The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Early Loan Closure Calculation Guide: Is Prepayment Worth It?

Understanding how to close a loan early can save you money and reduce stress. The Early Loan Closure Calculation Guide helps you figure out if prepaying your loan is the right choice. By knowing the benefits and costs, you can make informed decisions about your finances.

Why Consider Early Closure?

- Save on Interest: Paying off your loan early can significantly reduce the interest you pay over time.

- Financial Freedom: Being debt-free sooner can lead to less financial stress and more opportunities for saving or investing.

Using a Personal Loan Repayment Calculator

A Personal Loan Repayment Calculator is a handy tool. It helps you see how much you can save by paying off your loan early. Just input your loan amount, interest rate, and remaining term to get a clear picture of your potential savings.

Key Factors to Consider

- Prepayment Penalties: Some loans charge fees for early repayment. Check your loan agreement.

- Your Financial Goals: Consider if paying off the loan early aligns with your long-term financial plans.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

The Financial Impact of Prepaying Your Loan: Is It Worth It?

When considering a loan, many wonder about the benefits of paying it off early. The Early Loan Closure Calculation Guide helps you understand if prepayment is worth it, potentially saving you money and speeding up your journey to financial freedom. Let’s explore the financial impact of prepaying your loan.

Understanding Prepayment Benefits

Prepaying your loan can lead to significant savings on interest. Key benefits include:

- Reduced Interest Payments: Paying off your loan early means lower overall interest costs.

- Improved Credit Score: A lower debt-to-income ratio can enhance your credit score.

- Financial Freedom: Eliminating debt early allows more freedom to invest or save for future goals.

Using a Personal Loan Repayment Calculator

To see if prepayment is right for you, use a Personal Loan Repayment Calculator. This tool helps you:

- Calculate Total Savings: Determine how much you can save on interest.

- Assess Your Budget: Check if you can afford the prepayment.

- Make Informed Decisions: Weigh the benefits of prepaying against keeping your loan.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Early Loan Closure Calculation Guide: Key Factors to Consider

Deciding whether to pay off a loan early requires a solid understanding of the Early Loan Closure Calculation Guide. While prepayment can save you money on interest, it may not always be the best option. Here are key factors to consider:

Key Factors to Consider

Interest Savings

- Early loan repayment can significantly lower the total interest paid. Utilize a Personal Loan Repayment Calculator to estimate your savings.

Prepayment Penalties

- Some loans impose penalties for early repayment. Always review your loan agreement to identify any potential fees.

Financial Stability

- Ensure that early repayment won’t jeopardize your financial stability. It’s vital to maintain sufficient savings for emergencies after making a large payment.

Opportunity Cost

- Think about alternative uses for that money. Investing it might provide better returns than paying off a low-interest loan. In summary, the Early Loan Closure Calculation Guide helps you evaluate the benefits and drawbacks of prepayment. By assessing interest savings, penalties, financial stability, and opportunity costs, you can make a well-informed decision aligned with your financial goals.

Also Read: Personal Loan Repayment Calculator: Estimate Your Payments

How to Calculate Potential Savings from Early Loan Closure

When considering whether to pay off a loan early, understanding the potential savings is crucial. This is where the Early Loan Closure Calculation Guide comes into play. By calculating how much you can save, you can make an informed decision about prepayment and its benefits.

Use a Personal Loan Repayment Calculator

A Personal Loan Repayment Calculator can help you estimate your savings. Simply input your loan amount, interest rate, and remaining term. The calculator will show you how much interest you’ll save by paying off your loan early.

Key Steps to Calculate Savings

- Identify your loan details: Know your current balance, interest rate, and remaining term.

- Calculate total interest: Use the calculator to find out how much interest you would pay if you continue with regular payments.

- Estimate early payoff savings: Compare the total interest with the amount you’d pay if you close the loan early. This will reveal your potential savings!

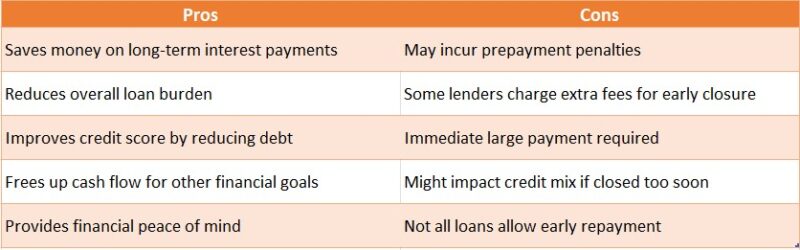

The Pros and Cons of Prepaying Your Loan

When considering whether to pay off your loan early, it’s essential to weigh the pros and cons. This Early Loan Closure Calculation Guide will help you understand if prepayment is worth it. By using a Personal Loan Repayment Calculator, you can see how much you might save in interest and how it impacts your finances.

Pros of Prepaying Your Loan

- Interest Savings: Paying off your loan early can save you a significant amount in interest payments.

- Debt-Free Sooner: You’ll enjoy the freedom of being debt-free, which can reduce stress and improve your financial health.

- Improved Credit Score: Reducing your debt-to-income ratio can positively impact your credit score, making future loans easier to obtain.

Cons of Prepaying Your Loan

- Prepayment Penalties: Some loans have fees for paying off early, which can offset your savings.

