The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Loan Refinance for Lower Interest Rates: How to Get the Best Deal

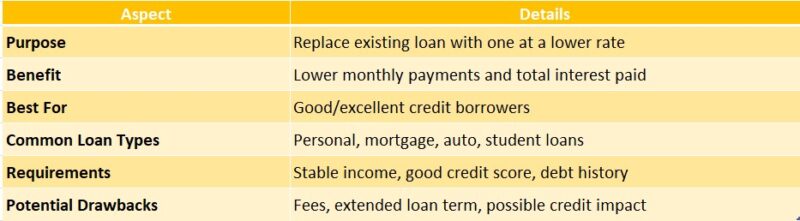

When it comes to managing your finances, understanding Loan Refinance for Lower Interest Rates can make a big difference. Refinancing your loan means replacing your current loan with a new one, ideally at a lower interest rate. This can save you money over time, making it an important topic to explore.

Why Refinance?

Refinancing can help you:

- Lower your monthly payments

- Reduce the total interest paid

- Access cash for other needs

By choosing the right Personal Loan Refinance Options, you can take control of your financial future and make your money work harder for you.

Steps to Get the Best Deal

To find the best refinancing deal, consider these steps:

- Check Your Credit Score: A higher score can lead to better rates.

- Shop Around: Compare offers from different lenders.

- Understand Fees: Look for hidden costs that could affect your savings.

By following these steps, you can navigate the refinancing process with confidence and find a deal that suits your needs.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Is Loan Refinancing Right for You? Key Considerations

When considering a loan refinance for lower interest rates, it’s essential to understand if it’s the right move for you. Refinancing can save you money, but it also requires careful thought. You want to ensure that the benefits outweigh any potential costs. Let’s explore some key considerations to help you make an informed decision.

Understand Your Current Loan Situation

Before jumping into refinancing, take a close look at your current loan. Ask yourself:

- What is my current interest rate?

- How much do I owe?

- How long do I have left on my loan?

Understanding these factors will help you determine if refinancing is a smart choice for your financial situation.

Evaluate Personal Loan Refinance Options

Next, explore your personal loan refinance options. Different lenders offer various rates and terms. Compare these to find the best deal. Remember, a lower interest rate can lead to significant savings over time. Don’t forget to check for any fees associated with refinancing, as they can impact your overall savings.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

How to Evaluate Your Current Loan for Refinancing Opportunities

Evaluating your current loan is crucial when considering a loan refinance for lower interest rates. This can lead to savings and more manageable monthly payments. Start by understanding your loan’s terms to find the best deal.

Check Your Current Interest Rate

Compare your current interest rate with market rates. If yours is significantly higher, it may be time to explore personal loan refinance options. Lower rates can save you money, so investigate your options!

Assess Your Credit Score

Your credit score is vital for refinancing. A higher score can secure better interest rates. Check your score and work on improving it if necessary, such as paying off debts or fixing errors on your report.

Calculate Your Break-Even Point

Lastly, determine how long it will take to recover refinancing costs, known as the break-even point. If you plan to stay in your home longer than this period, refinancing could be a wise financial decision.

Also Read: Personal Loan Refinance Options: Best Ways to Lower Your Payments

The Step-by-Step Process of Loan Refinance for Lower Interest Rates

Refinancing your loan for lower interest rates can significantly save you money each month, allowing you to allocate funds to other important expenses. To navigate the loan refinance process effectively, follow these steps:

Step 1: Assess Your Current Loan

Start by reviewing your current loan. Check the interest rate, remaining balance, and any associated fees. If your rate is higher than the market average, refinancing may be a smart move!

Step 2: Shop Around for Lenders

Don’t accept the first offer you encounter. Research various lenders and compare their rates, focusing on those that specialize in loan refinance for lower interest rates. Multiple quotes can lead to better deals, as even a small rate difference can lead to significant savings over time.

Step 3: Gather Your Documents

After identifying potential lenders, collect the necessary documents, such as proof of income, credit score, and current loan details. Being organized will expedite the process and help lenders assess your application more efficiently.

Comparing Lenders: Finding the Best Deal for Your Refinance

When it comes to saving money, finding the best deal on a loan refinance for lower interest rates can make a big difference. Lower rates mean lower monthly payments, which can free up cash for other important expenses. But how do you find the right lender? Let’s dive into some strategies to help you compare lenders effectively.

Start with Research

Begin by gathering information on various lenders. Look for banks, credit unions, and online lenders. Each may offer different personal loan refinance options, so it’s essential to compare their rates and terms. Don’t forget to check reviews and ratings to gauge customer satisfaction.

Key Factors to Compare

- Interest Rates: Look for the lowest rates available.

- Fees: Be aware of any hidden fees that could affect your savings.

- Loan Terms: Consider the length of the loan and how it impacts your payments.

- Customer Service: A responsive lender can make the process smoother.

By carefully comparing these factors, you can find the best deal for your refinance and save money in the long run.

What Factors Influence Your New Interest Rate?

