The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

How to Calculate Monthly Payments for a Personal Loan?

Understanding Personal Loans: What You Need to Know

When considering a personal loan, understanding how to calculate monthly payments is crucial. Knowing your monthly payment helps you budget effectively and ensures you can comfortably manage your finances. Let’s break down the basics of calculating those payments so you can make informed decisions.

To calculate your monthly payment, you can use a simple formula:

M = P[r(1 + r)^n] / [(1 + r)^n – 1]

Where:

- M is your monthly payment.

- P is the loan amount.

- r is the monthly interest rate (annual rate divided by 12).

- n is the number of payments (loan term in months).

This formula might look complex, but it’s just a way to ensure you pay off your loan over time without surprises!

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

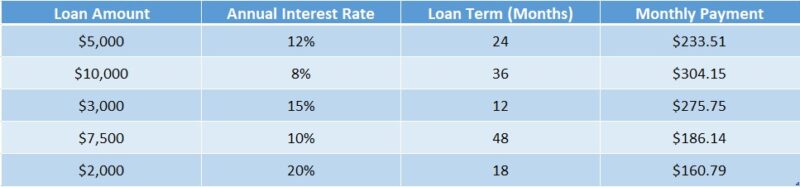

Using a Personal Loan Repayment Calculator

If math isn’t your favorite subject, don’t worry! You can use a Personal Loan Repayment Calculator. Just enter your loan amount, interest rate, and term length, and it will do the hard work for you. This tool is user-friendly and can give you a clear picture of what to expect each month, making budgeting much easier.

How to Calculate Monthly Payments: The Basic Formula

Calculating monthly payments for a personal loan is crucial. It helps you understand how much you’ll owe each month, making budgeting easier. Knowing how to calculate monthly payments can prevent surprises and ensure you choose a loan that fits your financial situation.

To figure out your monthly payment, you can use a simple formula. The formula is:

M = P[r(1 + r)^n] / [(1 + r)^n – 1]

Where:

- M = monthly payment

- P = principal loan amount

- r = monthly interest rate (annual rate divided by 12)

- n = number of payments (loan term in months)

This formula might look complex, but it’s just a way to break down your loan into manageable parts!

Using a Personal Loan Repayment Calculator

If math isn’t your favorite subject, don’t worry! You can use a personal loan repayment calculator. Just enter your loan amount, interest rate, and term. The calculator will do the hard work for you, showing your monthly payments instantly. This makes it super easy to compare different loans and find the best fit for your budget.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Factors That Influence Your Monthly Payment Amount

When you’re thinking about taking out a personal loan, knowing how to calculate monthly payments is super important. It helps you understand what you can afford and how it fits into your budget. Let’s dive into the factors that influence your monthly payment amount!

Interest Rate

The interest rate is one of the biggest factors. A lower rate means lower monthly payments. You can use a Personal Loan Repayment Calculator to see how different rates affect your payment.

Loan Amount

How much money you borrow also plays a role. If you take out a larger loan, your payments will be higher. Think about what you really need to borrow to keep payments manageable.

Loan Term

The length of the loan matters too. A longer term means smaller monthly payments, but you might pay more in interest overall. Finding the right balance is key!

Additional Fees

Don’t forget about fees! Some loans come with origination fees or other costs that can increase your monthly payment. Always read the fine print before signing!

Also Read: Personal Loan Repayment Calculator: Estimate Your Payments

Step-by-Step Guide: How to Calculate Monthly Payments

Calculating monthly payments for a personal loan is essential for effective budgeting. It helps you know how much you owe each month, preventing surprises and ensuring you select a loan that suits your financial needs.

Gather Your Loan Details

Start by collecting key information: the loan amount, interest rate, and loan term. This data is crucial for using a Personal Loan Repayment Calculator effectively.

Use the Formula

The formula for calculating monthly payments is:

M = P[r(1 + r)^n] / [(1 + r)^n – 1]

Where:

- M = monthly payment

- P = principal loan amount

- r = monthly interest rate (annual rate divided by 12)

- n = number of payments (loan term in months)

Plug in Your Numbers

After gathering your numbers, plug them into the formula to find your monthly payment. If math isn’t your strong suit, online calculators can simplify this process. Understanding how to calculate monthly payments empowers you to make informed financial decisions, helping you manage your loan effectively and plan your budget to avoid financial stress.

