The Trusted Choice for Cash Loans

Request Your Cash Advance or Personal Loan Now

The Trusted Choice for Cash Loans

Submit your information today!

Get lender-approved in as fast as 5 min!

Receive a decision as soon as the next business day!

Fast Funding

Get money as soon as the next business day

What Is the Best Way to Submit Loan Documents Online?

Submitting loan documents online is crucial for streamlining your borrowing experience. In our digital age, many lenders provide the convenience of online submissions, making the process faster and more efficient. You can upload your documents from home, avoiding long lines and paperwork, which saves time and reduces stress associated with loan applications. The online submission process is typically straightforward. Here are some key steps to follow:

- Gather Your Documents: Collect all necessary personal loan documentation, including proof of income and identification.

- Choose a Secure Platform: Use the lender’s official website or app to ensure your information is protected.

- Follow Instructions Carefully: Each lender has specific requirements, so read their guidelines thoroughly.

- Confirm Submission: After uploading, check for confirmation emails to ensure your documents were received successfully.

Submitting documents online enhances convenience and offers several benefits:

- Speed: Online submissions are processed faster than traditional methods.

- Accessibility: Submit documents anytime, anywhere with internet access.

- Reduced Errors: Digital forms minimize mistakes common with handwritten documents.

- Environmentally Friendly: Going paperless supports sustainability efforts.

By understanding these aspects, you can navigate the loan process confidently, ensuring your application stands out.

Looking for fast and reliable personal loans? Visit ExpressCash to get started today!

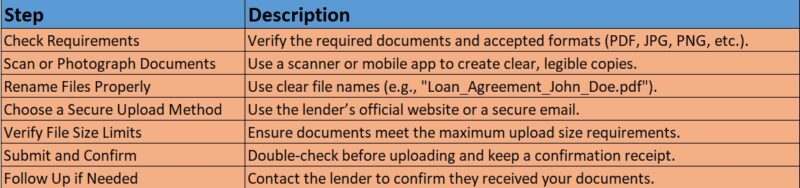

Step-by-Step Guide to Submit Documents Online

Submitting loan documents online may seem intimidating, but it can be a straightforward process with the right steps. Start by gathering all necessary documents, such as proof of income, credit history, and identification. Being organized will help you save time and reduce stress.

Next, select a reliable platform for document submission. Most lenders offer secure portals for uploads, so look for features like encryption and user-friendly designs. Once you have access, follow these steps: 1. Log into your lender’s portal. 2. Find the document upload section. 3. Choose the files you need to submit. 4. Ensure all documents are clear and legible. 5. Click the submit button and confirm receipt if prompted.

Lastly, track your submission. After sending your documents, follow up with your lender to confirm everything is in order. This proactive approach can help prevent delays in processing your loan. Remember, submitting your loan documents online not only saves time but also provides the convenience of completing the process from home.

Choosing the Right Platform for Online Document Submission

Submitting loan documents online requires careful selection of the right platform to ensure a smooth experience. Many lenders provide user-friendly portals for secure document uploads, but how do you choose the best one? Look for platforms that emphasize security and ease of use, as they will protect your sensitive information and guide you through the submission process effectively. Key benefits of a reliable online document submission platform include:

- Security: Ensure the platform uses encryption and secure access to safeguard your data.

- User-Friendly Interface: A straightforward layout can simplify the process.

- Real-Time Updates: Some platforms notify you when your documents are received and reviewed, keeping you informed.

- Customer Support: Having access to assistance can be invaluable if you face any issues during submission.

To submit your documents online, follow these steps:

- Gather Required Documents: Collect necessary personal loan documentation like proof of income and identification.

- Choose Your Lender’s Platform: Navigate to the lender’s website and locate the document submission section.

- Upload Your Files: Follow the prompts for secure uploads.

- Confirm Submission: Make sure you receive confirmation that your documents have been submitted.

Following these steps will help streamline the process and bring you closer to securing your loan.

Essential Documents Needed for Online Loan Applications

When applying for a loan, knowing the essential documents for online applications can simplify the process. Lenders typically require specific information to evaluate your financial situation, verify your identity, and determine your loan eligibility. Here are the most common documents needed:

- Proof of Identity: A government-issued ID, such as a driver’s license or passport.

- Income Verification: Recent pay stubs, tax returns, or bank statements.

- Credit History: A recent credit report can be useful, even if lenders pull this themselves.

- Employment Details: Information about your employer and job position may be necessary.

- Loan Purpose: A brief explanation of why you need the loan can be advantageous.

Once you have these documents, submitting them online is usually straightforward. Most lenders offer a secure portal for uploading files. Follow these steps:

- Log into the lender’s website: Create an account or log in.

- Navigate to the document upload section: Look for ‘Submit Documents’ or ‘Upload Files’.

