options: Best Ways to Lower Your Payments

The Impact of Loan Refinance on Your Credit Score

When considering loan refinance pros and cons, one important factor to think about is how it affects your credit score. Your credit score is like a report card for your financial health, and refinancing can have both positive and negative impacts. Understanding these effects can help you decide if refinancing is the right move for you.

Positive Impacts on Your Credit Score

- Lower Credit Utilization: If you refinance to pay off high-interest debt, your credit utilization ratio may decrease, which can boost your score.

- Diverse Credit Mix: Adding a new loan type can improve your credit mix, another factor that can enhance your score.

Negative Impacts on Your Credit Score

- Hard Inquiries: When you apply for a refinance, lenders will check your credit, which can cause a small, temporary dip in your score.

- Shorter Average Account Age: If you close old accounts after refinancing, it can lower your average account age, negatively impacting your score.

In summary, weighing the loan refinance pros and cons is crucial. While refinancing can improve your credit score by lowering debt and diversifying your credit, it can also lead to temporary dips. Always consider your personal loan refinance options carefully before making a decision.

Exploring Alternatives to Loan Refinancing

When considering a loan refinance, it’s crucial to weigh the Loan Refinance Pros and Cons. This understanding helps you make informed decisions that align with your financial goals. While refinancing may seem like a quick solution, exploring all options is essential before proceeding.

Other Options to Consider

Before refinancing, consider these alternatives:

- Debt Consolidation: Combines multiple debts into one, often with a lower interest rate.

- Personal Loan Refinance Options: May offer better terms without a full refinance.

- Negotiating with Lenders: Talking to your lender can sometimes yield better terms on your current loan.

Weighing the Benefits and Risks

Each option has its pros and cons. Refinancing can lower monthly payments but may extend your loan term, resulting in more interest paid over time. Always consider if this is the best choice for your financial future.

Understanding Your Financial Situation

Examine your financial situation closely. Are you facing high-interest rates, or do you have a stable income to manage your current payments? Knowing your standing can guide your choice between refinancing and other options.

The Importance of Research

Research is vital! Investigate different lenders and their offers. A personal loan refinance might provide better terms than refinancing your existing loan. Compare interest rates, fees, and repayment terms to find the best fit.

Seeking Professional Advice

Don’t hesitate to consult financial experts. They can clarify the Loan Refinance Pros and Cons and provide personalized insights, ensuring you make a well-informed decision.

How ExpressCash Can Help You Navigate Loan Refinance Options

When considering a loan refinance, grasping the Loan Refinance Pros and Cons is essential. It’s not solely about lower rates; it’s about finding what fits your financial situation best. At ExpressCash, we guide you through the myriad of options available, ensuring informed decisions.

Navigating personal loan refinance options can be daunting. Here’s how we assist:

- Expert Guidance: Our team offers insights into the benefits and drawbacks of refinancing.

- Tailored Solutions: We help you find options that align with your financial goals.

- Simplified Process: We break down complex terms into easy-to-understand language.

Understanding the pros and cons of refinancing is crucial. For example, while refinancing can lower monthly payments, it may also extend your loan term. At ExpressCash, we help you weigh these factors to choose the best path for your financial future.

Key Benefits of Refinancing

- Lower Interest Rates: This can lead to reduced monthly payments.

- Access to Cash: You can tap into your home’s equity for other expenses.

- Improved Loan Terms: Switch to a more favorable loan structure.

Potential Drawbacks to Consider

- Closing Costs: Fees can accumulate during refinancing.

- Longer Loan Terms: You might pay more interest over time.

- Credit Impact: Applying for a new loan can temporarily affect your credit score.

At ExpressCash, we believe understanding these factors is vital for making the right choice.

FAQs

-

What are the main advantages of refinancing a loan?

Refinancing can offer lower interest rates, reduced monthly payments, shorter loan terms, or debt consolidation—all of which can improve your financial flexibility. -

Can refinancing save me money in the long run?

Yes, especially if you secure a lower interest rate or shorten your loan term. You’ll pay less in total interest over time. -

What are the downsides of refinancing a loan?

Possible cons include processing fees, prepayment penalties, and resetting the loan term, which could increase the total interest paid if extended. -

Will refinancing affect my credit score?

It may cause a temporary dip due to hard inquiries, but timely payments on the new loan can boost your score over time. -

Is refinancing worth it for small loan balances?

Not always. If your remaining balance is low, the fees and paperwork might outweigh the potential savings from refinancing.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.