The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Total Interest Payable Calculator: Know Your Loan Interest Cost

When you’re thinking about taking out a loan, understanding how much you’ll pay in interest is crucial. That’s where the Total Interest Payable Calculator comes in. This handy tool helps you figure out the total interest you’ll owe over the life of your loan, making it easier to plan your finances and avoid surprises.

Using a Personal Loan Repayment Calculator can also be beneficial. It not only shows your monthly payments but also breaks down how much of each payment goes toward interest versus the principal. This way, you can see how your payments affect your loan balance over time.

Why Use the Total Interest Payable Calculator?

- Clarity: It gives you a clear picture of your total loan cost.

- Budgeting: Helps you budget better by knowing your total repayment amount.

- Comparison: Allows you to compare different loan offers easily.

- Informed Decisions: Empowers you to make informed choices about borrowing.

In conclusion, using the Total Interest Payable Calculator is a smart step in managing your loans. It ensures you understand your financial commitments, making your borrowing experience smoother and less stressful.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Does the Total Interest Payable Calculator Work?

Understanding how much interest you’ll pay on a loan is crucial. That’s where the Total Interest Payable Calculator comes in. This handy tool helps you see the total cost of borrowing, making it easier to plan your finances. Knowing your loan interest cost can save you money and stress in the long run!

Using the Total Interest Payable Calculator is simple and straightforward. You just need to input a few details about your loan, such as:

- Loan Amount: The total money you plan to borrow.

- Interest Rate: The percentage charged on your loan.

- Loan Term: How long you will take to repay the loan.

Once you enter this information, the calculator does the math for you! It shows the total interest you will pay over the life of the loan. This way, you can compare different loans easily and choose the best option for your needs. Additionally, you can use a Personal Loan Repayment Calculator to see how your monthly payments will look. This helps you budget better and avoid surprises. With these tools, you’re empowered to make informed decisions about your finances!

Why Knowing Your Loan Interest Cost is Crucial for Financial Planning

Understanding your loan interest cost is essential for effective financial planning. Using a Total Interest Payable Calculator can help you see how much you’ll actually pay over time. This knowledge empowers you to make informed decisions about borrowing and budgeting.

The Big Picture

When you take out a loan, it’s not just about the amount you borrow. The interest adds up! Knowing your total interest cost helps you understand the real price of your loan. It’s like knowing the full cost of a video game before you buy it.

Benefits of Knowing Your Loan Interest Cost

- Better Budgeting: With a Personal Loan Repayment Calculator, you can plan your monthly payments. This helps you avoid surprises later.

- Smart Borrowing: Understanding interest costs allows you to choose loans that fit your financial situation. You can compare different options easily!

Take Control of Your Finances

In the end, knowing your loan interest cost means you’re in charge. You can save money and make better choices. So, don’t skip the Total Interest Payable Calculator—use it to guide your financial journey!

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Key Factors Influencing Total Interest Payable on Loans

Understanding how much interest you’ll pay on a loan is crucial. That’s where the Total Interest Payable Calculator comes in. It helps you see the bigger picture of your loan costs, making it easier to plan your finances. Knowing your total interest can save you money and stress in the long run!

Loan Amount

The more money you borrow, the more interest you’ll pay. A larger loan means higher total interest costs, so it’s important to borrow only what you need. This is where a Personal Loan Repayment Calculator can help you visualize your payments.

Interest Rate

Interest rates can vary widely. A lower rate means you’ll pay less interest overall. Always shop around for the best rates to minimize your total interest payable. Even a small difference can lead to significant savings!

Loan Term

The length of your loan also affects the total interest. Longer terms usually mean lower monthly payments but higher total interest. Balancing your loan term is key to managing costs effectively.

Also Read: Personal Loan Repayment Calculator: Estimate Your Payments

Can the Total Interest Payable Calculator Help You Save Money?

When you’re thinking about taking out a loan, understanding how much interest you’ll pay is crucial. That’s where the Total Interest Payable Calculator comes in. It helps you see the big picture of your loan costs, making it easier to plan your finances and avoid surprises down the road.

Using a Total Interest Payable Calculator can be a game changer. Here’s how it can help you save money:

Key Benefits:

- Clear Understanding: You’ll know exactly how much interest you’ll pay over the life of your loan. This clarity helps you make informed decisions.

- Compare Options: By using a Personal Loan Repayment Calculator alongside it, you can compare different loan offers. This way, you can choose the one with the lowest total interest.

