The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Interest Savings Calculator: How Much Can You Save on Loans?

When it comes to loans, understanding how much interest you can save is crucial. That’s where an Interest Savings Calculator comes into play. This handy tool helps you visualize your potential savings, making it easier to plan your finances and make informed decisions about borrowing.

Using an Interest Savings Calculator is simple and effective. You input details like your loan amount, interest rate, and repayment term. Then, the calculator shows you how much interest you could save by making extra payments or choosing a different loan option.

Key Benefits of Using an Interest Savings Calculator

- Visualize Savings: See how small changes can lead to big savings.

- Plan Ahead: Make smarter financial choices by understanding your options.

- Compare Loans: Use it alongside a Personal Loan Repayment Calculator to find the best deal.

By utilizing these tools, you can take control of your loans and save money in the long run!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Does an Interest Savings Calculator Work?

Understanding how much you can save on loans is essential. An Interest Savings Calculator reveals potential savings on interest payments, making it a valuable tool for managing finances. By using this calculator, you can make informed decisions about your loans and repayments.

This calculator takes your loan details—amount borrowed, interest rate, and repayment term—and calculates the total interest you will pay over time. It allows you to see how different factors impact your savings.

Key Features of the Calculator:

- Input Loan Details: Enter your loan amount, interest rate, and term.

- Compare Options: Discover how changing these factors can reduce your interest.

- Visualize Savings: Gain a clear understanding of your potential savings over time.

Using a Personal Loan Repayment Calculator alongside can help you plan monthly payments, making budgeting easier. In summary, an Interest Savings Calculator is a powerful tool that not only enhances your understanding of loans but also helps you save money. Why not give it a try?

The Benefits of Using an Interest Savings Calculator

When it comes to loans, every penny counts. That’s where an Interest Savings Calculator comes into play. This handy tool helps you figure out how much you can save on interest over time, making it easier to manage your finances. By understanding your potential savings, you can make smarter decisions about borrowing money.

Why Use an Interest Savings Calculator?

Using an Interest Savings Calculator is like having a financial superhero by your side. It helps you:

- Visualize Savings: See how different loan amounts and interest rates affect your total payments.

- Compare Options: Easily compare various loan offers to find the best deal.

- Plan Ahead: Understand how extra payments can reduce your overall interest costs.

Personal Loan Repayment Calculator

Another great tool is the Personal Loan Repayment Calculator. This calculator not only shows your monthly payments but also highlights how much interest you’ll pay over the life of the loan. By using both calculators, you can confidently choose the loan that fits your budget and saves you money in the long run.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Can You Really Save Money on Loans with This Tool?

When it comes to loans, every penny counts, and that’s where the Interest Savings Calculator shines. This tool helps you determine how much you can save by adjusting interest rates or repayment terms, acting like a financial advisor in your pocket!

Using an Interest Savings Calculator can uncover valuable insights:

- Compare Loan Options: See how different interest rates impact your total repayment.

- Adjust Repayment Terms: Experiment with loan lengths to find what fits your budget best.

- Visualize Savings: The calculator clearly shows potential savings, making it easy to grasp.

Pairing it with a Personal Loan Repayment Calculator gives you a comprehensive view of your finances, enabling informed decisions that could save you hundreds or even thousands over time! In summary, the Interest Savings Calculator is an essential tool for saving money on loans. By understanding your options and making smart choices, you can take charge of your finances and reach your goals more effectively.

Also Read: Personal Loan Repayment Calculator: Estimate Your Payments

Comparing Loan Options: How the Calculator Helps

When it comes to loans, every penny counts. That’s where the Interest Savings Calculator comes into play. It helps you see how much you can save by comparing different loan options. Understanding your potential savings can make a big difference in your financial journey!

Easy Comparisons

Using an Interest Savings Calculator is like having a financial guide. You can input various loan amounts, interest rates, and terms to see which option is best for you. This way, you can make informed decisions without the confusion!

Key Benefits of Using the Calculator

- Visualize Savings: Instantly see how much you could save with lower interest rates.

- Personal Loan Repayment Calculator: This tool helps you understand monthly payments and total interest paid over time.

- Make Smart Choices: With clear comparisons, you can choose the loan that fits your budget best.

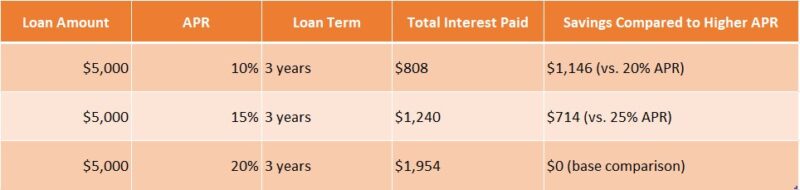

Real-Life Examples of Savings from Using an Interest Savings Calculator

When it comes to loans, every penny counts. That’s where an Interest Savings Calculator comes into play. This handy tool helps you see how much you can save on your loans by adjusting interest rates or repayment terms. Understanding these savings can make a big difference in your financial journey!

