The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

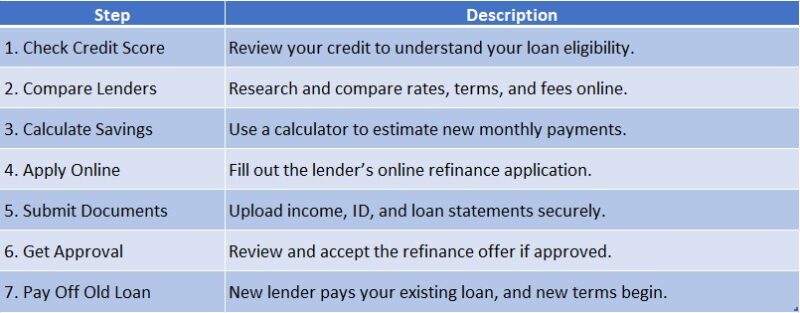

Steps to Refinance a Loan Online: A Simple Guide

Refinancing a loan online can seem daunting, but it’s a smart move for many borrowers. Understanding the basic steps to refinance a loan online. It can help you lower your monthly payments or even secure a better interest rate. So, let’s break it down simply!

What Does It Mean to Refinance a Loan Online?

Refinancing a loan online means replacing your current loan with a new one, often with better terms. This can be done from the comfort of your home, making it convenient and quick. You can explore various personal loan refinance options without stepping out!

Why Refinance?

Here are some reasons why you might consider refinancing your loan:

- Lower Interest Rates: Save money over time.

- Lower Monthly Payments: Make your budget easier to manage.

- Debt Consolidation: Combine multiple loans into one.

- Access Cash: Tap into your home’s equity for other needs.

By understanding these basics, you’re already on your way to mastering the steps to refinance a loan online!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Why Choose Online Refinancing? The Benefits Explained

Refinancing a loan online may seem intimidating, but it can be straightforward! Knowing the Steps to Refinance a Loan Online is essential for anyone wanting to save money or reduce monthly payments. With just a few clicks, you can discover various personal loan refinance options tailored to your needs.

Convenience at Your Fingertips

A major advantage of online refinancing is convenience. You can compare rates and terms from home, free from sales pressure, and at any time—no need to rush to a bank!

Quick and Easy Process

Online refinancing typically offers a faster process. Many lenders provide instant pre-approval, allowing you to view your options quickly, which helps you make informed decisions and saves time and money.

Lower Costs

Refinancing online can save you money as many online lenders have lower overhead costs, leading to better rates than traditional banks. You can find personal loan refinance options that are more affordable.

Access to More Options

Refinancing online gives you access to a broader range of lenders, making it easier to compare offers and find the best deal for your financial situation. Transparency in fees and terms also empowers you to make informed choices.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Steps to Refinance a Loan Online: A Comprehensive Overview

Refinancing a loan online can seem daunting, but it’s a smart way to save money and lower your monthly payments. Understanding the steps to refinance a loan online is essential, especially if you’re looking for better personal loan refinance options. Let’s break it down into simple steps!

Step 1: Assess Your Current Loan

Before diving in, take a good look at your current loan. What’s your interest rate? How much do you owe? Knowing these details helps you understand if refinancing is worth it.

Step 2: Research Lenders

Next, explore different lenders online. Look for those offering competitive rates and favorable terms. Don’t forget to check reviews to ensure they’re trustworthy!

Step 3: Gather Your Documents

You’ll need some paperwork ready, like your income statements and credit score. Having these handy makes the process smoother and faster.

Step 4: Apply Online

Once you’ve chosen a lender, fill out their online application. It’s usually straightforward and can be done in just a few minutes!

Step 5: Review Offers

After applying, you’ll receive offers. Compare them carefully! Look for the best interest rates and terms that fit your financial goals.

Also Read: Personal Loan Refinance Options: Best Ways to Lower Your Payments

How to Prepare for the Online Refinancing Process: Essential Documents Needed

When considering the Steps to Refinance a Loan Online, preparation is key. Having the right documents ready can make the process smoother and faster. This guide will help you gather everything you need to take advantage of personal loan refinance options effectively.

Essential Documents Needed

To start your online refinancing journey, you’ll need a few important documents. Here’s a quick list to help you prepare:

- Identification: A government-issued ID, like a driver’s license or passport.

- Income Verification: Recent pay stubs or tax returns to show your income.

- Loan Information: Details about your current loan, including the balance and interest rate.

- Credit Report: A recent copy to check your credit score and history.

Why These Documents Matter

Having these documents ready not only speeds up the process but also helps lenders assess your application accurately. This way, you can explore the best personal loan refinance options available to you. Remember, being organized is your best friend in this journey!

Comparing Lenders: How to Find the Best Online Loan Refinancing Options

When it comes to refinancing a loan online, finding the right lender can feel overwhelming. However, understanding the steps to refinance a loan online can make this process much easier. By comparing lenders, you can discover the best personal loan refinance options that suit your financial needs.