- Cash Flow Issues: Using a large sum to pay off your loan might leave you short on cash for emergencies or other expenses.

- Opportunity Cost: The money used for prepayment could potentially earn more if invested elsewhere.

When Is the Right Time to Consider Early Loan Closure?

When it comes to managing your finances, understanding the right time for early loan closure is crucial. This Early Loan Closure Calculation Guide will help you decide if prepayment is worth it. After all, paying off a loan early can save you money, but it’s essential to know when to take that step.

- Interest Rates: If your loan has a high-interest rate, paying it off early can save you a lot in interest payments. Use a Personal Loan Repayment Calculator to see how much you can save!

- Financial Stability: If you have extra cash and a stable income, it might be a good time to consider early closure. This can free you from monthly payments and give you peace of mind.

- Loan Terms: Check if your loan has any prepayment penalties. If there are none, it’s often beneficial to pay it off early. Just make sure it aligns with your financial goals!

Exploring Different Loan Types: Which Ones Benefit Most from Prepayment?

When considering whether to pay off a loan early, understanding the nuances of different loan types is crucial. This is where our Early Loan Closure Calculation Guide comes into play. Knowing which loans benefit most from prepayment can save you money and stress in the long run.

Personal Loans

Personal loans often come with high-interest rates. Using a Personal Loan Repayment Calculator can help you see how much you could save by paying off your loan early. Many lenders allow prepayment without penalties, making this a smart choice for borrowers looking to reduce interest costs.

Mortgages

Mortgages can be tricky. Some have prepayment penalties, while others do not. If your mortgage allows it, paying extra can significantly reduce the total interest paid over time. Always check your loan terms before deciding!

Auto Loans

Auto loans usually have lower interest rates, but prepaying can still be beneficial. If your loan has no penalties, consider making extra payments to shorten the loan term and save on interest.

Real-Life Scenarios: Success Stories of Early Loan Closure

When it comes to loans, many people wonder if paying them off early is a smart move. This is where our Early Loan Closure Calculation Guide comes into play. Understanding the benefits of prepayment can help you save money and achieve financial freedom sooner. Let’s explore some real-life success stories that highlight the advantages of early loan closure.

Success Story 1: Sarah’s Smart Move

Sarah took out a personal loan for $10,000 with a 5-year term. After just two years, she used a Personal Loan Repayment Calculator to see how much she could save by paying off her loan early. By making extra payments, she reduced her interest costs significantly and paid off her loan six months ahead of schedule!

Success Story 2: Mark’s Financial Freedom

Mark had a car loan that seemed never-ending. After learning about early loan closure, he decided to make extra payments. With the help of the Early Loan Closure Calculation Guide, he realized he could save over $1,200 in interest. Mark paid off his loan a year early, giving him more freedom to save for his future.

How ExpressCash Can Help You Navigate Loan Prepayment Options

When considering whether to pay off your loan early, it’s crucial to understand the implications. Our Early Loan Closure Calculation Guide helps you weigh the pros and cons of prepayment. Is it worth it? Let’s explore how you can make informed decisions about your finances.

Understanding Your Options

Navigating loan prepayment can be tricky. With our Personal Loan Repayment Calculator, you can easily see how much you’ll save by paying off your loan early. This tool breaks down the numbers, making it simple to understand your potential savings.

Key Benefits of Prepayment

- Save on Interest: Paying off your loan early can reduce the total interest paid.

- Improve Credit Score: A lower debt-to-income ratio can boost your credit score.

- Financial Freedom: Eliminating debt early gives you peace of mind and more financial flexibility.

By using our resources, you’ll be better equipped to decide if prepayment is the right choice for you.

Final Thoughts: Making an Informed Decision on Early Loan Closure

When considering an early loan closure, it’s essential to weigh the pros and cons. The Early Loan Closure Calculation Guide helps you understand if prepayment is worth it. By crunching the numbers, you can see how much interest you save and if it fits your financial goals.

Key Considerations for Prepayment

- Interest Savings: Paying off your loan early can save you money on interest. Use a Personal Loan Repayment Calculator to see the potential savings.

- Prepayment Penalties: Some loans have fees for paying off early. Check your loan terms to avoid surprises.

- Financial Flexibility: Consider how early closure affects your budget. Will you have enough for emergencies after prepayment?

In conclusion, making an informed decision about early loan closure requires careful thought. Use the Early Loan Closure Calculation Guide and a Personal Loan Repayment Calculator to guide your choices. Remember, it’s not just about saving money; it’s about ensuring your financial future is secure.

FAQs

-

What is early loan closure?

Early loan closure, also known as prepayment or foreclosure, means paying off the remaining loan balance before the scheduled tenure ends, reducing overall interest costs. -

How is the early loan closure amount calculated?

The total amount includes the outstanding principal, accrued interest until the closure date, and any prepayment penalties or charges set by the lender. -

Can I save money by closing my loan early?

Yes, early closure reduces the total interest paid, but some lenders charge a prepayment penalty, which should be compared against the potential savings. -

Are there any penalties for early loan closure?

Some lenders impose prepayment or foreclosure charges, typically 1-5% of the outstanding loan balance, depending on the loan type and lender policies. -

How do I check if early loan closure is beneficial for me?

Use an early loan closure calculator to compare the interest savings vs. prepayment charges, ensuring that closing the loan early provides a net financial benefit.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.