The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

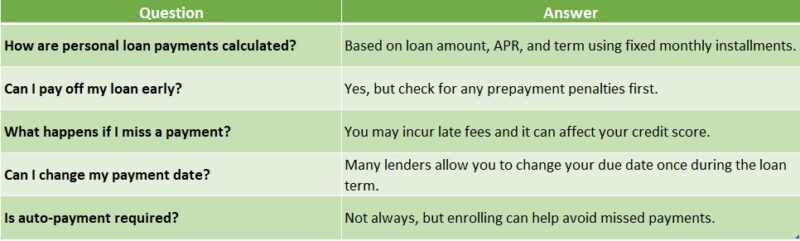

Personal Loan Payment FAQs: Your Key Questions Answered

When it comes to personal loans, understanding the repayment process is crucial. Many borrowers have questions about how payments work, what to expect, and how to manage their loans effectively. This is where Personal Loan Payment FAQs come into play, providing clarity and guidance for those navigating the world of loans.

What is a Personal Loan Repayment Calculator?

A Personal Loan Repayment Calculator is a handy tool that helps you estimate your monthly payments. By entering your loan amount, interest rate, and term, you can see how much you’ll pay each month. This can help you budget better and avoid surprises!

Common Questions About Repayment

- How long do I have to repay my loan? Most personal loans have terms ranging from 1 to 7 years.

- What happens if I miss a payment? Missing a payment can lead to late fees and affect your credit score. Always communicate with your lender if you’re struggling.

- Can I pay off my loan early? Yes! Many lenders allow early repayment, but check for any prepayment penalties.

Understanding these FAQs can empower you to manage your personal loan effectively and make informed decisions.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Are Personal Loan Payments Structured?

Understanding the structure of personal loan payments is essential for anyone considering borrowing money. Personal Loan Payment FAQs can clarify common concerns, making repayment less daunting. Knowing what to expect helps you plan your finances effectively.

Personal loans usually have fixed monthly payments, meaning you pay the same amount until the loan is fully repaid. Here’s a breakdown:

- Principal and Interest: Your payment includes both the borrowed amount (principal) and the cost of borrowing (interest).

- Loan Term: The repayment period affects your monthly payment; shorter terms lead to higher payments, while longer terms lower them.

- Personal Loan Repayment Calculator: This tool estimates your monthly payments based on the loan amount, interest rate, and term, helping you visualize your financial commitment!

Understanding these components allows you to make informed decisions about your personal loan. Being prepared is key to successful repayment!

Monthly Payment Breakdown

Each monthly payment consists of:

- Principal: The original amount borrowed, which reduces your overall debt.

- Interest: The cost of borrowing, calculated based on your loan’s interest rate, which decreases as you pay down the principal.

Fixed vs. Variable Rates

Most personal loans have fixed rates, keeping your payments consistent. Some may have variable rates, which can change over time, affecting your payment amount.

Early Repayment Options

Check if your lender allows early repayment without penalties, as paying off your loan sooner can save on interest!

Conclusion

Knowing how personal loan payments are structured empowers you to manage your finances better. Use a Personal Loan Repayment Calculator to stay on track.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

What Happens If You Miss a Personal Loan Payment?

When it comes to managing personal loans, understanding your repayment options is crucial. That’s why Personal Loan Payment FAQs: Answers to Common Repayment Questions is so important. Knowing what happens if you miss a payment can save you from unnecessary stress and financial trouble.

Missing a personal loan payment can feel overwhelming, but it’s essential to know the consequences. First, your lender may charge a late fee, which can add to your overall debt. Additionally, your credit score might take a hit, affecting your ability to borrow in the future.

What Should You Do If You Miss a Payment?

If you find yourself in this situation, don’t panic! Here are some steps you can take:

- Contact Your Lender: Reach out to discuss your options. They may offer a grace period or alternative payment plans.

- Make the Payment ASAP: If possible, pay the missed amount quickly to minimize damage to your credit score.

- Use a Personal Loan Repayment Calculator: This tool can help you understand how missed payments affect your overall loan balance and future payments.

Also Read: Personal Loan Repayment Calculator: Estimate Your Payments

Can You Pay Off a Personal Loan Early?

Understanding Personal Loan Payment FAQs is crucial for anyone considering a loan. One common question borrowers ask is, “Can you pay off a personal loan early?” This topic is important because it can save you money and help you become debt-free faster. Let’s dive into the details!

