The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

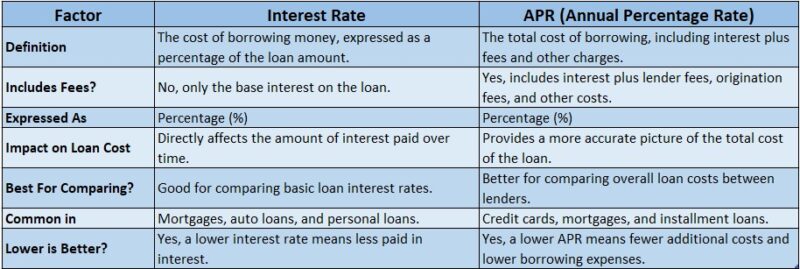

APR vs. Interest Rate Explained: Key Differences to Know

Understanding APR and Interest Rate Basics

Understanding the difference between APR and interest rate is essential when dealing with loans and credit. While both terms relate to borrowing costs, they serve distinct purposes. The interest rate is the percentage charged by lenders on the loan amount, while APR, or Annual Percentage Rate, encompasses the interest rate along with any additional fees, offering a clearer picture of total borrowing costs.

For instance, if you borrow ten thousand dollars at a five percent interest rate, you will pay five hundred dollars in interest annually. However, if the APR is six percent, it indicates that there are extra fees involved, raising your overall cost. Recognizing this difference is vital for making informed financial choices, particularly when comparing bank loan rates to online loan rates. Key insights to remember include:

- Interest Rate: The basic cost of borrowing as a percentage, excluding fees.

- APR: A comprehensive measure that includes fees and other costs.

- Bank Loan Rates: Generally more stable but may have higher fees.

- Online Loan Rates: Often more competitive but can vary significantly by lender.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

Understanding the difference between APR and interest rate is crucial when borrowing money. APR, or Annual Percentage Rate, includes not only the interest on a loan but also any additional fees or costs, providing a comprehensive view of what you’ll pay over the loan’s life. For instance, a personal loan with a low interest rate but high fees could have a significantly higher APR, affecting your overall costs.

In contrast, the interest rate only reflects the cost of borrowing the principal amount and excludes extra fees, which can be misleading. When comparing bank loan rates to online loan rates, it’s vital to focus on the APR rather than just the interest rate. Online lenders may advertise lower interest rates, but their APR could include higher fees, making them more expensive in the long run. Here are some key insights:

- APR gives a clearer picture of total borrowing costs.

- Interest rates can be misleading without considering fees.

- Always compare APRs when evaluating loans.

- Consider the loan term; longer terms may lower monthly payments but increase total interest paid.

Understanding these differences helps you make informed financial decisions and choose the best loan option.

How Interest Rates Affect Your Loans

Understanding how interest rates affect your financial decisions is crucial when it comes to loans. Interest rates represent the cost of borrowing money, while the Annual Percentage Rate (APR) includes both the interest and any additional fees. This means a loan with a low interest rate might have a significantly higher APR, affecting your total repayment amount. For instance, a personal loan with a 5 percent interest rate could have a 7 percent APR due to fees, which is important to consider when budgeting your payments.

When comparing bank loan rates to online loan rates, it’s essential to look beyond just the numbers. Banks often provide lower interest rates but may have stricter qualification criteria. Conversely, online lenders might offer quicker approvals and more flexible terms, but their rates can be higher. Here are some key points to consider:

- Loan Amount: Online lenders may offer smaller loans, while banks typically cater to larger amounts.

- Approval Speed: Online loans can be approved within hours, whereas banks may take days.

- Customer Service: Banks often provide in-person support, while online lenders rely on digital communication.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Key Differences Between APR and Interest Rate

Understanding the difference between APR and interest rate is crucial when borrowing money. While both terms relate to borrowing costs, they serve different purposes. The interest rate is the percentage charged by lenders for borrowing, whereas APR, or Annual Percentage Rate, includes the interest rate plus any additional fees associated with the loan. This makes APR a more comprehensive measure of what you will actually pay over the loan’s life.