Using an Online Calculator: Is It Worth It?

When you’re thinking about taking out a personal loan, understanding how to calculate monthly payments is crucial. Knowing your monthly payment helps you budget better and avoid surprises. But how do you figure it out? That’s where an online calculator comes in handy!

Using a Personal Loan Repayment Calculator can simplify the process. Here’s why it’s beneficial:

- Quick and Easy: You just enter the loan amount, interest rate, and term. The calculator does the rest!

- Accurate Results: It provides precise monthly payment amounts, helping you plan your finances effectively.

- Compare Options: You can easily see how different loan amounts or interest rates affect your payments.

This way, you can choose the best option for your needs. In conclusion, using an online calculator is definitely worth it. It saves time and gives you confidence in your financial decisions. So, before you sign on the dotted line, make sure to calculate your monthly payments first!

What Happens If You Miss a Payment?

Understanding how to calculate monthly payments for a personal loan is crucial. It helps you budget effectively and avoid financial pitfalls. But what happens if you miss a payment? Let’s dive into the consequences and how to handle them.

Missing a payment can lead to several issues. First, your lender may charge a late fee, which adds to your overall debt. Additionally, your credit score could take a hit, making future loans more expensive. Here’s what you should know:

- Late Fees: Most lenders impose a fee for missed payments, which can increase your total loan cost.

- Credit Score Impact: A missed payment can lower your credit score, affecting your ability to borrow in the future.

- Loan Default: If payments continue to be missed, your loan may go into default, leading to serious financial consequences.

Tips for Lowering Your Monthly Payments

When you’re thinking about taking out a personal loan, understanding how to calculate monthly payments is crucial. Knowing your monthly payment helps you budget better and avoid surprises. Luckily, there are tools like a Personal Loan Repayment Calculator that can simplify this process for you.

To make your monthly payments more manageable, consider these tips:

- Shop Around for Rates: Different lenders offer different interest rates. Take the time to compare them to find the best deal.

- Choose a Longer Loan Term: While this might mean paying more interest overall, it can lower your monthly payments significantly.

- Make a Larger Down Payment: If possible, putting down more money upfront can reduce the amount you need to borrow, leading to lower monthly payments.

By following these tips, you can make your personal loan more affordable. Remember, using a Personal Loan Repayment Calculator can help you visualize how these changes affect your monthly payments. So, take control of your finances and make informed decisions!

How ExpressCash Can Help You Manage Your Loan

Understanding how to calculate monthly payments for a personal loan is crucial. It helps you budget effectively and ensures you can manage your finances without stress. Knowing your monthly payment can also prevent surprises down the road, making your loan experience smoother.

Use Our Personal Loan Repayment Calculator

Our website offers a user-friendly Personal Loan Repayment Calculator. This tool allows you to input your loan amount, interest rate, and repayment term. In just a few clicks, you’ll see your estimated monthly payments. It’s that simple!

Benefits of Knowing Your Monthly Payments

- Budgeting Made Easy: Knowing your monthly payment helps you plan your expenses.

- Avoiding Over-Borrowing: Understanding your limits prevents you from taking on too much debt.

- Peace of Mind: With clear numbers, you can focus on enjoying life, not worrying about loans.

By using our resources, you can confidently navigate your personal loan journey!

Frequently Asked Questions About Personal Loan Payments

-

What formula is used to calculate monthly loan payments?

The standard formula is:

EMI = [P × R × (1+R)^N] / [(1+R)^N – 1],

where P = loan amount, R = monthly interest rate, and N = number of months. -

Can I calculate my monthly payment without a calculator?

Yes, but manual calculations can be complex. Using an online EMI calculator simplifies the process by instantly providing accurate results. -

How does the loan term affect my monthly payments?

A longer loan term reduces monthly payments but increases total interest paid, while a shorter term results in higher payments but lower total interest costs. -

Do interest rates impact monthly loan payments?

Yes, higher interest rates increase monthly payments, while lower rates make them more affordable. Fixed-rate loans have consistent payments, whereas variable rates can change. -

Are there extra costs included in my monthly loan payment?

Some loans may include processing fees, insurance, or prepayment penalties, so always check the loan terms to understand the total cost of borrowing.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.