The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

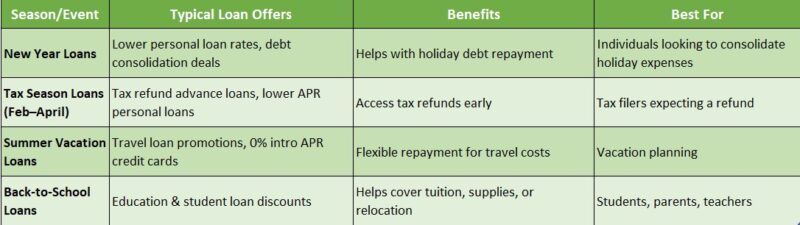

Seasonal Loan Offers and Discounts: When to Apply for the Best Rates

Understanding Seasonal Loan Offers and Discounts

Understanding Seasonal Loan Offers and Discounts can greatly influence your financial choices. Lenders often introduce special promotions at specific times of the year, making it a prime opportunity to secure loans at lower rates. For example, banks may offer enticing rates during the holiday season to boost spending, while spring typically features discounted home improvement loans. Timing your application can lead to substantial savings. When evaluating Bank Loan Rates versus Online Loan Rates, the timing of your application is crucial. Online lenders often present competitive rates during promotional periods. Here are some essential tips to consider:

- Timing is Everything: Apply during seasonal promotions for optimal rates.

- Research is Key: Compare offers from banks and online lenders.

- Read the Fine Print: Be aware of any associated fees.

- Consider Your Needs: Select a loan type that fits your financial objectives.

In summary, leveraging Seasonal Loan Offers and Discounts can result in significant savings. By recognizing the best times to apply and understanding the distinctions between Bank Loan Rates and Online Loan Rates, you can make informed financial decisions. Keep an eye on seasonal promotions and explore various options for the best deal.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Timing is crucial when applying for loans, as it can significantly impact the rates you receive. Seasonal loan offers and discounts are typically linked to specific times of the year, making it vital to know when to apply. For example, many lenders introduce special promotions during spring and fall, aligning with peak home-buying seasons, which can result in lower interest rates and better terms for mortgages and personal loans. Consider these key times for loan applications:

- Spring: The housing market heats up, prompting lenders to offer competitive rates, ideal for home loans.

- Fall: Financial institutions often provide end-of-year promotions, leading to attractive deals on personal loans and auto financing.

- Holiday Season: Some lenders may present special discounts or lower rates during the holidays, making it a good time for personal loans or credit cards.

When comparing bank loan rates to online loan rates, online lenders usually offer more competitive rates due to lower overhead costs. Always shop around and compare offers to secure the best deal. By strategically timing your application, you can leverage seasonal offers and potentially save significantly on your loan.

How Seasonal Discounts Impact Loan Rates

Timing is crucial when securing a loan, as seasonal loan offers and discounts can greatly influence the rates you receive. Many banks and online lenders introduce special promotions during specific times of the year, often aligned with holidays or fiscal quarters. For example, lower interest rates may be available during spring or year-end sales, as lenders aim to enhance their loan portfolios. Recognizing these trends can help you secure a better deal. Key insights into how seasonal discounts affect loan rates include:

- Increased Competition: Lenders may lower rates during peak seasons to attract more borrowers.

- Promotional Offers: Limited-time offers can lead to significant savings.

- Market Trends: Interest rates fluctuate based on economic conditions, so staying informed is essential.

Comparing bank loan rates with online loan rates often reveals more competitive options, especially during promotional periods, as online lenders typically have lower overhead costs.

To maximize seasonal loan offers, consider these steps:

- Research: Monitor market trends and lender promotions.

- Compare Rates: Utilize online tools to compare rates from various lenders.

- Act Quickly: Apply promptly if you find a favorable rate, as these offers can be time-sensitive.

