The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

How to Compare Monthly Loan Payments for Different Lenders?

When you’re looking for a loan, understanding how to compare monthly loan payments for different lenders is crucial. It can save you money and help you choose the best option for your financial situation. With various lenders offering different rates and terms, knowing how to evaluate these payments can make a big difference in your budget.

Use a Personal Loan Repayment Calculator

A personal loan repayment calculator is a handy tool that can simplify your comparison process. By entering the loan amount, interest rate, and term length, you can see how much you’ll pay each month. This way, you can easily compare offers from different lenders side by side.

Key Factors to Consider

- Interest Rates: Lower rates mean lower monthly payments.

- Loan Terms: Shorter terms may have higher payments but less interest overall.

- Fees: Some lenders charge origination fees that can affect your total cost.

By keeping these factors in mind, you can confidently choose the loan that fits your needs best. Remember, a little research goes a long way in making informed financial decisions!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Why Comparing Loan Payments Matters for Your Finances

When it comes to borrowing money, understanding how to compare monthly loan payments is crucial. Different lenders offer various terms, interest rates, and fees that can significantly impact your finances. By comparing these payments, you can find the best deal that fits your budget and financial goals.

The Importance of Comparing Loan Payments

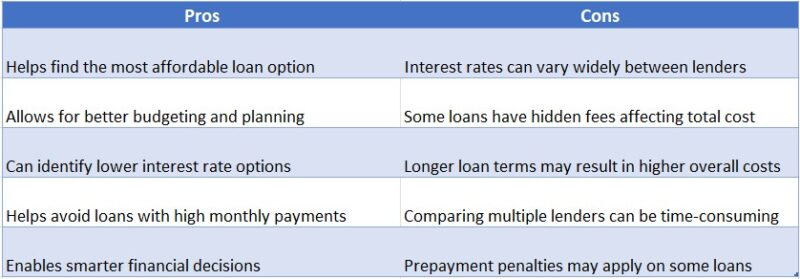

Comparing loan payments helps you avoid overpaying. Here’s why it matters:

- Save Money: A lower monthly payment means more cash in your pocket.

- Better Terms: Different lenders may offer better repayment terms that suit your needs.

- Financial Planning: Knowing your monthly obligations helps you budget effectively.

Tools to Help You

Using a personal loan repayment calculator can simplify this process. With just a few inputs, you can see how different interest rates and loan amounts affect your monthly payments. This way, you can make informed decisions and choose the lender that offers the best deal for your situation.

Key Factors to Consider When Comparing Lenders

When you’re looking for a loan, understanding how to compare monthly loan payments for different lenders is crucial. It can save you money and help you choose the best option for your financial situation. With so many lenders out there, it’s important to know what to look for to make an informed decision.

Interest Rates

One of the first things to check is the interest rate. A lower rate means lower monthly payments. Use a personal loan repayment calculator to see how different rates affect your payments. Even a small difference can add up over time!

Loan Terms

Next, consider the loan terms. This includes the length of the loan and any fees involved. Shorter terms usually mean higher payments but less interest paid overall. Think about what fits your budget best!

Additional Fees

Don’t forget about additional fees! Some lenders charge origination fees or prepayment penalties. These can increase your total cost, so make sure to factor them in when comparing your options.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

How to Compare Monthly Loan Payments: A Step-by-Step Guide

When seeking a loan, comparing monthly payments from various lenders is essential. This process helps you secure the best deal and avoid unexpected costs. Knowing how to compare monthly loan payments can save you both money and stress. Let’s explore some simple steps to streamline this process!

Gather Your Loan Options

Begin by listing potential lenders and checking their interest rates, loan terms, and fees. This information is vital for effectively using a Personal Loan Repayment Calculator.

Use a Personal Loan Repayment Calculator

Enter the loan amount, interest rate, and term into the calculator. It will display the monthly payment for each lender, allowing you to see how varying rates impact your budget. Even minor interest differences can accumulate significantly over time!

Compare and Choose Wisely

After obtaining the monthly payments, compare them side by side. Seek the best mix of low payments and favorable terms. Remember to consider the total loan cost, not just the monthly payment, to make a well-informed decision.

Also Read: Personal Loan Repayment Calculator: Estimate Your Payments

The Role of Interest Rates in Monthly Payments: What to Look For

When borrowing money, knowing how to compare monthly loan payments across different lenders is essential. This understanding can save you money and help you find the best option for your needs. A key factor influencing these payments is the interest rate.

Interest rates significantly impact your monthly payments. Lower rates lead to smaller payments, while higher rates can strain your budget. Here are some important factors to consider:

Key Factors to Consider:

- APR vs. Interest Rate: The Annual Percentage Rate (APR) includes fees, providing a clearer picture of the total cost.

- Loan Term: Shorter terms typically result in higher payments but less interest paid overall.

- Monthly Payment Calculator: Utilize a personal loan repayment calculator to see how varying rates affect your payments, helping you visualize your options better!

By evaluating these aspects, you can make a well-informed decision. Even a small difference in interest rates can lead to significant savings over time. Take your time, do the math, and choose wisely!