Yes, you can pay off a personal loan early! Many people choose to do this to avoid paying extra interest. However, it’s essential to check your loan agreement first. Some lenders charge a fee for early repayment, known as a prepayment penalty.

Benefits of Paying Off Early

- Save on Interest: Paying off your loan early can reduce the total interest you pay.

- Improve Credit Score: A lower debt-to-income ratio can boost your credit score.

- Financial Freedom: Eliminating debt early gives you more financial flexibility.

Using a Personal Loan Repayment Calculator

To see how much you can save, consider using a Personal Loan Repayment Calculator. This tool helps you estimate your remaining balance and potential savings when paying off early. It’s a smart way to plan your finances!

What Are the Consequences of Late Payments on Personal Loans?

Understanding the consequences of late payments on personal loans is crucial for anyone considering borrowing money. Personal Loan Payment FAQs often highlight these issues, as they can significantly impact your financial health. Knowing what happens when you miss a payment can help you make informed decisions and avoid pitfalls.

Impact on Your Credit Score

When you miss a payment, your lender may report it to credit bureaus. This can lower your credit score, making it harder to borrow in the future. A lower score can mean higher interest rates or even denial of loans.

Late Fees and Increased Interest

Most lenders charge late fees if you miss a payment. These fees can add up quickly, increasing the total amount you owe. Additionally, some loans may have a penalty interest rate that kicks in after a late payment, costing you even more.

Potential for Default

If you continue to miss payments, your loan could go into default. This means the lender can take serious actions, like sending your account to collections or even taking legal action. It’s essential to communicate with your lender if you’re struggling to make payments. They may offer solutions to help you avoid these consequences.

How Can ‘ExpressCash’ Help You Manage Your Personal Loan Payments?

Managing personal loans can feel overwhelming, especially when it comes to understanding repayment options. That’s why Personal Loan Payment FAQs: Answers to Common Repayment Questions are so important. They help clarify your doubts and guide you through the repayment process, making it easier to stay on track with your payments.

At ‘ExpressCash’, we offer tools and resources to simplify your loan management. One of our standout features is the Personal Loan Repayment Calculator. This handy tool allows you to estimate your monthly payments based on your loan amount, interest rate, and repayment term. It’s like having a financial advisor right at your fingertips!

Key Benefits of Using Our Resources:

- Clear Understanding: Our FAQs break down complex terms into simple language, making it easier for you to grasp your loan’s details.

- Budgeting Help: The repayment calculator helps you plan your budget by showing how much you’ll need to pay each month.

- Expert Tips: We provide insights on how to manage your payments effectively, ensuring you never miss a due date.

Tips for Staying on Track with Your Personal Loan Repayments

Managing your personal loan repayments can feel overwhelming, but understanding the process is key. That’s why Personal Loan Payment FAQs: Answers to Common Repayment Questions are so important. They help you navigate your repayment journey with confidence, ensuring you stay on track and avoid any surprises.

Create a Budget

Start by making a budget that includes your loan payments. This way, you can see how much money you have left for other expenses. A clear budget helps you prioritize your loan repayment and avoid missing payments.

Use a Personal Loan Repayment Calculator

A Personal Loan Repayment Calculator can be your best friend. It helps you estimate monthly payments based on your loan amount, interest rate, and term. Knowing your payment amount in advance can make planning easier and less stressful.

Set Up Automatic Payments

Consider setting up automatic payments from your bank account. This ensures you never miss a payment, and you can often avoid late fees. Plus, it gives you peace of mind knowing your loan is being taken care of without extra effort.

FAQs

-

How are personal loan payments calculated?

Personal loan payments are typically calculated using the loan amount, interest rate, and repayment term. Most loans follow a fixed monthly installment (EMI) structure. -

Can I pay off my personal loan early?

Yes, most lenders allow early repayment, but some may charge a prepayment penalty. Check with your lender before making extra payments. -

What happens if I miss a personal loan payment?

Missing a payment can result in late fees, interest penalties, and a negative impact on your credit score. Some lenders offer grace periods—check your loan terms. -

Can I change my loan repayment schedule?

Some lenders allow you to adjust due dates or refinance the loan to a more manageable repayment schedule. Contact your lender for options. -

How can I lower my personal loan payments?

-

Refinance to a lower interest rate.

-

Extend the loan term (this reduces monthly payments but increases total interest).

-

Make extra payments to reduce the principal faster.

-

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.