The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

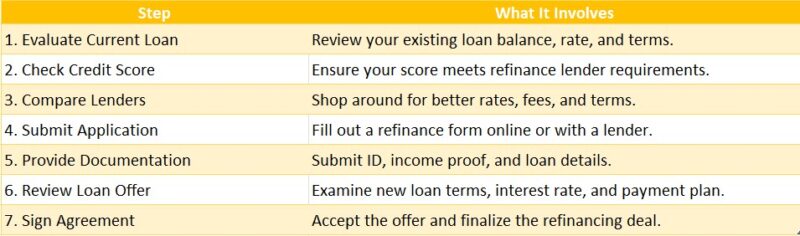

Loan Refinance Application Process: How to Apply Smoothly

Understanding the Loan Refinance Application Process is essential for anyone aiming to reduce monthly payments. Refinancing can help lower your interest rate or modify loan terms, making finances more manageable. Here’s how to apply smoothly!

Step 1: Assess Your Current Loan

Begin by reviewing your existing loan. Know your interest rate, remaining balance, and any early repayment penalties. This information is vital to decide if refinancing is beneficial for you.

Step 2: Explore Personal Loan Refinance Options

Research various lenders and their personal loan refinance options. Compare interest rates, fees, and terms to find the best deal for your situation. Don’t hesitate to ask questions!

Step 3: Gather Necessary Documents

After selecting a lender, collect required documents like proof of income, credit history, and current loan details. Being prepared will streamline the application process.

Step 4: Submit Your Application

Fill out the application honestly and thoroughly. After submission, your lender will review it and may ask for more documents. Keep in touch for updates!

Step 5: Close the Loan

If approved, you’ll receive a closing disclosure. Review it carefully before signing. Once finalized, your new loan will pay off the old one, allowing you to enjoy better terms!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

What Documents Do You Need for a Smooth Refinance Application?

When you’re ready to dive into the Loan Refinance Application Process, having the right documents can make everything smoother. Imagine trying to bake a cake without all the ingredients—frustrating, right? The same goes for refinancing your loan. Being prepared helps you avoid delays and makes the process feel less overwhelming.

What Documents Do You Need?

To ensure a smooth refinance application, gather these essential documents:

- Proof of Income: This can include pay stubs, tax returns, or bank statements. Lenders want to see you can repay the loan!

- Credit Report: Check your credit score beforehand. A good score can lead to better Personal Loan Refinance Options.

- Property Information: Have details about your home, like the address and current mortgage balance. This helps lenders assess your situation.

- Debt Information: List any other debts you have. This gives lenders a complete picture of your financial health.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

How to Choose the Right Lender for Your Loan Refinance

Choosing the right lender is essential in the Loan Refinance Application Process, as it can greatly impact your financial future. With numerous options available, how do you find the best fit? Let’s explore!

Research Your Options

Begin by examining various lenders, including banks, credit unions, and online options. Each may provide different personal loan refinance options. Compare interest rates, fees, and customer reviews to narrow your choices.

Ask the Right Questions

When reaching out to lenders, ask key questions such as:

- What are the interest rates?

- Are there hidden fees?

- What is the approval timeline?

These inquiries will help you understand the lender’s terms and ensure a smoother application process.

Check for Pre-Approval

Consider getting pre-approved to gain a clearer picture of what you can afford. This step also signals to lenders that you’re serious about refinancing!

Evaluate Customer Service

Look for lenders with responsive and helpful customer service. A supportive lender can make your Loan Refinance Application Process much easier.

Read the Fine Print

Always review the terms and conditions carefully to avoid unexpected surprises, including penalties for early loan payoff.

Also Read: Personal Loan Refinance Options: Best Ways to Lower Your Payments

Common Mistakes to Avoid During the Loan Refinance Application Process

When you’re looking to save money on your monthly payments, understanding the Loan Refinance Application Process is crucial. A smooth application can lead to better rates and terms, making your financial life easier. However, many people stumble along the way, which can cost them time and money.

Common Mistakes to Avoid

- Not Checking Your Credit Score: Before applying, check your credit score. A low score can lead to higher interest rates or even denial of your application. Knowing where you stand helps you prepare better.

- Ignoring Personal Loan Refinance Options: Many borrowers overlook various personal loan refinance options. Researching different lenders can help you find the best deal tailored to your needs.

- Skipping Documentation: Failing to gather necessary documents can delay your application. Make sure you have your income statements, tax returns, and any other required paperwork ready to go.

By avoiding these common mistakes, you can navigate the Loan Refinance Application Process more smoothly and achieve the financial relief you seek.

How Long Does the Loan Refinance Application Process Take?

Understanding the Loan Refinance Application Process is crucial for anyone looking to save money on their monthly payments. Knowing how long this process takes can help you plan better and avoid unnecessary stress. So, let’s dive into the timeline of refinancing your loan smoothly!