How Loan Terms Affect Your Monthly Payments: Short vs. Long

When seeking a loan, knowing how to compare monthly loan payments across different lenders is essential. The terms of your loan can greatly influence your monthly payments, particularly the distinction between short and long loan terms.

Short vs. Long Loan Terms

- Short Loan Terms: These often lead to higher monthly payments but lower overall interest costs, allowing you to pay off the loan faster and save money in the long run.

- Long Loan Terms: These generally result in lower monthly payments, making them easier to manage, but they may incur higher interest costs over time.

Utilizing a Personal Loan Repayment Calculator can clarify how various terms affect your payments. Simply enter the loan amount, interest rate, and term length for a better understanding.

In summary, comparing monthly loan payments involves more than just numbers; it’s about grasping how loan terms influence your financial future. By evaluating the advantages and disadvantages of short versus long terms, you can make a well-informed decision that aligns with your budget.

Using Online Calculators to Simplify Your Comparison

When you’re looking for a loan, comparing monthly payments from different lenders is crucial. Understanding how to compare monthly loan payments can save you money and help you choose the best option for your needs. Thankfully, online tools make this process much easier!

What is a Personal Loan Repayment Calculator?

A personal loan repayment calculator is a handy tool that helps you estimate your monthly payments. By entering the loan amount, interest rate, and term, you can see how much you’ll pay each month. This way, you can easily compare offers from various lenders.

Benefits of Using Online Calculators

- Quick Comparisons: Instantly see how different rates affect your payments.

- User-Friendly: Most calculators are simple to use, even for beginners.

- Informed Decisions: With clear numbers, you can make smarter choices about your loans.

Using these calculators can simplify your decision-making process and ensure you find the best loan for your financial situation.

How to Evaluate Lender Fees and Their Impact on Payments

When borrowing money, knowing how to compare monthly loan payments across different lenders is essential. Each lender has unique fees and interest rates that can significantly impact your monthly payments. Evaluating these factors can save you money and lead to better decisions.

Understand the Fees

- Origination Fees: Some lenders charge a fee for processing your loan, increasing your total loan amount.

- Prepayment Penalties: Paying off your loan early may incur fees from some lenders, affecting your overall savings.

Use a Personal Loan Repayment Calculator

A personal loan repayment calculator is a valuable tool that shows how various fees and interest rates influence your monthly payments. By entering the loan amount, interest rate, and term, you can easily compare lenders and find the best deal. Taking the time to assess lender fees and utilizing a repayment calculator enables informed choices. Remember, even minor differences in fees can lead to significant changes in your monthly payments, making it worthwhile to compare options!

Real-Life Examples: Comparing Monthly Payments Across Lenders

When you’re looking for a loan, understanding how to compare monthly loan payments across different lenders is crucial. It helps you find the best deal that fits your budget. After all, a lower monthly payment can free up cash for other important expenses.

Use a Personal Loan Repayment Calculator

A personal loan repayment calculator is a handy tool. It allows you to input different loan amounts, interest rates, and terms. By doing this, you can see how your monthly payments change with each lender. This way, you can make informed decisions without any guesswork.

Key Factors to Consider

- Interest Rates: A lower rate usually means lower payments.

- Loan Terms: Shorter terms may have higher payments but less interest overall.

- Fees: Some lenders charge fees that can affect your total cost.

By comparing these factors, you can easily see which lender offers the best monthly payment for your needs. Remember, a little research can save you a lot of money!

How ExpressCash Can Help You Find the Best Loan Options

When you’re looking for a loan, understanding how to compare monthly loan payments from different lenders is crucial. It helps you find the best deal that fits your budget. After all, a small difference in interest rates can lead to big changes in what you pay each month!

At ExpressCash, we make it easy to compare monthly loan payments. Our Personal Loan Repayment Calculator allows you to input different loan amounts and interest rates. This way, you can see how much you’ll pay each month for various lenders. It’s like having a financial advisor right at your fingertips!

Key Benefits of Using Our Calculator

- Quick Comparisons: Instantly see how different loans stack up against each other.

- Informed Decisions: Make choices based on clear numbers, not just gut feelings.

- Budget-Friendly: Find a loan that won’t stretch your finances too thin. With these tools, you can confidently choose the loan that’s right for you!

FAQs

-

What factors should I consider when comparing monthly loan payments?

Key factors include loan amount, interest rate, loan tenure, type of interest (fixed or variable), and additional fees like processing charges or late payment penalties. -

How does loan tenure affect monthly payments?

A longer tenure results in lower monthly payments but increases total interest paid, while a shorter tenure increases monthly payments but reduces total interest costs. -

Can I compare different loan offers using an EMI calculator?

Yes, an EMI calculator helps compare different loan options by inputting loan amount, interest rate, and tenure to estimate monthly payments and total repayment costs. -

Do fixed and variable interest rates affect monthly payments differently?

Yes, a fixed interest rate keeps monthly payments constant, while a variable interest rate can fluctuate based on market conditions, leading to potential payment changes. -

How do extra payments or prepayments impact monthly loan payments?

Making extra payments can reduce the principal balance, lowering future interest costs and allowing you to either reduce the loan tenure or lower monthly payments.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.