The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Interest Rate Calculator for Loans: Compare Your Borrowing Costs

When it comes to borrowing money, understanding your costs is crucial. An Interest Rate Calculator for Loans can be your best friend in this journey. It helps you compare different loan options, making it easier to choose the right one for your needs. After all, no one wants to pay more than they have to!

Why Use an Interest Rate Calculator?

Using an Interest Rate Calculator for Loans is simple and effective. Here’s why you should consider it:

- Compare Rates: See how different lenders stack up against each other.

- Understand Payments: Get a clear picture of what your monthly payments will look like.

- Plan Ahead: Knowing your costs helps you budget better for the future.

Benefits of a Personal Loan Repayment Calculator

A Personal Loan Repayment Calculator can also be incredibly useful. Here’s what it offers:

- Calculate Total Costs: Find out how much you’ll pay in total over the life of the loan.

- Adjust Terms: Experiment with different loan amounts and interest rates to see how they affect your payments.

- Make Informed Decisions: With all this information, you can choose a loan that fits your financial situation best.

In short, using these calculators can save you money and stress, making your borrowing experience smoother!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

How Does an Interest Rate Calculator Work?

When you’re thinking about taking out a loan, understanding how much you’ll pay in interest is crucial. That’s where an Interest Rate Calculator for Loans comes in handy. It helps you compare your borrowing costs, making it easier to choose the right loan for your needs.

Using an Interest Rate Calculator for Loans is simple and straightforward. You start by entering a few key details:

- Loan Amount: How much money do you need?

- Interest Rate: What rate is the lender offering?

- Loan Term: How long do you plan to take to repay the loan?

Once you input this information, the calculator does the math for you. It shows you your monthly payments and total interest paid over the life of the loan. This is similar to a Personal Loan Repayment Calculator, which focuses specifically on personal loans. By comparing different loans, you can see which one fits your budget best. This way, you can make informed decisions and avoid surprises later on. So, whether you’re buying a car or funding a home renovation, an interest rate calculator is your best friend!

Key Features to Look for in an Interest Rate Calculator

When you’re considering a loan, understanding your borrowing costs is crucial. An Interest Rate Calculator for Loans helps you see how much you’ll pay over time. By comparing different rates, you can make smarter financial decisions and avoid surprises down the road.

When choosing an interest rate calculator, keep an eye out for these important features:

- User-Friendly Interface: A simple design makes it easy to input your loan details.

- Comparison Tools: Look for calculators that let you compare multiple loan options side by side.

- Amortization Schedule: This shows how your payments break down over time, helping you understand your personal loan repayment calculator better.

Benefits of Using an Interest Rate Calculator

Using an interest rate calculator can save you money and time. Here are some benefits:

- Informed Decisions: You can see how different rates affect your total cost.

- Budget Planning: Knowing your monthly payments helps you plan your budget effectively.

- Stress Reduction: Understanding your loan terms can ease your worries about borrowing.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Comparing Borrowing Costs: Why It Matters

Understanding your borrowing costs is essential when taking out a loan. An Interest Rate Calculator for Loans helps you determine how much you’ll pay over time. By comparing various loan options, you can make informed financial decisions that align with your budget.

Why Compare Borrowing Costs?

Comparing borrowing costs is important for several reasons:

- Save Money: Lower interest rates lead to reduced monthly payments, potentially saving you hundreds or thousands over the loan’s life.

- Understand Your Options: A Personal Loan Repayment Calculator shows how different rates impact your total repayment, aiding in wise choices.

- Plan for the Future: Knowing your borrowing costs allows for better budgeting, helping you manage other expenses without unexpected financial stress.

How to Use an Interest Rate Calculator

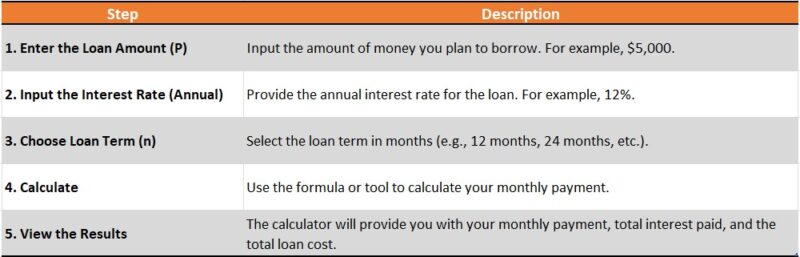

Using an Interest Rate Calculator for Loans is straightforward. Follow these steps:

- Input Your Loan Amount: Enter the amount you wish to borrow.

- Choose Your Interest Rate: Research different lenders for the best rates.

- Select the Loan Term: Decide how long you want to repay the loan; longer terms mean lower payments but higher total interest.

- Calculate: Click calculate to see your monthly payments and total cost, giving you a clear understanding of your financial commitment.

Also Read: Personal Loan Repayment Calculator: Estimate Your Payments

What Types of Loans Can You Analyze with an Interest Rate Calculator?