Being proactive and informed allows you to take advantage of seasonal discounts and secure a loan that meets your financial needs.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Identifying the Most Attractive Seasonal Loan Offers

Timing is crucial when securing a loan, as identifying attractive seasonal loan offers can lead to significant savings. Many banks and online lenders introduce special promotions during specific times of the year, often aligned with holidays or fiscal quarters. For example, lower interest rates may be available in spring when lenders aim to enhance their portfolios after winter. This period is ideal for exploring options and comparing rates. To maximize these seasonal offers, consider these tips:

- Research Seasonal Trends: Monitor when lenders typically provide discounts, such as lower rates during back-to-school season for educational loans.

- Compare Bank Loan Rates vs. Online Loan Rates: Online lenders often offer more competitive rates than traditional banks, so it’s wise to shop around.

- Sign Up for Alerts: Subscribe to newsletters from financial institutions to be notified of the best deals.

Real-world examples highlight the importance of timing. A family financing a new car may find better rates during holiday sales events, while those seeking personal loans for home renovations might benefit from spring promotions. By staying proactive and aware of seasonal trends, you can take advantage of the best loan offers.

Read Also: Bank Loan Rates vs. Online Loan Rates: Which Is Cheaper?

Tips for Maximizing Seasonal Loan Discounts

Timing is crucial when securing the best rates on loans, as seasonal loan offers and discounts often arise at specific times of the year. Many banks and online lenders launch enticing promotions during holidays or at the end of the fiscal year. By monitoring these trends, you can benefit from lower interest rates and improved terms. It’s important to note that the difference between bank loan rates and online loan rates can be substantial, so shopping around is essential. To maximize your chances of landing a great deal, consider these tips:

- Research seasonal trends: Identify when lenders typically offer discounts, often during spring or holidays.

- Compare offers: Look beyond the first offer; compare rates from various banks and online lenders.

- Check your credit score: A higher score can lead to better rates, especially during promotions.

- Act quickly: Seasonal offers can be time-sensitive, so have your documents ready to apply promptly.

Real-world examples highlight the importance of timing. A homeowner who applied for a mortgage during a spring sale saved thousands compared to waiting until summer when rates usually rise. Similarly, a personal loan seeker who applied during a holiday promotion secured a rate two percentage points lower than average. By being proactive and informed about seasonal loan offers and discounts, you can significantly improve your financial outcomes.

Comparing Seasonal Loan Offers from Different Lenders

Timing is crucial when securing a loan, as seasonal offers and discounts can greatly influence the rates available to you. Many lenders, including traditional banks and online platforms, introduce special promotions at certain times of the year, such as during holidays or back-to-school seasons. Recognizing these patterns can help you secure a better deal. When comparing seasonal loan offers, consider the following insights:

- Bank Loan Rates: Banks often provide lower rates during their fiscal year-end or when they aim to increase their loan portfolio.

- Online Loan Rates: Online lenders tend to have more flexibility and may offer competitive rates throughout the year, along with seasonal promotions.

- Promotional Offers: Look for limited-time deals that feature reduced interest rates or waived fees, which can significantly lower your loan costs.

To maximize seasonal loan offers, follow these steps:

- Research: Monitor various lenders and their promotional periods.

- Compare: Utilize online tools to assess rates from both banks and online lenders.

- Apply: Act quickly when you find a favorable rate. Being proactive can lead to substantial savings and a more rewarding borrowing experience.

The Role of Credit Scores in Seasonal Loan Applications

Your credit score is vital when applying for seasonal loan offers and discounts. Lenders use this score to assess your creditworthiness, which directly impacts the interest rates you can secure. A high credit score can qualify you for lower rates during promotional periods, making it an excellent time to apply for a loan. In contrast, a lower score may restrict your options, especially as banks and online lenders compete with enticing seasonal rates. To improve your chances of getting the best deal, keep these insights in mind:

- Check Your Credit Score: Know your standing; a score above 700 is favorable.

- Timing is Key: Seasonal offers often coincide with holidays or fiscal year-end, so plan your application wisely.

- Compare Rates: Don’t accept the first offer. Bank loan rates can differ from online loan rates, so explore your options.

