The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Personal Loan Refinance Explained: A Complete Guide

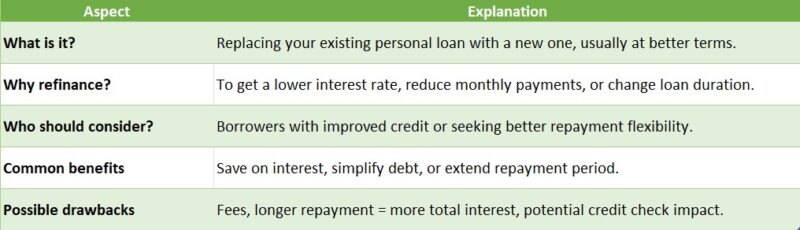

Understanding Personal Loan Refinance Explained: How It Works & When to Apply is crucial for anyone looking to manage their finances better. Refinancing a personal loan can save you money and reduce your monthly payments, making it an appealing option for many borrowers.

What is Personal Loan Refinance?

Personal loan refinance explained simply means taking out a new loan to pay off an existing one. This new loan often comes with better terms, such as a lower interest rate or a longer repayment period. It’s like trading in your old car for a newer model that fits your needs better!

When Should You Consider Refinancing?

Here are some key reasons to explore personal loan refinance options:

- Lower Interest Rates: If rates have dropped since you took out your loan, refinancing could save you money.

- Improved Credit Score: A better credit score can qualify you for lower rates.

- Change in Financial Situation: If your income has increased, you might want to refinance to pay off your loan faster.

By understanding these factors, you can make an informed decision about when to apply for refinancing.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

When Should You Consider Refinancing Your Personal Loan?

When it comes to managing your finances, understanding when to refinance your personal loan can make a big difference. Personal Loan Refinance Explained: How It Works & When to Apply is crucial for anyone looking to save money or improve their financial situation. Refinancing can lower your interest rate, reduce monthly payments, or even help you pay off your loan faster.

There are several situations where refinancing might be a smart move:

- Lower Interest Rates: If interest rates have dropped since you took out your loan, refinancing could save you money.

- Improved Credit Score: If your credit score has improved, you may qualify for better rates.

- Change in Financial Situation: If you have a new job or increased income, refinancing can help you manage payments more comfortably.

- Debt Consolidation: If you have multiple loans, refinancing can simplify your payments by combining them into one loan with a lower rate.

The Benefits of Personal Loan Refinance: Is It Worth It?

When considering a personal loan refinance, it’s essential to understand its benefits. Personal Loan Refinance Explained: How It Works & When to Apply can help you save money and simplify your finances. But is it really worth it? Let’s dive into the advantages of refinancing your personal loan.

Refinancing can lead to lower interest rates, which means you’ll pay less over time. Here are some key benefits:

- Lower Monthly Payments: A reduced interest rate can lower your monthly payments, freeing up cash for other expenses.

- Consolidation of Debt: If you have multiple loans, refinancing can combine them into one, making it easier to manage.

- Improved Credit Score: By paying off existing loans, you may improve your credit score, which can help you secure better rates in the future.

In conclusion, exploring Personal Loan Refinance Options could be a smart financial move. It’s worth considering if you want to save money and simplify your payments.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

How Does Personal Loan Refinance Work? A Step-by-Step Guide

Understanding how personal loan refinance works is essential for managing debt effectively. Personal Loan Refinance Explained: How It Works & When to Apply can help you save money and streamline your finances. Here’s a simple guide to the refinancing process.

Step 1: Assess Your Current Loan

Begin by reviewing your current loan details, including the interest rate, monthly payments, and remaining balance. This assessment will help you determine if refinancing is beneficial for you.

Step 2: Explore Personal Loan Refinance Options

Research various lenders and their refinancing offers. Compare interest rates, terms, and fees to find the best deal that suits your financial situation.

Step 3: Apply for the New Loan

Once you identify a suitable option, gather necessary documents like proof of income and credit history. The lender will evaluate your application to see if you qualify for the new loan.

Step 4: Pay Off Your Old Loan

If approved, the new lender will pay off your old loan directly. You will then start making payments on the new loan, ideally at a lower interest rate, leading to potential savings over time!

Also Read: Personal Loan Refinance Options: Best Ways to Lower Your Payments

What Are the Costs Associated with Refinancing a Personal Loan?

When considering a personal loan refinance, understanding the costs involved is crucial. Personal Loan Refinance Explained: How It Works & When to Apply can help you make informed decisions. Refinancing can save you money, but it’s essential to know what you might pay upfront.

Key Costs to Consider

- Origination Fees: Some lenders charge a fee to process your new loan. This can range from 1% to 5% of the loan amount.

- Prepayment Penalties: If your original loan has a prepayment penalty, you might face extra charges for paying it off early.

- Closing Costs: Just like buying a house, refinancing can come with closing costs, which may include appraisal fees and title searches.