Understanding your borrowing costs is crucial when taking out a loan. An Interest Rate Calculator for Loans helps you compare different loan options, making it easier to choose the best one for your needs. By analyzing various loans, you can save money and avoid surprises down the road.

Types of Loans You Can Analyze

With an Interest Rate Calculator for Loans, you can explore a variety of loan types, including:

- Personal Loans: Use a Personal Loan Repayment Calculator to see how much you’ll pay each month.

- Auto Loans: Calculate your monthly payments and total interest on a car loan.

- Home Mortgages: Compare different mortgage rates to find the best deal for your dream home.

- Student Loans: Understand your repayment options and total costs for education financing.

Why Use an Interest Rate Calculator?

Using an Interest Rate Calculator for Loans not only simplifies your decision-making but also empowers you with knowledge. You can see how interest rates affect your total repayment, helping you choose wisely. Plus, it’s a great way to budget and plan for your financial future!

How to Use the Loan Interest Rate Calculator

Maximizing Your Savings: Tips for Using an Interest Rate Calculator Effectively

When it comes to borrowing money, understanding your costs is crucial. An Interest Rate Calculator for Loans can be your best friend in this journey. It helps you compare different loan options, ensuring you make informed decisions that can save you money over time.

Tips for Using an Interest Rate Calculator Effectively

- Input Accurate Information: Always enter the correct loan amount, interest rate, and term. This ensures the calculator gives you precise results.

- Explore Different Scenarios: Try varying the interest rates and loan terms. This will help you see how changes affect your monthly payments and total interest paid.

- Use a Personal Loan Repayment Calculator: This tool can help you visualize your repayment plan, making it easier to budget for your monthly expenses.

By taking the time to use these calculators, you can maximize your savings. Remember, every little bit counts when it comes to loans. So, dive in, compare your options, and choose the best path for your financial future!

How ExpressCash Simplifies Your Loan Comparison Process

Understanding your borrowing costs is essential when taking out a loan. An Interest Rate Calculator for Loans simplifies this process by allowing you to compare various loan options quickly. With just a few clicks, you can see how different interest rates impact your overall repayment.

Easy Comparisons

Our Personal Loan Repayment Calculator enables you to input various loan amounts and interest rates effortlessly. This tool reveals your monthly payments, helping you make informed decisions without the hassle of complex calculations.

Key Benefits

- Save Time: Eliminate tedious manual calculations.

- Understand Costs: View total loan costs at a glance.

- Make Informed Choices: Compare multiple loans side by side to find the best fit for your financial needs.

User-Friendly Interface

Designed for ease of use, our Interest Rate Calculator for Loans is intuitive, making it accessible even for those without a finance background.

Real-Time Updates

As you modify loan amounts or interest rates, the Personal Loan Repayment Calculator provides instant updates. This feature helps you see how changes affect your budget, empowering you to negotiate better loan terms confidently.

Common Mistakes to Avoid When Using an Interest Rate Calculator

Using an Interest Rate Calculator for Loans can be a game-changer when you’re planning to borrow money. It helps you compare different loan options and understand your borrowing costs. However, many people make common mistakes that can lead to confusion or poor financial decisions. Let’s explore these pitfalls so you can use the calculator effectively.

Not Considering All Costs

One major mistake is only focusing on the interest rate. Remember, loans often come with additional fees, like origination fees or closing costs. Always look at the total cost of the loan, not just the interest rate. This will give you a clearer picture of what you’ll actually pay.

Ignoring Loan Terms

Another common error is overlooking the loan term. A Personal Loan Repayment Calculator can help you see how different terms affect your monthly payments. Shorter terms usually mean higher payments but less interest paid overall. Make sure to consider what fits your budget best!

Failing to Compare Multiple Options

Lastly, don’t just use one calculator or check one lender. Different lenders offer various rates and terms. Use multiple Interest Rate Calculators for Loans to find the best deal. This way, you can ensure you’re making the most informed choice possible.

FAQs

-

What is an interest rate calculator for loans?

An interest rate calculator helps borrowers estimate their loan payments by calculating the interest amount based on the principal, interest rate, and loan tenure. -

How do I use a loan interest rate calculator?

Enter the loan amount, interest rate (annual or monthly), and repayment period into the calculator to get details on monthly payments (EMI), total interest payable, and total repayment amount. -

Does the interest rate calculator work for all types of loans?

Yes, it can be used for personal loans, auto loans, home loans, payday loans, and business loans, as long as you enter the correct interest type (fixed or variable). -

What is the difference between simple and compound interest in loan calculations?

-

Simple Interest (SI) is calculated only on the principal: SI = (P × R × T) / 100

-

Compound Interest (CI) considers interest on both principal and accumulated interest: CI = P(1 + R/n)^(nT) – P

-

-

Can an interest rate calculator help me compare loan offers?

Yes, by using different interest rates and loan terms, you can compare lenders and find the most affordable option with the lowest total repayment cost.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.