The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

Best Personal Loan Deals by Banks: Compare & Save

Understanding Best Personal Loan Deals by Banks: What to Look For

Finding the best personal loan deals by banks can be simplified with the right insights. Whether you’re planning a major purchase or a vacation, knowing what to look for in a loan can save you time and money.

Interest Rates and Fees

When comparing bank loan rates to online loan rates, consider both interest rates and additional fees. Banks often offer competitive rates, while online lenders might provide more flexible terms. Key factors include:

- Interest Rates: Focus on the Annual Percentage Rate (APR), which includes interest and fees.

- Origination Fees: Some lenders charge a processing fee, impacting the overall cost.

- Prepayment Penalties: Check for charges on early loan repayment.

- Loan Terms and Flexibility: The best deals often come with flexible terms tailored to your financial situation. Consider:

- Loan Duration: Shorter terms mean higher payments but less interest.

- Repayment Options: Some banks offer plans that adjust to your cash flow.

By understanding these elements, you can compare and save on your next personal loan, ensuring the best deal for your financial goals.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

When searching for the best personal loan deals, banks are a popular choice due to their stability and customer service. Notable banks like Chase, Wells Fargo, and Bank of America offer competitive personal loan options tailored to individual needs.

Chase Bank is known for its flexible terms and competitive rates, providing a seamless online application process. Benefits include no origination fees, flexible repayment terms, and a quick approval process, making it convenient for busy individuals.

Wells Fargo offers personalized loan options with excellent customer service. They provide competitive interest rates, often lower than online lenders, no prepayment penalties, and easy online account management, ensuring a perfect fit for various financial situations.

Bank of America caters to those preferring a traditional banking experience with online convenience. They offer loyalty discounts for existing customers, a wide range of loan amounts, and a transparent fee structure.

While bank loan rates are competitive, comparing them with online loan rates is crucial. Online lenders may offer lower rates due to reduced overhead, but banks provide reliable customer service, helping you make an informed financial decision.

How to Compare Personal Loan Offers from Banks

Navigating personal loans can be daunting, but understanding how to compare offers from banks simplifies the process and helps secure the best deal. Start by identifying your financial needs—whether it’s for debt consolidation, home improvement, or unexpected expenses. This clarity helps determine the appropriate loan amount and term.

When comparing offers, focus on interest rates. Bank loan rates differ from online rates; banks may offer stability, while online lenders might have competitive rates. Key factors to consider include:

- Interest Rates: Check the Annual Percentage Rate (APR) for the loan’s true cost.

- Loan Terms: Assess how the loan length affects monthly payments.

- Fees: Be aware of origination, late payment, or prepayment penalties.

Real-world examples highlight the importance of calculating the total cost over the loan term, especially if one bank offers lower rates but higher fees than another. Negotiating with your bank can also yield better rates or fee waivers, especially with a good credit score or long-standing relationship. These steps ensure you find a loan that aligns with your financial goals and offers the best value.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Interest Rates: Key Factor in Best Personal Loan Deals by Banks

Understanding interest rates is essential when seeking the best personal loan deals by banks. These rates dictate the total cost of your loan, making them a critical component of your decision. Banks typically offer competitive fixed rates, ensuring stability and predictability in payments. They may also provide discounts for loyal customers or those with excellent credit scores.

Bank Loan Rates vs. Online Loan Rates

- Banks: Offer fixed rates, providing financial stability.

- Online Lenders: Often have lower rates due to reduced overhead but may include variable rates and higher fees.

Example: Jane needed a $10,000 loan and compared her bank’s 5% fixed rate with an online lender’s 4.5% variable rate. She chose the bank for its rate stability, avoiding potential future increases.

Key Insights:

- Stability vs. Flexibility: Choose between fixed rate stability or potential savings with variable rates.

- Customer Perks: Look for bank loyalty discounts.

- Comprehensive Comparison: Evaluate the APR, which includes all fees, for a complete cost picture.

By comparing bank and online loan rates, you can find a deal that aligns with your financial goals, ensuring long-term savings.

