The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Loan Payment Breakdown Guide: Understand Your Repayment Costs

What is a Loan Payment Breakdown Guide and Why Do You Need One?

Understanding your loan payments can feel overwhelming, but that’s where a Loan Payment Breakdown Guide comes in handy. This guide helps you see exactly what you’re paying for when you take out a loan. Knowing your repayment costs is crucial because it can save you money and help you plan your budget effectively.

A Loan Payment Breakdown Guide breaks down your loan into easy-to-understand parts. It shows you how much of your payment goes to interest, principal, and other fees. This clarity helps you make informed decisions about your finances. Here’s why it’s essential:

- Clarity: Understand where your money goes each month.

- Budgeting: Plan your finances better with clear repayment costs.

- Comparison: Easily compare different loan options using a Personal Loan Repayment Calculator.

Using a Personal Loan Repayment Calculator alongside the guide can further simplify your understanding. You can input your loan amount, interest rate, and term to see your monthly payments. This tool helps you visualize your financial commitment and can even show you how extra payments can reduce your overall interest costs.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

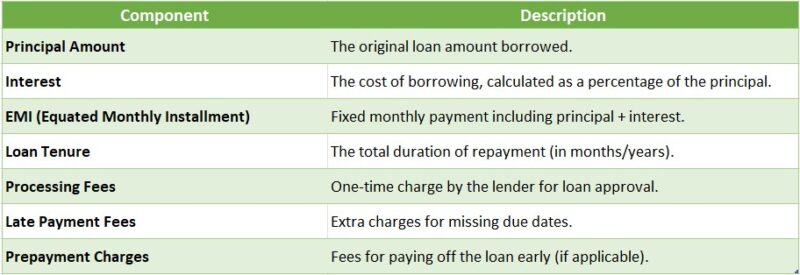

Understanding the Components of Your Loan Payments

Understanding your loan payments is crucial for managing your finances effectively. A Loan Payment Breakdown Guide can help you see where your money goes each month. This knowledge empowers you to make informed decisions and avoid surprises down the road. Let’s dive into the components that make up your loan payments!

When you take out a loan, your monthly payment consists of several key parts. Knowing these can help you use a Personal Loan Repayment Calculator effectively. Here are the main components:

Principal

- This is the original amount you borrowed. Each payment reduces this balance, bringing you closer to being debt-free!

Interest

- This is the cost of borrowing money. It’s calculated as a percentage of the principal. Higher interest means higher payments, so it’s important to shop around for the best rates.

Fees

- Some loans come with additional fees, like origination fees or late payment penalties. Always read the fine print to avoid unexpected costs!

Insurance and Taxes

- Depending on your loan type, you might need to pay for insurance or property taxes as part of your monthly payment. These can add up, so keep them in mind when budgeting.

How Interest Rates Affect Your Loan Repayment Costs

Understanding your loan repayment costs is crucial for making informed financial decisions. In our Loan Payment Breakdown Guide, we’ll explore how interest rates play a significant role in determining what you’ll pay back over time. Knowing this can help you choose the right loan and avoid surprises later on.

Interest rates are like the price tag on your loan. They determine how much extra money you’ll pay back on top of the amount you borrowed. Here’s how they impact your repayments:

Key Points to Consider:

- Higher Interest Rates Mean Higher Payments: If your loan has a high interest rate, your monthly payments will be larger. This can make it harder to manage your budget.

- Lower Interest Rates Save You Money: A lower interest rate means you’ll pay less in total. Using a Personal Loan Repayment Calculator can help you see the difference!

- Fixed vs. Variable Rates: Fixed rates stay the same, while variable rates can change. Knowing which type you have is important for planning your payments.

By understanding how interest rates affect your loan repayment costs, you can make smarter choices. This knowledge can lead to savings and less stress in the long run!

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Fixed vs. Variable Rates: Which is Better for You?

Understanding your loan repayment costs is crucial for making informed financial decisions. In our Loan Payment Breakdown Guide, we explore the differences between fixed and variable rates, helping you choose the best option for your situation. Let’s dive into how these rates can affect your monthly payments and overall financial health.

Fixed Rates: Stability You Can Count On

Fixed-rate loans offer predictable monthly payments. This means your interest rate stays the same throughout the loan term. If you prefer stability and want to avoid surprises, a fixed rate might be the right choice for you. It’s like having a steady anchor in a sometimes turbulent sea of finances.

Variable Rates: Potential for Savings

On the other hand, variable-rate loans can start with lower interest rates. However, they can change over time based on market conditions. This means your payments could go up or down. If you’re comfortable with some risk and believe rates will stay low, a variable rate could save you money in the long run.

Key Considerations:

- Budgeting: Fixed rates help with budgeting since payments remain constant.

- Market Trends: Variable rates can be beneficial if interest rates decrease.

- Personal Loan Repayment Calculator: Use this tool to compare potential costs for both options and see what fits your budget best.