Additional Expenses

- Credit Report Fees: Lenders often check your credit score, and some may charge for this service.

- Interest Rates: Keep an eye on the interest rates offered; a lower rate can lead to significant savings over time. Understanding these costs helps you weigh your Personal Loan Refinance Options and decide if refinancing is the right move for you.

Personal Loan Refinance Explained: Common Myths Debunked

Understanding how personal loan refinance works is essential for managing debt effectively. Many misconceptions about refinancing can lead to missed savings opportunities. This section debunks common myths about personal loan refinance options, helping you make informed financial decisions.

Myth 1: Refinancing is Only for Home Loans

Some believe refinancing applies only to mortgages. In reality, you can refinance any personal loan, potentially lowering your interest rate or adjusting payment terms, which can be beneficial for many borrowers.

Myth 2: It Always Hurts Your Credit Score

Another myth is that refinancing will damage your credit score. While applying for a new loan may cause a temporary dip, managing it responsibly can improve your credit over time. Don’t let fear stop you from exploring personal loan refinance options!

Myth 3: You Can’t Refinance if You Have Bad Credit

Many think bad credit disqualifies them from refinancing. However, some lenders specialize in working with individuals with less-than-perfect credit. Exploring these options can lead to better terms and lower payments, making refinancing a worthwhile consideration.

How to Choose the Right Lender for Your Refinance Needs

Choosing the right lender for your personal loan refinance is crucial. It can save you money and make your financial journey smoother. With so many options available, understanding how to navigate this process can feel overwhelming. But don’t worry! Let’s break it down together.

Research Lender Options

Start by exploring various personal loan refinance options. Look for lenders that specialize in refinancing. Check their interest rates, fees, and customer reviews. This will help you find a lender that fits your needs and budget.

Compare Rates and Terms

Once you have a list of potential lenders, compare their rates and terms. Some may offer lower interest rates but have higher fees. Others might have flexible repayment terms. Make sure to read the fine print to avoid surprises later!

Check for Prequalification

Many lenders offer prequalification without affecting your credit score. This step allows you to see potential rates and terms. It’s a great way to narrow down your choices and find the best deal for your personal loan refinance.

Tips for a Successful Personal Loan Refinance Application

When considering a personal loan refinance, understanding the process is crucial. Personal Loan Refinance Explained: How It Works & When to Apply can help you save money and reduce monthly payments. But how do you ensure your application stands out? Here are some tips to guide you through the process.

Gather Your Financial Documents

Before applying, collect all necessary documents. This includes your income statements, credit report, and current loan details. Having everything ready shows lenders you’re organized and serious about refinancing.

Check Your Credit Score

Your credit score plays a big role in your refinancing options. A higher score can lead to better interest rates. If your score isn’t great, consider improving it before applying. This can make a significant difference in your personal loan refinance options.

Compare Lenders

Not all lenders offer the same terms. Take the time to shop around and compare rates. Look for lenders that specialize in personal loans. This way, you can find the best deal that suits your financial needs.

How ExpressCash Can Help You Navigate Personal Loan Refinance Options

Refinancing a personal loan can seem daunting, but understanding the process is essential. Personal Loan Refinance Explained: How It Works & When to Apply can help you save money and lower monthly payments. At ExpressCash, we simplify this journey, making it easier to explore your options.

Personalized Guidance

We offer tailored advice based on your financial situation, guiding you through various Personal Loan Refinance Options to find the best fit.

Key Benefits of Refinancing

- Lower Interest Rates: Save money over time.

- Reduced Monthly Payments: Easier budgeting.

- Debt Consolidation: Combine multiple loans into one.

With our assistance, you can confidently navigate refinancing, making informed decisions aligned with your financial goals.

Easy Comparison Tools

Our user-friendly comparison tools allow you to evaluate different lenders and rates, helping you make the best refinancing choice.

Ongoing Support

Even after refinancing, we provide continuous support, answering questions and helping you manage your new loan effectively to stay on track with your financial goals.

FAQs

-

What is personal loan refinancing?

Personal loan refinancing is the process of taking out a new loan to pay off an existing loan, usually to get a lower interest rate, reduced monthly payments, or better terms. -

What are the benefits of refinancing a personal loan?

Refinancing can help you:-

Lower your interest rate and save money.

-

Reduce your monthly payments by extending the loan term.

-

Pay off your loan faster with a shorter repayment period.

-

-

Can I refinance my personal loan with a different lender?

Yes, you can refinance with either your current lender or a new one that offers better terms. Comparing multiple lenders can help you find the best deal. -

Does refinancing a personal loan affect my credit score?

Initially, refinancing may cause a small drop in your credit score due to a hard inquiry, but timely payments on the new loan can improve your score over time. -

Are there any fees for refinancing a personal loan?

Some lenders charge origination fees, prepayment penalties, or processing fees. Always check the costs to ensure refinancing will save you money overall.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.