- Budgeting: Knowing your total interest helps you budget better. You can set aside money for repayments without stressing about unexpected costs. In short, the Total Interest Payable Calculator is a handy tool that empowers you to take control of your finances.

By understanding your loan interest costs, you can make smarter choices and potentially save a lot of money!

Real-Life Scenarios: When to Use the Total Interest Payable Calculator

Understanding your loan costs is crucial, especially when it comes to making informed financial decisions. The Total Interest Payable Calculator helps you see the bigger picture of how much interest you’ll pay over the life of your loan. Knowing this can save you money and stress in the long run!

Planning for a Personal Loan

Imagine you’re considering a personal loan for a new car. Using a Personal Loan Repayment Calculator alongside the Total Interest Payable Calculator can help you understand how different loan amounts and interest rates affect your total cost. This way, you can choose the best option for your budget!

Comparing Loan Offers

When you receive multiple loan offers, it can be confusing. By inputting each loan’s details into the Total Interest Payable Calculator, you can easily compare the total interest costs. This makes it simpler to pick the loan that saves you the most money over time!

Budgeting for Future Payments

If you’re planning to take out a loan soon, using the Total Interest Payable Calculator can help you budget effectively. Knowing your total interest helps you set aside the right amount each month, ensuring you’re prepared for your repayments without any surprises.

Exploring the Benefits of Using a Total Interest Payable Calculator on ExpressCash

When it comes to borrowing money, understanding how much you’ll pay in interest is crucial. That’s where the Total Interest Payable Calculator comes in. This handy tool helps you see the full picture of your loan costs, making it easier to plan your finances. Knowing your loan interest cost can save you money and stress in the long run.

Using a Total Interest Payable Calculator can be a game-changer. Here’s why:

Easy Understanding of Costs

- Clarity: It breaks down the total interest you’ll pay over the life of your loan.

- Comparison: You can compare different loan options easily, helping you choose the best one.

Better Financial Planning

- Budgeting: Knowing your total interest helps you budget better.

- Savings: You can identify ways to save on interest, like paying off your loan early.

Using a Personal Loan Repayment Calculator alongside can further enhance your understanding of monthly payments, making your financial journey smoother.

Common Misconceptions About Loan Interest Calculations

When it comes to loans, understanding how much interest you’ll pay is crucial. That’s where the Total Interest Payable Calculator comes in. It helps you see the big picture of your loan costs, making it easier to plan your finances. But there are some common misconceptions about how loan interest calculations work that can lead to confusion.

Misconception 1: All Loans Have the Same Interest Calculation

Many people think that all loans calculate interest in the same way. However, different types of loans, like personal loans or mortgages, can have varying methods. Using a Personal Loan Repayment Calculator can help clarify how much interest you’ll actually pay over time.

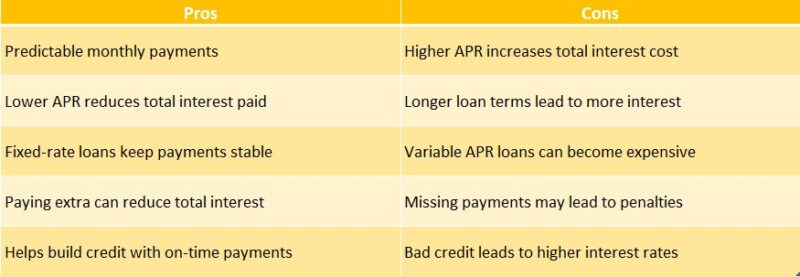

Misconception 2: Lower Interest Rates Always Mean Lower Costs

Another common belief is that a lower interest rate automatically means you’ll pay less in total interest. This isn’t always true! The loan term and amount also play significant roles. Always use the Total Interest Payable Calculator to get a clearer picture of your total costs.

FAQs

-

What is a total interest payable calculator?

A total interest payable calculator helps you estimate the total interest cost over the loan term based on the principal amount, interest rate, and repayment period. -

How does a total interest payable calculator work?

It uses the formula:

Total Interest = (Monthly EMI × Loan Term) – Principal Amount

This shows how much extra you’ll pay beyond the borrowed amount. -

Can I reduce the total interest payable on my loan?

Yes, you can lower interest costs by:-

Making extra payments toward the principal.

-

Choosing a shorter loan term.

-

Refinancing at a lower interest rate.

-

-

Does a higher loan tenure increase total interest payable?

Yes, a longer repayment term means more interest paid over time, even if monthly payments are lower. -

Where can I find a total interest payable calculator?

Many bank websites, financial apps, and loan comparison platforms offer free calculators to estimate interest costs before taking a loan.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.