Start with Research

Begin by researching various lenders. Look for online reviews and ratings to gauge their reputation. This will help you identify trustworthy lenders who offer competitive rates and terms.

Key Factors to Consider

- Interest Rates: Compare the interest rates offered by different lenders. A lower rate can save you money over time.

- Fees: Check for any hidden fees that might increase your overall cost.

- Customer Service: Good customer support can make your refinancing experience smoother.

By following these steps, you can confidently choose the best online loan refinancing options that align with your financial goals.

What to Expect During the Online Application Process: A Step-by-Step Guide

Refinancing a loan online is a smart way to save money, even if it feels overwhelming at first. Knowing the Steps to Refinance a Loan Online can help you navigate the process with ease. This guide outlines what to expect during the online application process, simplifying your search for personal loan refinance options.

Getting Started: Gather Your Information

Start by collecting essential documents such as your income details, credit score, and current loan information. This preparation will streamline your application process.

Step 1: Choose a Lender

Research various lenders to find the best rates and terms. Check online reviews and compare fees to ensure you secure the best deal available.

Step 2: Fill Out the Application

After selecting a lender, complete their online application accurately. Expect to provide details about your income, employment, and the loan you wish to refinance.

Step 3: Review Offers

Once your application is submitted, you’ll receive loan offers. Take your time to evaluate each offer, focusing on interest rates, repayment terms, and any associated fees. This is your chance to select the best personal loan refinance options for your situation.

How to Evaluate Your New Loan Terms: Key Factors to Consider

When you’re considering the Steps to Refinance a Loan Online, it’s crucial to evaluate your new loan terms carefully. This guide will help you understand what to look for, ensuring you make the best decision for your financial future. Refinancing can save you money, but only if you choose the right terms!

Key Factors to Consider

- Interest Rate: Look for a lower interest rate than your current loan. A small difference can lead to significant savings over time.

- Loan Term: Decide if you want a shorter or longer loan term. Shorter terms usually mean higher payments but less interest paid overall.

- Fees and Costs: Be aware of any fees associated with refinancing. These can include application fees, closing costs, and prepayment penalties.

- Monthly Payments: Calculate how much your new monthly payment will be. Make sure it fits comfortably within your budget!

Evaluating these factors will help you choose the best personal loan refinance options available. Remember, refinancing is not just about getting a lower rate; it’s about finding a loan that aligns with your financial goals. Take your time, compare offers, and make an informed decision!

Common Mistakes to Avoid When Refinancing Online: Tips for a Smooth Experience

Refinancing a loan online can save you money and reduce monthly payments, but it’s essential to avoid common mistakes. Understanding these pitfalls will help you navigate the Steps to Refinance a Loan Online confidently. Here are some tips to keep in mind!

Not Researching Enough Options

A major mistake is failing to explore all your personal loan refinance options. Different lenders provide various rates and terms, so take the time to compare offers to find the best fit for your needs.

Ignoring Your Credit Score

Your credit score significantly impacts refinancing. A low score may prevent you from securing better rates. Check your score before applying and consider improving it if needed.

Skipping the Fine Print

Always read the terms and conditions carefully. Hidden fees can arise unexpectedly! Understanding the fine print helps you avoid surprises later on.

Not Asking Questions

If anything is unclear, don’t hesitate to ask your lender. They are there to assist you. Clear communication can prevent misunderstandings and ensure a smoother refinancing experience.

How ExpressCash Can Simplify Your Loan Refinancing Journey

Refinancing a loan may seem overwhelming, but it can be a straightforward process with the right guidance. Understanding the steps to refinance a loan online is essential for those looking to save money or reduce monthly payments. At ExpressCash, we simplify the personal loan refinance options into manageable steps. Here’s how we assist you:

- Easy Comparison: Our tools allow you to compare various lenders and their rates, helping you find the best deal.

- Guided Process: We provide a step-by-step guide to ensure you don’t overlook any important details during refinancing.

- Expert Advice: Our knowledgeable team is available to answer your questions and clarify your options, making the process less intimidating.

Before starting, research your current loan terms, including your interest rate and balance. This knowledge will empower you to make informed choices. Additionally, gather necessary documents such as income proof, credit score, and loan details to streamline your application. Finally, utilize our online calculators at ExpressCash to estimate potential savings, giving you a clearer understanding of what refinancing could mean for your finances.

FAQs

-

What’s the first step to refinance a loan online?

Start by checking your current loan details—interest rate, remaining balance, and repayment terms—so you know what to compare. -

How do I compare refinancing options online?

Use loan comparison websites or visit individual lender sites to compare interest rates, fees, loan terms, and eligibility requirements. -

What documents are needed for online loan refinancing?

You’ll typically need to upload ID proof, income proof (like pay stubs or tax returns), bank statements, and details of your existing loan. -

How long does online loan refinancing take?

The online process is usually fast—many lenders offer same-day or 1–3 business day approvals, depending on how quickly you submit documents. -

Is it safe to refinance a loan online?

Yes, as long as you use trusted lenders or platforms with secure websites (https://) and read terms carefully to avoid scams or hidden fees.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.