Read Also: Bank Loan Rates vs. Online Loan Rates: Which Is Cheaper?

Hidden Fees in Personal Loan Deals: What Banks May Not Tell You

When exploring the best personal loan deals by banks, it’s essential to look beyond the appealing interest rates, as hidden fees can significantly increase the loan’s total cost. Recognizing these fees helps you make informed choices and genuinely compare and save.

Key Hidden Fees to Consider:

- Origination Fees: A one-time charge for processing the loan, typically 1% to 5% of the loan amount.

- Prepayment Penalties: Fees for paying off your loan early, which can offset interest savings.

- Late Payment Fees: Penalties for missed payments, making it crucial to understand the bank’s late fee policy.

Although bank loan rates might initially appear more attractive than online loan rates, hidden fees can alter the equation. For example, a bank offering a 6% interest rate with a 3% origination fee could end up being more expensive than an online lender with a 7% rate and no extra fees.

To effectively compare and save, examine the fine print of personal loan deals, inquire about all potential fees, and weigh both bank and online loan rates. This approach helps avoid surprises and ensures you secure the best financial deal.

Eligibility Criteria for Bank Personal Loans: What You Need to Know

Understanding the eligibility criteria for personal loans is essential to securing the best deals from banks. Banks prioritize applicants with stable income and employment history, as these factors indicate your ability to repay the loan. For example, having a steady job for over two years can enhance your approval chances.

- Steady Income: Shows your capability to make regular payments.

- Employment Duration: Longer tenure at your current job is favorable.

Your credit score is another crucial element. A higher score often results in lower bank loan rates compared to online loan rates, which might be more lenient but typically come with higher interest.

- Good Credit Score: Above 700 can secure better terms.

- Credit History: Timely payments boost your score.

Additionally, banks evaluate your debt-to-income (DTI) ratio, which should ideally be below 36%. A lower DTI ratio suggests a healthy balance between debt and income, reducing your risk as a borrower.

By understanding these factors, you can enhance your application and secure the best personal loan deals by banks, often more competitive than online options.

How to Save Money with the Best Personal Loan Deals

Finding the best personal loan deals by banks can simplify your financial journey, whether you’re consolidating debt or making a major purchase. Understanding how to compare and save is crucial. Begin by distinguishing between bank loan rates and online loan rates. Banks may offer competitive rates, especially if you have a good relationship with them, while online lenders often provide more flexible terms and faster approvals.

To secure the best deal, follow these steps:

- Research and Compare: Compare interest rates and terms from various banks and online lenders. Use websites that aggregate loan offers for easier comparison.

- Check Your Credit Score: A higher credit score can lead to better rates. Ensure your credit report is accurate and consider improving your score before applying.

- Evaluate Fees and Penalties: Look beyond interest rates to consider origination fees, prepayment penalties, and other charges that affect the loan’s total cost.

By thoroughly researching and understanding your financial needs, you can find a loan that fits your budget and helps achieve your financial goals.

Personal Loan Terms Explained: What Banks Offer

Understanding personal loan terms from banks can significantly impact your financial decisions. Banks offer various options tailored to different needs, and comparing these with online lenders is crucial.

Interest Rates and Fees

Banks often provide competitive interest rates, especially for those with good credit scores. However, online lenders might offer lower rates due to fewer overheads. Consider the following:

- Fixed vs. Variable Rates: Fixed rates offer payment stability, while variable rates may start lower but can increase.

- Origination Fees: Banks may charge processing fees ranging from 1% to 5% of the loan amount, affecting the total cost.

- Repayment Terms: Banks typically offer repayment terms from one to seven years, influencing your monthly payments and total interest. Choose between:

- Short-Term Loans: Higher monthly payments but lower total interest.

- Long-Term Loans: Lower monthly payments but potentially higher total interest.

Real-World Example

Jane needed a $10,000 loan. Her bank offered a 5% fixed rate for three years, while an online lender offered a 4.5% variable rate. Jane chose the bank for its rate stability.