The Loan Refinance Application Process typically takes anywhere from 30 to 45 days. However, this can vary based on several factors. Here’s what you need to keep in mind:

Key Factors Influencing the Timeline:

- Documentation: Having all your paperwork ready can speed things up. This includes income verification, credit history, and details about your current loan.

- Lender Efficiency: Different lenders work at different paces. Some may process applications faster than others, so do your research!

- Personal Loan Refinance Options: If you choose a straightforward refinance option, it might take less time compared to more complex scenarios.

What Are the Costs Involved in Refinancing Your Loan?

When considering the Loan Refinance Application Process, understanding the costs involved is crucial. Refinancing can save you money, but it’s essential to know what you might pay upfront. Let’s break down these costs so you can apply smoothly and confidently.

Upfront Costs to Consider

- Application Fees: Some lenders charge a fee to process your application. This can vary, so always ask!

- Closing Costs: These can include fees for appraisal, title insurance, and other services. They typically range from 2% to 5% of the loan amount.

- Prepayment Penalties: If you’re refinancing a personal loan, check if your current lender charges a fee for paying off your loan early.

Ongoing Costs

- Interest Rates: A lower rate can save you money, but make sure to compare rates from different lenders.

- Monthly Payments: Consider how your new payment fits into your budget. Refinancing can sometimes lead to lower monthly payments, but not always!

In summary, knowing the costs involved in refinancing your loan helps you navigate the Loan Refinance Application Process. By being informed about personal loan refinance options and their associated costs, you can make a decision that benefits your financial future.

How to Improve Your Chances of Approval for a Refinance

When considering a loan refinance application process, understanding how to improve your chances of approval is crucial. A smooth application can save you time and money, making it easier to secure better terms on your loan. So, let’s dive into some effective strategies!

Know Your Credit Score

Your credit score plays a significant role in the loan refinance application process. Before applying, check your score and ensure it’s in good shape. A higher score can lead to better rates and terms. If it’s low, consider taking steps to improve it first.

Gather Necessary Documents

Having the right paperwork ready can speed up your application. Here’s what you typically need:

- Proof of income

- Current loan details

- Credit history

- Personal identification

Being organized shows lenders you’re serious and prepared, boosting your chances of approval.

Explore Personal Loan Refinance Options

Different lenders offer various personal loan refinance options. Research and compare rates, terms, and fees. This not only helps you find the best deal but also shows lenders you’re informed, which can enhance your credibility during the application process.

How ‘ExpressCash’ Can Simplify Your Loan Refinance Application Process

When it comes to refinancing your loan, understanding the Loan Refinance Application Process is crucial. A smooth application can save you time and money, making it easier to secure better rates. At ‘ExpressCash’, we’re here to help you navigate this journey effortlessly.

Refinancing doesn’t have to be overwhelming. Here’s how we can assist you:

- Personalized Guidance: Our experts will walk you through every step, ensuring you understand your options.

- Easy Application: With our user-friendly platform, you can complete your application in just a few clicks.

- Quick Approvals: We prioritize fast processing, so you won’t be left waiting for answers.

Benefits of Refinancing with ‘ExpressCash’

Choosing us for your personal loan refinance options means you’ll enjoy:

- Lower Interest Rates: We help you find the best rates available.

- Flexible Terms: Tailor your loan to fit your financial needs.

- Expert Support: Our team is always ready to answer your questions, making the process smoother.

Tips for a Stress-Free Loan Refinance Experience

When it comes to refinancing your loan, understanding the Loan Refinance Application Process is crucial. A smooth application can save you time and money, making the whole experience less stressful. So, let’s dive into some tips that will help you navigate this journey with ease.

Gather Your Documents

Start by collecting all necessary documents. This includes your income statements, tax returns, and current loan details. Having everything ready can speed up the process and reduce anxiety.

Compare Personal Loan Refinance Options

Not all lenders are the same! Take time to compare different personal loan refinance options. Look for interest rates, terms, and fees. This way, you can find the best deal that suits your financial needs.

Stay Organized

Keep track of your application progress. Use a checklist to monitor what you’ve submitted and what’s still needed. Staying organized can help you avoid last-minute surprises and keep your mind at ease.

FAQs

-

How do I start the loan refinance application process?

Begin by researching lenders, comparing offers, and checking if you meet the eligibility criteria. Then, fill out the online or in-branch application form. -

What documents are required for refinancing a loan?

You typically need to submit ID proof, income documents, existing loan details, address proof, and sometimes bank statements or credit reports. -

How long does the refinance approval process take?

It can take anywhere from a few hours to a few days, depending on the lender, your credit profile, and how quickly you submit all required documents. -

Will my current lender be notified during the refinance process?

Yes, once your new loan is approved, the new lender will usually pay off your existing loan directly and notify your current lender of the closure. -

Can I apply for loan refinance with multiple lenders at once?

Yes, but keep in mind that each application may involve a hard credit check, which can temporarily affect your credit score.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.