- Select the files: Upload your documents individually or in batches.

- Review and confirm: Ensure all documents are uploaded correctly before submitting. Being organized and thorough is essential for a successful online loan submission.

Need cash for unexpected expenses? ExpressCash offers quick and easy personal loans tailored to your needs.

Tips for Ensuring Secure Document Submission Online

When submitting loan documents online, prioritizing security is essential. With the increase in digital transactions, protecting your sensitive information is crucial. Here are some tips for safe document submission: First, always use secure websites. Look for URLs that start with HTTPS, indicating that the site encrypts your data.

Additionally, consider using a virtual private network (VPN) when on public Wi-Fi for added security. This ensures that your personal loan documentation requirements are submitted without fear of interception. Next, double-check your documents to ensure they are complete and accurate. Common requirements include proof of income, credit history, and identification.

By having everything in order, you can prevent delays in your loan application process. Consider using secure file-sharing services that provide encryption, as these platforms enhance the safety of your documents during transfer. Lastly, always keep a backup of your submitted documents. This way, if any issues arise, you have copies available for quick reference or resubmission.

Common Mistakes to Avoid When Submitting Loan Documents Online

Submitting loan documents online can be straightforward if you avoid common mistakes that often lead to delays. Many applicants rush the process, which can result in errors that hinder approval. One major pitfall is failing to check the required file formats. Each lender may have specific guidelines, so confirm whether they accept PDFs, JPEGs, or other formats before uploading your documents.

Another frequent mistake is not double-checking your information. Typos in your name, Social Security number, or income details can raise concerns and slow down your application. Always review your information before submitting. Additionally, ensure that you include all necessary documents, as missing even one can cause delays. Key documents typically required for personal loans include:

- Proof of identity (like a driver’s license or passport)

- Proof of income (such as pay stubs or tax returns)

- Employment verification

- Bank statements By being thorough and organized, you can streamline the submission process and enhance your chances of a smooth approval.

Remember, attention to detail is crucial for securing your loan efficiently.

How to Track Your Loan Document Submission Status

Tracking the status of your loan document submission is essential for a smooth application process. Most lenders offer a user-friendly portal where you can log in to monitor your application’s progress. This feature provides peace of mind and allows you to address any issues quickly, such as missing documents or requests for clarification.

To track your loan document status effectively, follow these steps:

- Log into your lender’s portal using your application credentials.

- Navigate to the application status section, which is typically easy to find.

- Check for updates regarding your documents.

- Contact customer support if you have questions or notice discrepancies.

This proactive approach can save you time and reduce stress. Staying informed about your loan application is crucial. Benefits of tracking your submission status include:

- Immediate updates on document acceptance.

- Quick resolution of any issues that may arise.

- Enhanced communication with your lender for a smoother experience.

By following these steps, you can confidently navigate the loan process.

The Benefits of Submitting Loan Documents Online

Submitting loan documents online has revolutionized the borrowing experience for many. It saves time and simplifies the process, allowing you to upload documents from home and avoid long lines. Here are some key benefits of online submissions:

- Speed: Online submissions are processed faster than traditional methods, enabling quick document uploads and reviews by lenders.

- Accessibility: You can submit documents anytime and anywhere with internet access, making it convenient for those with busy schedules.

- Security: Reputable lenders use encryption and secure portals to protect your sensitive information, ensuring peace of mind.

- Tracking: Many platforms allow you to track your submission status, keeping you informed throughout the loan process.

To submit your documents online, follow these steps:

- Gather required personal loan documentation, such as proof of income and identification.

- Visit your lender’s secure online portal.

- Upload your documents as instructed, ensuring clarity.

- Confirm submission and monitor your email for updates.

Frequently Asked Questions About Online Document Submission

-

Where can I upload my loan documents?

Most lenders provide a secure online portal or mobile app where you can upload your documents directly. Some may also accept email submissions. -

What file formats are accepted for document uploads?

Lenders typically accept PDF, JPG, PNG, or DOC formats. Check the lender’s requirements to avoid upload issues. -

How can I ensure my documents are clear and readable?

Use a scanner or high-quality camera, ensure good lighting, and avoid blurry or cropped images. All text and numbers should be legible and complete. -

What should I do if my document upload fails?

Try reducing the file size, using a different browser, or switching to a stable internet connection. If issues persist, contact the lender’s support team. -

Is it safe to upload sensitive documents online?

Yes, as long as you use the lender’s official website with HTTPS encryption. Avoid using public Wi-Fi and double-check the URL to prevent scams.

Don’t wait! Apply for a personal loan through ExpressCash and get the funds you need fast.

🔗Explore our website, AdvanceCash, to apply for a loan, or contact our customer service team today to learn more about how we can assist you.