By understanding these terms, you can find the best personal loan deals by banks, balancing bank and online loan rates for informed decisions.

Tips for Securing the Best Personal Loan Deals from Banks

Securing the best personal loan deals from banks requires a strategic approach. Start by assessing your financial needs and budget to determine the appropriate loan amount and monthly payment that fits comfortably within your financial plan. This clarity will guide your decision-making process.

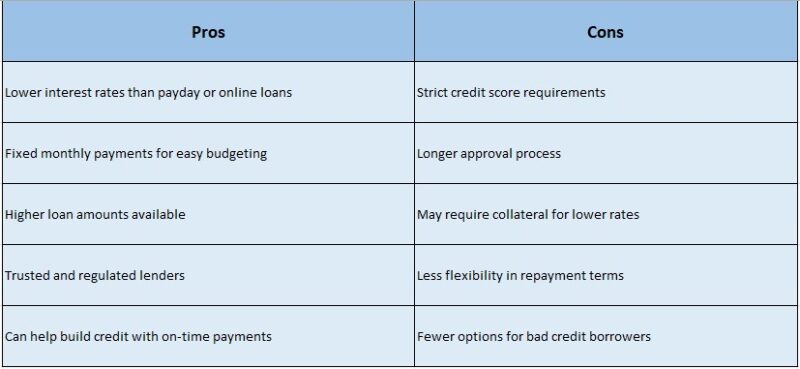

When comparing options, consider both bank loan rates and online loan rates. While banks may offer competitive rates, online lenders often provide lower rates due to reduced overhead costs. However, banks might offer perks like flexible repayment terms or customer loyalty discounts. Key factors to compare include:

- Interest Rates: Look at the annual percentage rates (APR) from both banks and online lenders.

- Loan Terms: Evaluate the length of the loan and any associated fees.

- Customer Service: Consider the support and guidance each lender offers.

Improving your credit score can also help you secure better loan terms. Check your credit report for errors and work on improving your score by paying down debt and ensuring timely bill payments. Additionally, having necessary documentation ready, such as proof of income and identification, can expedite the loan process.

Customer Reviews: Insights into Bank Personal Loan Deals

Customer reviews are invaluable when searching for the best personal loan deals by banks. They offer a real-world perspective on bank loan rates versus online loan rates, highlighting both advantages and drawbacks. Here’s what customers are saying:

Real-World Examples:

- Flexible Repayment Options: Customers appreciate banks offering adjustable repayment terms, helping them avoid penalties.

- Competitive Interest Rates: Many reviews praise banks for their competitive rates, which can lower loan costs compared to some online lenders.

- Customer Service: Excellent customer service is a common highlight, with borrowers valuing personalized support and clear communication.

Key Insights from Customer Reviews:

- Transparency is Key: Customers prefer banks that are upfront about fees, avoiding unexpected charges.

- Speed of Approval: Some banks match the quick approval times of online lenders, benefiting those needing fast cash.

- Trust and Security: Banks are often favored for their established reputation and secure handling of financial information.

These insights can help you navigate personal loan options, balancing bank and online rates. The best deal isn’t just about the lowest rate but finding a lender that meets your financial needs with a smooth borrowing experience.

FAQs

-

How can I find the best personal loan deals from banks?

Compare interest rates, loan amounts, tenure, processing fees, and eligibility criteria from multiple banks to find the best deal. -

Which banks offer the lowest personal loan interest rates?

Banks like HDFC, ICICI, SBI, and Kotak Mahindra often provide competitive rates, but the lowest rate depends on your credit score and profile. -

Do banks charge processing fees for personal loans?

Yes, most banks charge a processing fee, typically ranging from 1% to 4% of the loan amount, though some banks may offer zero-fee promotions. -

What factors determine my personal loan interest rate?

Your credit score, income, loan amount, tenure, and relationship with the bank influence the interest rate offered to you. -

Can I negotiate the interest rate on a personal loan?

Yes, if you have a high credit score and a good banking history, you may be able to negotiate a lower interest rate with the bank.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.