For instance, a bank loan with a 5 percent interest rate may seem straightforward, but if there are origination fees, the APR could rise to 6 percent. This highlights the importance of comparing APRs across different loan options, particularly between bank loan rates and online loan rates. Online lenders often have lower fees, resulting in a more favorable APR, making them appealing to borrowers. Key insights to remember when comparing APR and interest rates include:

- Interest Rate: The basic cost of borrowing, expressed as a percentage.

- APR: A broader measure that includes interest and fees, giving a clearer picture of total costs.

- Bank Loan Rates: Often have higher fees, inflating the APR.

- Online Loan Rates: Typically feature lower fees, leading to potentially lower APRs.

Understanding these differences can help you make informed financial decisions.

Why APR is Crucial for Comparing Loans

Understanding the difference between APR and interest rate is essential when borrowing money. APR, or Annual Percentage Rate, includes not only the interest on a loan but also any additional fees or costs. This means that when comparing loans, focusing on the APR provides a clearer picture of the total cost over time. For example, a bank loan may have a lower interest rate but higher fees, resulting in a higher APR compared to an online loan with a slightly higher interest rate but lower fees. Here are some key benefits of focusing on APR when comparing loans:

- Comprehensive Cost: APR gives you a complete view of what you’ll pay.

- Better Comparisons: It enables apples-to-apples comparisons between different loan offers, whether from banks or online lenders.

- Informed Decisions: Understanding APR helps you make better financial choices, ensuring you select the best option for your needs.

Not all lenders are equal; bank loan rates often follow a traditional structure, while online loan rates can be more competitive. By comparing APRs, you can find the most cost-effective solution tailored to your financial situation.

Interest Rate Variability and Its Impact

Understanding loans can be tricky, especially when it comes to the terms APR and interest rate. While both relate to borrowing costs, they serve distinct purposes. The interest rate is the percentage of the loan amount you pay in interest annually. In contrast, the APR, or Annual Percentage Rate, encompasses the interest rate plus any additional fees or costs, providing a clearer picture of your total repayment over the loan’s life. Interest rates can differ significantly between traditional banks and online lenders. For example, banks may offer lower interest rates but charge higher fees, while online lenders might have slightly higher rates with lower fees. Here are some key points to consider:

- Bank Loan Rates: Generally more stable but may include higher fees.

- Online Loan Rates: Often more flexible and competitive, with faster approval times.

- Overall Cost: Always calculate the total cost using APR for a clearer understanding of what you owe.

By grasping these differences, you can make informed borrowing decisions. When considering a personal loan, compare APRs from various lenders to find the best deal and uncover any hidden costs. Remember, a lower interest rate does not always equate to a better deal if the APR is higher due to fees.

Calculating APR: What You Need to Know

Understanding loans involves two key terms: APR and interest rate. While they may seem similar, they serve distinct purposes. The interest rate is the cost of borrowing money, expressed as a percentage of the loan amount. In contrast, APR, or Annual Percentage Rate, encompasses not only the interest but also any additional fees or costs associated with the loan, providing a more comprehensive view of what you will actually pay over the loan’s life. Calculating APR can be straightforward if you know what to consider:

- Total Loan Amount: The principal you are borrowing.

- Interest Rate: The percentage charged on the loan.

- Fees: Additional costs like origination or closing fees.

- Loan Term: The duration for repayment.

For instance, a $10,000 loan at a 5 percent interest rate with $500 in fees will have an APR higher than 5 percent, reflecting those extra costs. When comparing bank loan rates to online loan rates, focus on the APR rather than just the interest rate. Online lenders may advertise lower rates but often have higher fees, inflating the APR. Traditional banks might offer higher interest rates but lower fees, leading to a more favorable APR. Always calculate the APR to ensure you get the best deal, helping you make informed financial decisions.