For example, during the holiday season, lenders may provide promotional rates significantly lower than their usual offerings. With a strong credit score, you could secure a personal loan at around 5 percent, while those with lower scores might face rates of 15 percent or higher. This highlights the importance of maintaining a healthy credit profile, especially during seasonal promotions.

How to Prepare for Seasonal Loan Promotions

Timing is crucial when securing the best loan rates, and seasonal loan promotions can provide significant discounts. To maximize these opportunities, it’s important to know when to apply and how to prepare. Many banks and online lenders offer special deals during holidays or at the end of the fiscal year, so staying alert during these times can help you find a better deal. To prepare for seasonal promotions, consider these steps:

- Research: Keep an eye on upcoming promotions from banks and online lenders.

- Check Your Credit Score: A higher score can lead to lower rates, so ensure yours is healthy.

- Compare Rates: Look beyond the first offer; compare bank loan rates with online options to find the best fit.

- Gather Documentation: Having your financial documents ready can expedite the application process.

By planning ahead, you can fully leverage seasonal loan offers and discounts. The aim is to secure a loan that meets your needs while fitting your budget. With some research and preparation, you can be ready to take advantage of the best rates when they arise.

Common Mistakes to Avoid with Seasonal Loan Offers

Seasonal loan offers can be enticing for borrowers, but there are common mistakes that can lead to missed opportunities or financial issues. One major error is failing to research the differences between bank loan rates and online loan rates. While banks may present attractive seasonal discounts, online lenders often provide more competitive rates and flexible terms, which can save you money.

Another mistake is applying for a loan without first checking your credit score. A lower credit score can result in higher interest rates, even during promotional periods. Reviewing your credit report and addressing any discrepancies before applying can help you secure the best rate when seasonal offers are available. Timing your application is also essential, as many lenders have specific windows for their promotions, so plan ahead. Finally, don’t ignore the fine print.

Seasonal loan offers may come with conditions that impact your overall cost, including fees and repayment terms that might not be immediately clear. By being diligent and informed, you can maximize the benefits of seasonal loan offers and discounts, ensuring a better borrowing experience.

Future Trends in Seasonal Loan Discounts and Offers

Timing is crucial when it comes to seasonal loan offers and discounts. Lenders, including traditional banks and online platforms, often adjust their rates based on market trends and consumer demand. For example, during the holiday season, you may encounter attractive offers on personal loans or home equity lines of credit, which can significantly reduce your borrowing costs. This makes it an ideal time to apply if you’re planning a major purchase or debt consolidation. Here are some essential tips for navigating seasonal loan offers:

- Research is crucial: Compare bank loan rates with online loan rates, as online lenders typically have lower overhead costs, leading to better rates for borrowers.

- Stay informed: Subscribe to newsletters from your preferred lenders to receive updates on seasonal promotions. Many lenders announce special offers in advance, giving you a head start on applications.

- Plan ahead: If you anticipate needing a loan for a specific purpose, like home renovations in spring, monitor rates in the months leading up to your project to take advantage of seasonal discounts.

By understanding seasonal loan patterns, you can secure the best rates and maximize your borrowing experience.

FAQs

-

What are seasonal loan offers and how do they work?

Seasonal loan offers provide lower interest rates, reduced processing fees, or special benefits during festive periods or promotional events from banks and lenders. -

When is the best time to get a loan with seasonal discounts?

Festive seasons like Diwali, Christmas, New Year, and financial year-end sales often feature the best loan offers with lower rates and special benefits. -

Which types of loans typically have seasonal offers?

Personal loans, home loans, car loans, and business loans frequently come with festive discounts or promotional offers. -

How can I check if a lender is offering seasonal loan discounts?

Visit the lender’s website, check banking apps, or look for announcements on financial comparison sites to find current promotions. -

What should I consider before applying for a seasonal loan offer?

Always check the terms, including interest rates, processing fees, repayment tenure, and any hidden charges, to ensure the deal is truly beneficial.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.