Real-Life Examples of Savings

Imagine you have a personal loan of $10,000 with a 10% interest rate. Using an Interest Savings Calculator, you discover that by refinancing to a 7% rate, you could save over $1,500 in interest! That’s money you can use for something fun or important instead of paying the bank.

Key Benefits of Using an Interest Savings Calculator

- Visualize Savings: See how different rates affect your total repayment.

- Make Informed Decisions: Choose the best loan options for your needs.

- Plan for the Future: Understand how much you can save over time with a Personal Loan Repayment Calculator.

Using these tools can empower you to take control of your finances!

Tips for Maximizing Your Savings with an Interest Savings Calculator

Understanding your potential savings on loans is essential for effective financial management. An Interest Savings Calculator is a valuable tool that allows you to visualize savings by comparing various loan options, interest rates, and repayment terms. This helps you make informed decisions that can lead to significant savings over time.

To maximize your savings, consider these tips:

- Compare Different Scenarios: Input various loan amounts and interest rates to see how small changes can lead to big savings.

- Adjust Repayment Terms: Experiment with different repayment periods; sometimes, a slightly higher monthly payment can save you more in interest over the loan’s life.

Also, use a Personal Loan Repayment Calculator to understand how your monthly payments will vary based on loan amount and interest rate. By grasping your repayment options, you can select a plan that fits your budget while maximizing savings. Remember, every little bit counts when saving on loans!

How to Choose the Right Interest Savings Calculator for Your Needs

Choosing the right Interest Savings Calculator is essential for determining how much you can save on loans. With numerous options available, it can be overwhelming. However, the right tool can empower you to make informed financial decisions and save money effectively.

Key Features to Look For

- User-Friendly Interface: Ensure the calculator is easy to navigate, allowing you to focus on calculations rather than figuring out how to use it.

- Customizable Inputs: Opt for a calculator that lets you input various loan amounts, interest rates, and repayment terms for flexible scenario analysis.

- Comparison Options: Some calculators allow side-by-side comparisons of multiple loans, helping you identify the best savings opportunity.

Benefits of Using an Interest Savings Calculator

An Interest Savings Calculator simplifies loan decisions by visualizing potential savings and clarifying how different factors impact payments. Additionally, a Personal Loan Repayment Calculator provides insights into monthly payments and total interest, aiding in effective budget planning.

Exploring Additional Features of Interest Savings Calculators

Managing loans effectively is crucial, and that’s where an Interest Savings Calculator becomes invaluable. This tool allows you to determine potential savings by comparing various interest rates and repayment terms, helping you make informed financial choices.

Benefits of Using an Interest Savings Calculator

- Easy Comparisons: Instantly see how different rates impact your total payment.

- Visual Insights: Many calculators offer graphs to showcase your savings over time.

- Personalized Results: Enter your loan specifics for customized outcomes.

Personal Loan Repayment Calculator

A Personal Loan Repayment Calculator is another useful resource. It estimates monthly payments based on the loan amount, interest rate, and term length, aiding in better budget planning and avoiding unexpected costs! By utilizing these calculators, you can take charge of your financial future. Imagine saving hundreds or even thousands of dollars simply by understanding your loan options more clearly. So, consider trying an Interest Savings Calculator—it could be your first step toward smarter borrowing!

How ExpressCash Can Help You Save More on Loans

Understanding how much you can save on loans is essential, and that’s where an Interest Savings Calculator comes in. This tool allows you to compare different interest rates and repayment terms, helping you see potential savings that can significantly impact your financial journey!

Discover Your Savings Potential

With our Interest Savings Calculator, simply input your loan details to find out how much interest you could save. It’s like having a financial advisor at your fingertips! Just enter your loan amount, interest rate, and term to see the results.

Benefits of Using Our Tools

- Personal Loan Repayment Calculator: Plan your monthly payments and understand how different rates affect your total cost.

- Easy Comparisons: Compare various loan options quickly to find the best deal.

- Informed Decisions: Make smarter borrowing choices by knowing your potential savings.

These tools empower you to make informed financial decisions that can lead to significant savings!

FAQs

-

What is an interest savings calculator?

An interest savings calculator helps you estimate how much interest you can save by making extra payments, refinancing, or choosing a shorter loan term. -

How does an interest savings calculator work?

It calculates savings by comparing different loan repayment scenarios, factoring in loan amount, interest rate, repayment term, and extra payments. -

Can an interest savings calculator help with refinancing decisions?

Yes, it shows potential interest savings when switching to a lower interest rate, helping you decide if refinancing is beneficial. -

How can I reduce my loan interest payments?

-

Make extra payments toward the principal.

-

Refinance to a lower interest rate.

-

Choose a shorter loan term to pay less interest over time.

-

-

Where can I find a reliable interest savings calculator?

Many banking websites, financial apps, and loan comparison platforms offer free interest savings calculators to help borrowers plan their payments.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.