The Role of APR in Credit Card Agreements

Understanding the role of APR, or Annual Percentage Rate, is crucial when navigating credit cards. APR reflects the total cost of borrowing annually, including both the interest rate and any associated fees. Therefore, a credit card with a low interest rate may have a higher APR due to fees, making it more expensive than it seems. For example, a card with a 12 percent interest rate could have an APR of 15 percent if it includes an annual fee.

APR differs from the interest rate in that the latter only indicates the cost of borrowing as a percentage, while APR provides a more complete picture by factoring in additional costs. This distinction is vital when comparing bank loan rates to online loan rates, as online lenders may advertise lower interest rates but have higher APRs due to various fees. Always look beyond the interest rate to grasp the total cost of your loan or credit card. Key insights about APR include:

- Comprehensive Cost: APR includes interest and fees for a clearer borrowing cost picture.

- Comparison Tool: Use APR to effectively compare credit cards or loans.

- Variable vs. Fixed: Some APRs can be variable, meaning they may change over time, impacting your payments.

Common Misconceptions About Interest Rates

Many people confuse APR and interest rates when borrowing money, but they serve different purposes. The interest rate is the percentage lenders charge for borrowing, while APR, or Annual Percentage Rate, includes the interest rate plus any additional fees associated with the loan. This distinction is vital as it provides a clearer picture of total costs over time. A common misconception is that only the interest rate matters when comparing loans. In reality, APR offers a more comprehensive view. For example, when comparing a bank loan with a low interest rate to an online loan with a slightly higher rate but lower fees, the APR helps determine which option is more cost-effective. Here are some key insights:

- Interest Rate: The basic cost of borrowing expressed as a percentage.

- APR: A broader measure that includes interest and other fees, providing a more accurate picture of total borrowing costs.

- Bank Loan Rates vs. Online Loan Rates: Online loans often have competitive APRs due to lower overhead costs, making them appealing for borrowers.

Understanding these differences empowers you to make informed financial decisions and choose the best loan for your needs.

Choosing the Right Loan: APR vs. Interest Rate Explained

Understanding the difference between APR and interest rate is crucial when choosing the right loan. While often used interchangeably, these terms represent different aspects of borrowing costs. The interest rate is the cost of borrowing the principal amount, expressed as a percentage. In contrast, the Annual Percentage Rate (APR) includes the interest rate plus any additional fees, providing a comprehensive view of total repayment costs.

For instance, if you take out a ten thousand dollar loan at a five percent interest rate, your repayment might seem straightforward. However, if the APR is seven percent due to extra fees, your total cost will be higher than expected. This highlights the importance of comparing APRs, especially between bank loan rates and online loan rates. Online lenders typically have lower overhead costs, leading to more competitive APRs, making them appealing to borrowers. Key insights when comparing APR and interest rates include:

- Interest Rate: The basic cost of borrowing, excluding fees.

- APR: A broader measure that includes interest and fees, clarifying total loan costs.

- Bank Loan Rates: Often higher due to additional fees compared to online lenders.

- Online Loan Rates: Generally lower, potentially offering better APRs.

FAQs

-

What is the difference between APR and interest rate?

The interest rate is the cost of borrowing money, while APR (Annual Percentage Rate) includes the interest rate plus fees and other loan costs. -

Why is APR higher than the interest rate?

APR includes additional costs like origination fees and processing charges, making it a more accurate measure of the total loan cost. -

Which is more important when comparing loans—APR or interest rate?

APR is more important because it reflects the true cost of the loan, including both interest and fees. -

Can a loan have the same APR and interest rate?

Yes, if there are no extra fees or charges, the APR and interest rate will be the same. -

How does APR affect loan affordability?

A higher APR means higher overall costs, so comparing APRs helps borrowers choose the most affordable loan option.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.