Ultimately, the choice between fixed and variable rates depends on your financial goals and comfort with risk.

Also Read: Personal Loan Repayment Calculator: Estimate Your Payments

The Impact of Loan Term Length on Your Monthly Payments

Understanding your loan repayment costs is essential for making informed financial decisions. Our Loan Payment Breakdown Guide helps you navigate loan complexities, ensuring you know what to expect each month. One significant factor influencing your payments is the loan term length.

When taking out a loan, you choose the repayment duration, known as the loan term. A shorter term means higher monthly payments but less interest paid overall. Conversely, a longer term results in lower monthly payments, but you’ll pay more interest over time.

Key Insights:

- Shorter Terms: Higher payments, less interest.

- Longer Terms: Lower payments, more interest. Using a Personal Loan Repayment Calculator can show how different terms affect your payments.

Adjusting the term length helps you find a balance that fits your budget. It’s not just about what you can afford now, but also the total amount you’ll pay.

Consider Your Financial Goals:

- To save on interest: Choose a shorter term.

- For lower monthly payments: A longer term may be better.

Our Loan Payment Breakdown Guide allows you to visualize how each option impacts your finances, helping you align your choice with your goals. Remember, every loan is unique, so explore your options and use tools like the Personal Loan Repayment Calculator for the best fit.

How to Use Our Loan Payment Breakdown Guide Effectively

Understanding your loan repayment costs is essential for making informed financial decisions. Our Loan Payment Breakdown Guide allows you to see exactly what you owe and when, helping you avoid surprises and manage your budget effectively.

Start with Your Loan Details

Begin by gathering your loan details, including the loan amount, interest rate, and repayment term. This information is crucial for using the Personal Loan Repayment Calculator effectively.

Use the Calculator

Plug your details into the Personal Loan Repayment Calculator. This tool will provide insights into your monthly payments, total interest paid, and the overall cost of the loan, acting like a personal financial advisor.

Review Your Breakdown

After calculating, review the breakdown to see how much of each payment goes toward interest versus the principal. This knowledge can help you strategize on paying off your loan faster or exploring refinancing options.

Set Your Goals

Consider your financial goals: do you want to pay off your loan quickly or keep monthly payments low? Knowing your objectives will enhance your use of the Loan Payment Breakdown Guide.

Adjust Your Payments

If possible, think about making extra payments. The guide can show how small additional payments can significantly reduce your interest costs over time, saving you money in the long run.

Stay Informed

Regularly track your payments and any changes in interest rates. Revisiting the Loan Payment Breakdown Guide can help you stay on top of your finances and adjust your strategy as needed.

How ExpressCash Can Help You Navigate Your Loan Repayment Journey

Understanding your loan repayment costs is essential for maintaining financial health. A Loan Payment Breakdown Guide allows you to see where your money goes each month, empowering you to make informed decisions and stay on track with your payments, avoiding any surprises.

At ExpressCash, we aim to make loan management less overwhelming. Our tools, like the Personal Loan Repayment Calculator, simplify the process. You can easily estimate your monthly payments and total interest, providing a clearer picture of your financial commitments.

Key Benefits of Using Our Tools

- Clarity: Know exactly how much you owe each month.

- Planning: Budget effectively with accurate repayment estimates.

- Confidence: Make informed decisions about your loans and finances.

Navigating your loan repayment journey with ExpressCash is straightforward. Our resources guide you step-by-step, ensuring you feel supported. Managing loans can be tricky, but with our Loan Payment Breakdown Guide, you can break down your payments into manageable parts, seeing how much goes toward interest and how much reduces your principal balance.

Easy Steps to Use Our Personal Loan Repayment Calculator

- Input Your Loan Amount: Enter how much you borrowed.

- Set Your Interest Rate: Add the agreed-upon interest rate.

- Choose Your Term: Select the repayment duration.

- Calculate: Click to see your monthly payment and total cost.

By following these steps, you’ll gain valuable insights into your repayment journey, making it easier to manage your finances.

FAQs

-

What are the main components of a loan payment?

A loan payment typically includes principal (the borrowed amount), interest (the lender’s charge for lending), and sometimes additional fees like processing charges or insurance. -

How does interest affect my loan payment?

Interest is calculated based on the loan balance and rate, with higher interest rates leading to larger payments and a higher total repayment amount over time. -

What is an amortization schedule?

An amortization schedule is a table that shows how each loan payment is divided between principal and interest over time, helping borrowers understand how their debt reduces. -

Can I reduce my loan payment amount?

Yes, you can lower payments by extending the loan term, negotiating a lower interest rate, or making extra payments to reduce the principal faster. -

Are there any hidden costs in loan payments?

Some loans may include hidden costs like origination fees, late payment penalties, prepayment charges, or insurance fees, so it’s important to read the loan agreement carefully.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.