When considering a loan refinance for lower interest rates, understanding what influences your new rate is crucial. A lower interest rate can save you money over time, making it an attractive option for many borrowers. But how do lenders determine what rate to offer you?

Your Credit Score Matters

Your credit score is one of the most significant factors in determining your interest rate. A higher score usually means a lower rate. Lenders see you as less risky, which can lead to better personal loan refinance options. Keep your credit in good shape by paying bills on time and reducing debt.

Loan-to-Value Ratio

Another key factor is your loan-to-value (LTV) ratio. This ratio compares your loan amount to the value of your home. A lower LTV ratio often results in a better interest rate. If your home has increased in value, refinancing could be a smart move to take advantage of lower rates.

The Role of Credit Scores in Loan Refinance for Lower Interest Rates

When refinancing for lower interest rates, your credit score is vital. A higher score can lead to better rates, ultimately saving you money. Understanding its impact on your refinancing options is key to securing the best deal.

Why Credit Scores Matter

Your credit score acts as a report card for your financial habits. Lenders evaluate your risk based on this score. Generally, a score above 700 is good, while lower scores may limit your personal loan refinance options. Here’s why it’s important:

- Lower Interest Rates: Higher scores often result in lower rates.

- More Options: A good score increases your lender choices.

Steps to Improve Your Credit Score

If your score needs improvement, here are some easy steps to take before refinancing:

- Pay Bills on Time: Late payments negatively affect your score.

- Reduce Debt: Lowering credit card balances can improve your score.

- Check Your Report: Identify and dispute any errors.

By following these steps, you can boost your chances of obtaining a favorable loan refinance for lower interest rates.

Hidden Costs of Refinancing: What to Watch Out For

When considering a loan refinance for lower interest rates, it’s crucial to understand the hidden costs that can sneak up on you. While the idea of saving money sounds great, these extra fees can sometimes outweigh the benefits. Let’s dive into what to watch out for!

Common Hidden Costs to Consider

- Application Fees: Some lenders charge fees just to process your application. Always ask upfront!

- Closing Costs: These can include appraisal fees, title insurance, and more. They can add up quickly, so be prepared.

- Prepayment Penalties: If you’re refinancing an existing loan, check if there are penalties for paying it off early. This could impact your savings!

Tips for a Smooth Refinance

- Shop Around: Compare personal loan refinance options from different lenders. You might find better deals!

- Read the Fine Print: Always review the loan terms carefully. Understanding all costs can help you avoid surprises later.

How ExpressCash Can Help You Secure the Best Refinance Deal

When it comes to managing your finances, finding ways to save money is crucial. One effective strategy is pursuing a Loan Refinance for Lower Interest Rates. This can help you reduce monthly payments and save on interest over time. But how do you secure the best deal? That’s where ExpressCash comes in!

How ExpressCash Can Help You

At ExpressCash, we understand that navigating the world of refinancing can be overwhelming. Our team is dedicated to simplifying the process for you. Here’s how we can assist:

- Expert Guidance: We provide personalized advice tailored to your financial situation.

- Comparative Analysis: Our tools allow you to compare various personal loan refinance options quickly.

- Negotiation Support: We help you negotiate terms that work best for you, ensuring you get the lowest rates possible.

With our resources and expertise, you can confidently approach refinancing. Let us help you unlock the potential savings that come with a lower interest rate, making your financial goals more achievable!

Success Stories: Real-Life Examples of Benefiting from Loan Refinance

When it comes to managing finances, many people overlook the power of loan refinancing. Loan refinance for lower interest rates can be a game-changer, allowing borrowers to save money and reduce monthly payments. Let’s explore some real-life success stories that highlight how refinancing can lead to better financial health.

Sarah’s Journey to Savings

Sarah, a single mom, was struggling with high-interest rates on her personal loan. After researching personal loan refinance options, she found a lender offering a significantly lower rate. By refinancing, she reduced her monthly payment by $150, which she now uses for her children’s education. This simple step transformed her financial situation!

Mark’s Smart Move

Mark, a recent college graduate, had a hefty student loan with a high interest rate. He decided to explore loan refinance for lower interest rates. After comparing several offers, he locked in a lower rate that saved him over $200 a month. This extra cash allowed him to start saving for his first home sooner than he expected.

FAQs

-

How does refinancing help get a lower interest rate?

Refinancing allows you to replace your current loan with a new one that offers a reduced interest rate, lowering your monthly payments and total interest cost. -

When should I refinance to get a lower interest rate?

You should consider refinancing if:-

Interest rates have dropped since you took your original loan.

-

Your credit score has improved, making you eligible for better rates.

-

-

Does refinancing always reduce interest costs?

Not always. It depends on the new rate, loan term, and any fees involved. Use a loan calculator to check if you’ll actually save money. -

What types of loans can be refinanced for lower interest?

Most personal, auto, and even some education loans can be refinanced to get a lower interest rate, depending on lender policies. -

Are there risks to refinancing for a lower rate?

Possible risks include fees, longer repayment terms (leading to more total interest), or losing existing loan benefits. Always compare the full cost before refinancing.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.